The Reserve Bank’s decision this month to reduce Australia’s official cash rate by 0.25% to an historic low of 1.50% was an unexpected boon to savers, unlike other rate cuts since 2011. Three of the Big 4 banks and some smaller institutions have increased one-, two- and three-year term deposit rates by up to 60 basis points (0.60%) to rates where savers are now ahead on their cash savings after tax and inflation.

To fund these increases, banks have passed on between only 10–14 basis points to mortgage-holders.

What’s behind the move?

The decision by the Big 4 is not surprising in retrospect given the pressures of regulatory reform and global funding markets, both now and coming soon.

Regulatory reform is perhaps the most significant pressure. Under Basel 3, banks are required to hold highly liquid assets equal to or greater than net cash outflow over 30 days. The Australian Prudential Regulation Authority's (APRA's) Liquidity Coverage Ratio (LCR) framework was fully implemented in Australia on 1 January 2015, after APRA determined that Australia did not need the extended phase-in period that lasts until 2019 in some other countries. Those banks that are larger and more complex with respect to their liquidity risk are subject to the LCR in Australia.

Banks are required to hold low-yielding assets (e.g. government bonds) against deposits and wholesale funding that have a maturity of less than 30 days, making deposits with a maturity greater than 30 days more attractive. Hence the introduction (albeit slow) of notice accounts that require 31 days’ notice to withdraw, and the toughening up by the banks of rules regarding early breaks of a term deposit. Term deposits are becoming more attractive to the banks, leading to an upwards re-pricing.

Strategy decided in advance

Judging by the speed with which the majors announced their rate decisions, ANZ, Commonwealth Bank and Westpac had planned and costed this strategy in advance. The banks are obviously protecting margins while establishing a funding mechanism for competitive two- and three-year fixed rate loans that are quarantined from the variable rate book. The same can be said on the funding side, but higher rates on term deposits are not passing through to their whole deposit base (for example existing term deposits until maturity, at-call bonus and online savers, and shorter-term term deposits). A significant majority of investors are looking for an investment term of 12 months or less, according to analysis of more than 100,000 visitors to the CANSTAR term deposit comparison tables so far this year. This latest move is likely to change that as investors chase the higher return, which is another good reason for consumers not to opt for the lazy rollover option.

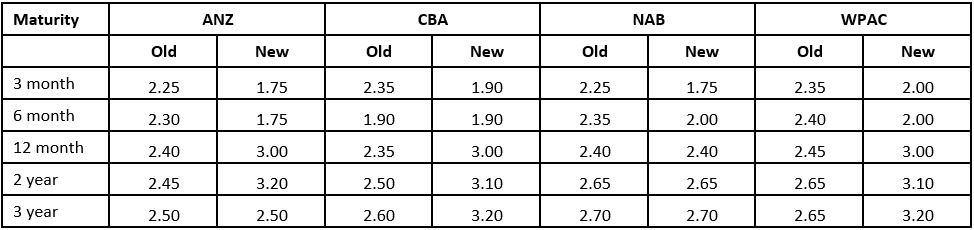

Big 4 term deposit rate increases in longer-term rates

Table 1 Big 4 term deposit rates

Source: canstar.com.au. Interest rates at maturity, based on a $25,000 deposit. CommBank interest rates above are not effective until 19th August.

Term deposit rates are far less supercharged as a contentious issue either politically or with media commentators, and banks can make moves without creating waves. Increasing domestic deposits also results in a reduced reliance on wholesale funding, with significant changes in funding mix since the GFC.

Sourced from http://www.rba.gov.au/publications/bulletin/2016/mar/3.html

Competition will significantly increase

The actions of the large banks to increase their domestic deposit reserves puts significant pressure on the smaller banking players, who are more reliant on term deposits to fund their home loan bases.

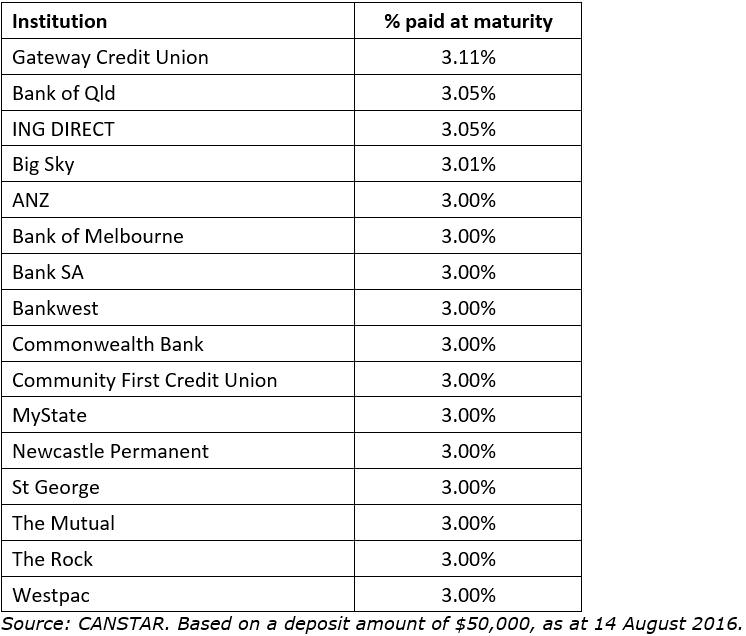

Canstar market share analysis shows that the aggregate of top and second tier bank term deposit balances is less than 16% of their aggregate home loans. Smaller institutions' reliance on term deposits to fund their balance sheet is, in most cases, double that and more. The smaller institutions therefore have much to lose and will be obliged to stay competitive in this space and raise their one to three-year term deposit rates accordingly. Indeed, this is already happening, with more than a dozen smaller players matching or exceeding the 12-month rates of the Big 4, while some have moved on 2- and 3-year rates.

Highest 12-month term deposit rates

Tellingly, of the 54 financial institutions in our database that have reduced standard variable home loan rates so far this month, only six have passed the full 25 basis points through to borrowers. Protecting deposit market share appears to be the primary focus right now. Keep an eye out for possible out-of-cycle home loan increases by the smaller institutions over the next year as margin pressures bite. This will be aggravated by maturities in the existing deposit book rolling into higher rates.

Overall, the cash rate is simply a signalling mechanism that flows through to other rates in the economy. This time it has not flowed through fully on the housing front, which both the RBA and APRA may quietly welcome, and has instead, for the first time in many years, provided welcome relief for savers.

Stephen Mickenbecker is the Group Executive, Ratings and Financial Services, at CANSTAR.