Yield chasing has spilled into nearly every asset class, with Australian listed bank hybrids no exception. The current average margin of bank bills at +2.40% is close to the lowest level for at least seven years. For institutional investors, there are some obvious alternatives that are both lower risk and higher returning. For retail buyers, the direct alternatives are fewer but nonetheless there are ways to receive a better return whilst taking the same or less risk.

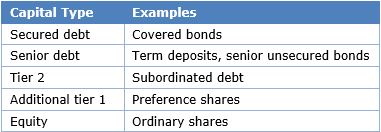

A quick description of the security types is useful for a fair comparison. The two types of securities captured by the moniker of bank hybrids are:

1. Subordinated debt (technically tier 2 capital) is the security type that ranks directly below senior debt and has interest payments that are compulsory unless the bank is insolvent. ASX:NABPE is the only listed security of this type from the major banks it is highly likely new issues will come soon (note, all the five-letter codes in this article are ASX codes).

2. Preference shares (technically additional tier 1 capital) rank below subordinated debt. The major banks currently have 19 of these securities listed on the ASX with the largest for each major bank being ANZPG, CBAPD, NABPF and WBCPG. Preference shares are not debt securities and they receive discretionary dividend payments which the directors or the regulator (APRA) can stop even when the bank remains solvent.

The structural weaknesses of bank hybrids

Bank hybrids include a range of issuer-friendly terms such as:

- The ability to delay (subordinated debt) or perpetually defer (preference shares) the repayment of the securities if the bank is in financial difficulty or if the share price falls below a threshold

- The potential to be converted into equity that has little or no value

- The lack of equity control rights, for instance being able to vote at shareholder meetings

- Limited covenants that protect the investor’s position

- Higher drawdowns than standard senior ranking bonds in times of market turbulence

- Limited liquidity in times of financial stress and for larger amounts

Some financial advisers tell their clients that bank hybrids will not suffer a capital loss as the Australian Government will never let a major bank fail. This is a misunderstanding of the reason these securities exist. Bank hybrids are a protection mechanism to ensure that the Australian Government does not use taxpayers’ funds to bail out a bank. It’s like the safety features in a car. The crumple zones and airbags exist to protect the people, not to ensure that the car isn’t damaged. If a major bank was in financial difficulty, APRA has the power to convert hybrids to equity or to completely wipe out their value.

Recent changes impact bank hybrids and relative values

Earlier this month, the regulator APRA released its determination on how much additional hybrid capital, and the major banks need roughly $20 billion of subordinated debt each year for the next four years. This additional debt will be sold to institutional investors and issued as ASX-listed securities. Westpac and ANZ have both already issued institutional subordinated debt into strong demand.

The most recent subordinated debt issue was by ANZ on 19 July and it was priced at bank bills +2.00%. This is not far away from the average margin of listed major bank preference shares at bank bills +2.43%. This is scant additional return for the major increase in risk, particularly the risk of dividends being stopped whilst the bank is still solvent. Whilst this comparison is between an institutional security and the more retail-orientated listed hybrids, many large investors have both options available to them.

Alternatives to bank hybrids

Whilst some might question whether the relative value between subordinated debt and preference shares matters, the interest rates available elsewhere makes both options look miserly. Institutional investors can look to securitisation, syndicated loans and marketplace lending opportunities for a better risk/return outlook.

Retail investors can also take advantage of online savings accounts, marketplace lending directly or various other debt sectors accessed via listed and unlisted managed funds. Here is a quick summary of four alternatives.

1. Securitisation

The most relevant debt type that demonstrates the poor value in bank hybrids is ‘non-conforming’ securitisation. Investors in the subordinated AAA tranches are often receiving margins equal to or better than the margins on BBB-rated major bank subordinated debt. As well as a much higher credit rating, these securities have a shorter tenor and a history of lower drawdowns in market downturns. For an equivalent BBB rating, securitisation tranches have been issued at around bank bills +4.30% this year, more than double the margin on the recent ANZ subordinated debt issue.

Comparing securitisation to preference shares isn’t an apples and apples comparison. The predominantly equity features of preferences shares, notably the ability for the directors or APRA to turn off dividends, means they cannot be fairly compared with a debt instrument that has non-discretionary repayments. Whilst ratings agencies do rate some of these securities (e.g. Standard and Poor’s rates the CBA preference shares at BB+) these ratings ignore most of the risks created by the non-debt features of preference shares. Once these features are included, preference shares arguably have a risk profile more in line with a B rating for a standard debt instrument.

Either way, bank bills +2.43% for preference shares compares poorly to bank bills +6.30%/7.75% (BB/B rating) for securitisation issuance this year.

2. Marketplace lending

Institutional and retail investors can both access marketplace lending (also known as peer-to-peer lending) via a growing number of online platforms. There’s a mixture of residential and commercial property secured loans available, as well as unsecured business and personal loans. For more conservative investors, loans backed by residential property with an LVR of 60% or less typically yield 5-7%. Commercial property loans, business loans and personal loans usually come with higher yields. Investors in riskier loans should be expecting to lose a portion of their total return when some of the borrowers default and should set their return expectations accordingly.

3. Online savings accounts

Retail investors have a profound advantage over institutional investors when it comes to rates for online savings accounts. NAB’s online subsidiary Ubank, for example, has the best at 2.41%, requiring only a $200 monthly deposit. There are other options with higher rates, but these have restrictions on withdrawals, spending requirements or are only introductory rates. Whilst this rate doesn’t seem that high, note that two major bank preference shares, NABPC and WBCPF, are both trading with a forecast yield to maturity of less than 3%.

4. Managed funds

Retail investors that cannot access securitisation, syndicated loans and various forms of private debt directly have a growing number of listed and unlisted fund options. As these types of securities are typically illiquid, care should be taken to (a) choose managers with a long track record of managing these assets well and (b) invest in a fund with a suitable liquidity profile for the asset type. Funds that offer daily liquidity whilst investing in illiquid securities have a history of blocking redemptions in substantial market downturns, as occurred in 2008-09.

Listed Investment Companies or Trusts meet liquidity demands via a sale of the units on the ASX rather than selling fund assets at prices that may be below their long-term fair value. Listed debt funds include GCI, MOT, MXT, NBI and QRI with these funds having various debt types, risk profiles and fee levels.

Jonathan Rochford, CFA, is Portfolio Manager for Narrow Road Capital. This article is for educational purposes and is not a substitute for professional and tailored financial advice. This article expresses the views of the author at a point in time, which may change in the future with no obligation on Narrow Road Capital or the author to publicly update these views.