Moves by regulators to encourage financial institutions to retain capital, coupled with lower earnings across most sectors, may have far-reaching implications for investors, companies and investment managers this year and beyond.

Realindex is a systematic equities manager and we used a range of data points to look at the impact of several themes affecting dividends in the current market. In particular, we considered the way central banks and regulators around the world have initiated policies in an attempt to constrain dividend payments by financial institutions.

Regulators take a proactive stance

The European Central Bank asked banks not to pay dividends for the financial years 2019 and 2020, nor buy back shares during COVID-19 pandemic. This appears to cover all EU banks (117 of them at last count)

While the US Federal Reserve has not specifically asked banks and financial institutions to suspend or reduce dividends, it has barred dividend payments by any firms that have received funds from the CARES Act (the US coronavirus aid bill). It is also providing facilities to support the flow of credit, which include a gradual phase-in of dividend restrictions if a bank’s capital buffer declines.

In the UK, the Prudential Regulation Authority released a supervisory statement (on 31 March 2020) that banks should not pay dividends, buybacks or other distributions, such as cash bonuses to staff, until the end of 2020, and to cancel any outstanding 2019 dividends.

Closer to home, APRA released a guidance note on 7 April 2020 recommending banks and insurers defer, reduce or cancel dividends, without specifying a time period. ANZ, Westpac and Macquarie’s decision to defer, and NAB’s move to reduce, interim dividends suggest institutions are complying.

It is worth noting that there has been a somewhat limited response from emerging market regulators directly on this issue. The largest emerging market economies of China, India, Brazil and Russia (the so-called BRIC economies) have been slow to formally request financial institutions to constrain or cease dividend payments.

Flow-on effects to the market

This could have a notable impact on markets. Realindex’s modeling suggests that historically, 60% of the ASX200 benchmark’s total return is due to dividends and for Financials, that rises to more than 70% of the total return (including dividends and buybacks). Moves to limit dividends could both reduce investor incomes and affect valuations.

We know that dividend payments are an important component of returns to shareholders, especially retirees. They are also the chief source of franking credits in Australia, and so they are a key part of the attraction for investors. The potential enforced cancellation of dividends will likely move capital to companies that do pay dividends. This could drive up the prices of stocks such as Telstra, Wesfarmers or Coles.

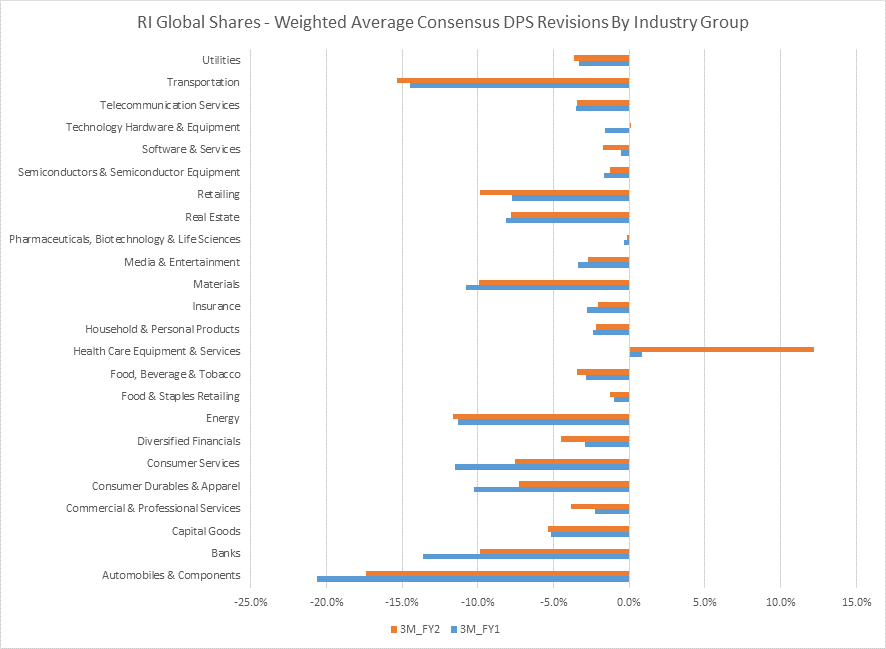

Such forced reductions are likely to come at the same time as lower earnings in other sectors put dividends at risk. Modeling of the Realindex portfolio shows that at the end of April 2020, the weighted average consensus of Dividend per Shares downgrades was -25% for Australia and -17.3% globally, with downward revisions led by energy, transport and banks.

The extent of dividend cancellation or withdrawal is not clear yet, but many dividend forecast downgrades have already appeared in analyst forecasts and there are some sectors that look at-risk (see Chart 1).

Chart 1: Dividends Per Share Revisions by Industry Group

Source: Realindex, Factset as at 31 March 2020

Impact on Australian portfolios

Our modeling suggests dividends in Australia will be more severely impacted from COVID-19 than other developed markets.

A decline in aggregate demand from China is likely to affect earnings in the Materials sector, at least in the short term. Real Estate, especially retail, is at risk of distress. Additionally, the low oil price will test the resilience of many energy companies, and we assume that this will lead to dividends being at risk, especially for global portfolios.

Beyond providing income, dividends can also play a key role in influencing corporate behaviour because they act as a signalling mechanism for firms. Strong, consistent dividend payout ratios and payments are a way for investors to understand the confidence that management has in the business.

In addition, companies that cater to the demands of investors by paying dividends can attract a premium for their shares. Significant changes to this behaviour could see changes in valuations going forward.

A changed dividend landscape could affect investment managers too, given that many investment processes rely on dividends as a key measure of company performance. This could be through core company metrics, or more widely through dividend yield and dividend futures. We are in the process of analysing whether we need to amend our normal processes in light of current market conditions, and we expect other managers will be doing the same.

Potential long-term consequences

Overall, the impact of these trends will depend on the length of the crisis. If it is a temporary change, many investment processes and market and corporate behaviour will probably not move markedly when averaged over a longer period. However, if this represents a longer-term change or permanent shift, then the implications may be very different. Time will tell.

David Walsh is Head of Investments at Realindex Investments, a wholly owned investment management subsidiary of First Sentier Investors, a sponsor of Firstlinks. This article is primarily for information. It discusses ideas that are important to the Realindex investment process and clients but may not be affected in the ways discussed here.

For more articles and papers from First Sentier Investors, please click here.