Last week’s article, ‘10 reasons not to hold a bank royal commission’, drew many heated comments for both sides of the debate, in the comments section and in the results of the survey.

The original article showed the strong public support for a bank royal commission, with 64% in the support camp and only 13% opposing.

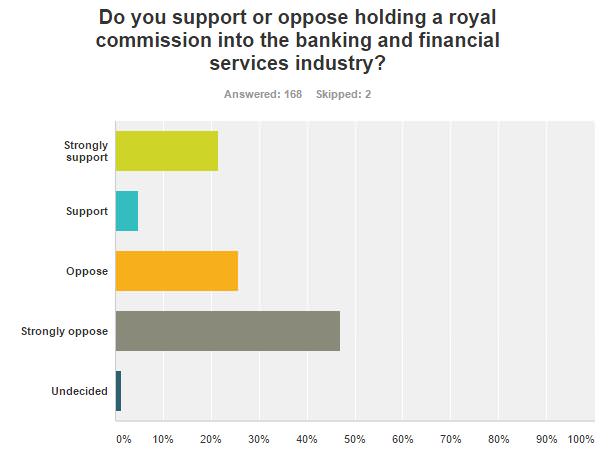

The Cuffelinks survey generally produced the opposite results, as shown in the table below:

The support camp was 25.6% while the oppose side was a healthy 73.2%. Even more impressive was the strong oppose score of 47.6%, nearly half of all respondents (although it is acknowledged that response numbers were down on our usual survey participation levels).

We will leave the survey open for a few more days to encourage more responses, and then open up the full survey results and comments before next week’s edition.

Please take our survey on whether a royal commission into banking and financial services is required [now closed].