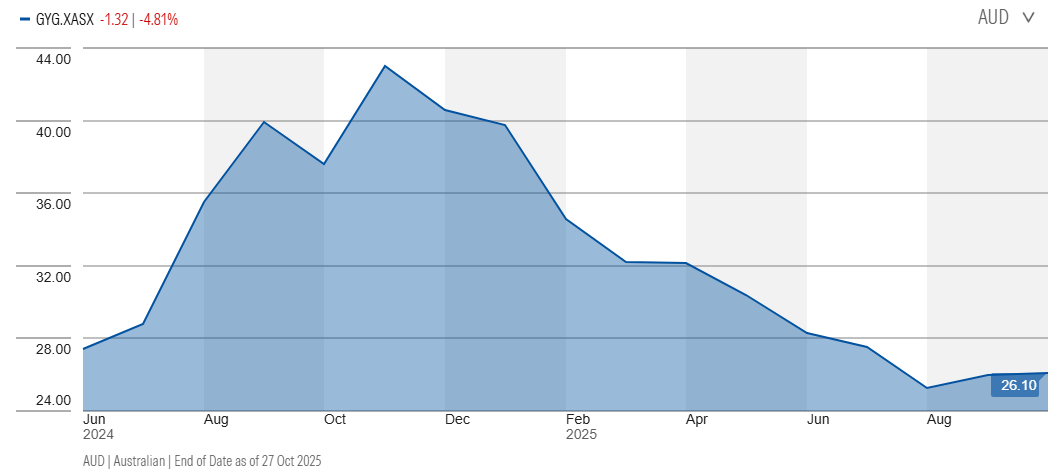

We continually seek to enhance the portfolio by selectively adding high-quality compounders at attractive valuations. This is an inherently difficult task – the market is usually very efficient at identifying these types of businesses and pricing them accordingly. However, with the FY25 reporting season being one of the most volatile on record, we found a few opportunities that met our stringent requirements. Most notably, we materially upweighted our position in Mexican fast-food chain Guzman y Gomez, or GYG.

GYG had been on our radar for some time. The company exemplifies many of the attractive traits we look for: market-leading position with a durable consumer brand, capital-light franchise model, long-term store rollout opportunity, predictable long-term economics, and founder-led management. On the back of these enviable qualities, we owned a small position leading into the FY25, with our primary reservation being valuation. While the FY25 result itself was impressive – total network sales in Australia increased 22% to $1.1 billion – the market was disappointed with a soft trading update where like-for-like sales slowed to +3.7%. The market reaction on the day was severe, with the stock trading down 24% at its lows. We viewed this almost one-quarter collapse in valuation as a substantial overreaction to just seven weeks of trading data and took the opportunity to materially upweight our position.

The crux of our thesis for GYG centres on the company’s stellar unit economics, in particular its strong sales per restaurant relative to quick service restaurants (QSR) peers. While there are some important nuances regarding margins, it’s largely this sales productivity figure that underpins the long-term profitability of the model: the higher the sales throughput in a store, the greater the leverage on fixed costs like rent, labour (partially) and shared corporate costs.

To put some numbers around this, the average GYG restaurant generates around $5.2 million in sales in Australia, well above most scaled QSR peers. For comparison, we estimate the average KFC generates around $4.1 million, Hungry Jack’s around $5 million, and McDonald’s – the gold standard for QSR in Australia – around $7.5 million in sales per restaurant. While GYG’s $5.2 million in sales per restaurant is impressive in absolute terms, what excites us most is the improvement in this sales productivity over time: GYG’s average sales per restaurant have grown at a 17% CAGR over the past five years, well outpacing peers despite relying less on pulling the price lever. While the company’s restaurant margins are already healthy – the average corporate restaurant margin sits at 17.9%, franchise margin at 20% – if this sales productivity continues to increase it will underwrite some impressive margins in the future.

Importantly, there are a couple of predictable drivers that should increase this sales productivity figure over time. For one, sales per restaurant should increase as the store mix for GYG continues to shift towards higher volume drive-thrus. Drive-thru locations currently account for just 52% of GYG’s store mix compared to around 73% for KFC in Australia, 91% for Hungry Jack’s, and 85% for McDonald’s. Drive-thru restaurants for GYG generate around 50% more in sales per restaurant than non-drive-thrus, so as they continue to roll out more drive-thrus they will benefit from a mix shift that improves both sales productivity and margins. It’s also important to contextualise GYG’s current sales productivity within this weaker store mix relative to peers. If you were to adjust GYG’s store mix to reflect McDonald’s 85% drive-thru composition, GYG’s average sales per restaurant would theoretically increase to around $6.4 million versus the current figure of $5.2 million. In other words, adjusted for the store mix, GYG’s sales productivity is rapidly approaching McDonald’s levels in Australia. To be clear, we are not suggesting GYG will reach that level of drive-thru mix any time soon. Rather, this offers a better apple-for-apples comparison of the relative strength of GYG’s sales productivity compared to those peers mentioned above.

The other factor driving sales productivity is GYG’s strong growth in breakfast and late-night dayparts, bolstered by their rollout of 24/7 restaurants. Breakfast and late-night offerings have averaged like-for-like comp growth of 27% and 26% respectively over the past three years and now account for around 16% of total network sales. At the FY25 result, only 18 restaurants in the network were 24/7 (has now increased to 23 stores), and two-thirds of those restaurants were in the top decile of top-performing restaurants with profit margins well above group average. Initially, any expansion of dayparts is going to be lower margin given the requisite increase in labour costs; however, with enough scale these can be meaningful contributors to profitability. McDonald’s generate a material portion of their sales in Australia from their breakfast offering – they sell a reported one in four coffees in Australia – so the opportunity is large if GYG can continue to execute.

These strong unit economics have important implications for GYG’s long-term rollout opportunity. Despite its already impressive brand strength, GYG have just 227 restaurants in Australia. For comparison, Hungry Jack’s have around 460 restaurants in Australia, KFC around 750, and McDonald’s over 1,000 restaurants. The strength of a QSR’s unit economics ultimately determines the viability of a long-term roll-out. With GYG’s already strong and improving metrics, it’s reasonable to think the company could, over time, triple its restaurant footprint in Australia.

Source: Morningstar

In terms of valuation, while the headline multiples today appear eye-watering, on a five-year view we estimate that GYG is trading on just 20x net profit after tax, an attractive multiple for a quality compounder that’s only halfway through its Australian store rollout. This multiple excludes the losses related to the US operations, which are currently relatively small at $13 million and are not expected to increase dramatically in FY26. Overall, these losses will only have a small impact on GYG’s intrinsic value and while we view the chance of success in the US as slim, the potential upside more than justifies the investment in our view. Importantly, the balance sheet is in terrific shape, with a strong net cash position that could help fund an aggressive US expansion if indeed the unit economics in the US improve to acceptable levels. Accordingly, GYG is now a top ten holding in the Fund, reflecting our conviction in the company’s durable brand and long runway for growth.

This excerpt of GYG is part of Airlie’s Small Companies Fund September 2025 quarterly commentary.

Will Granger is a Portfolio Manager at Airlie Funds Management, an affiliate of Magellan Group, a sponsor of Firstlinks. This article has been issued by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301, trading as Airlie Funds Management (‘Airlie’) and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs.

For more articles and papers from Magellan, please click here.