(Editor's introduction: Peter Thornhill is well-known to our readers for advocating a multi-decade investment strategy based on the long-term merits of industrial companies for income. For example, to show his consistency over time, some of his previous articles in Firstlinks are here and here and here. In this short update, he again checks the long-term return from industrial shares, but this time, he makes the comparison with resource stocks. He argues that for investors with the right risk capacity and investment horizon, there's only one place to invest).

***

The current resource bubble and the flow of healthy dividends will no doubt have many investors salivating. Whilst my long-term charts are based on calendar year, this article looks at the last three financial years to bring my analysis up-to-date.

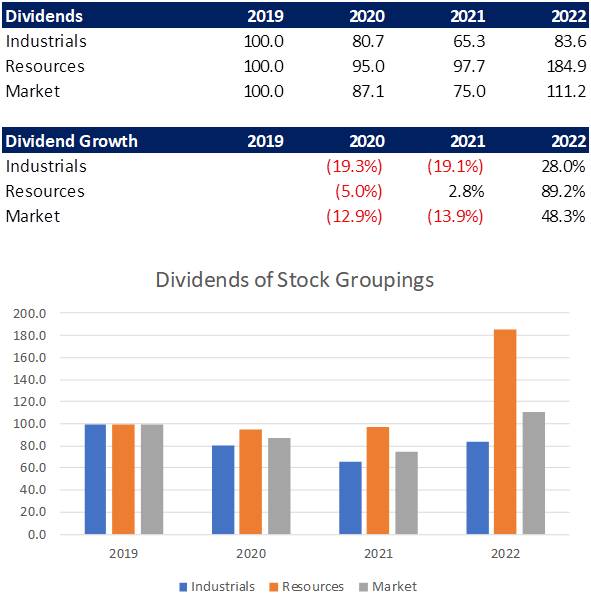

The table below takes 2019 as the starting point and looks at the dividend changes for financial years ending 30 June 2020, 2021 and 2022 for Industrials, Resources and the All Ordinaries.

Resource dividends come and go

Clearly, the impact of Covid effected industrial companies as dividends were suspended or reduced during this unsettling period, while the spectacular jump in resource dividends was driven by surging prices and demand for commodities.

Resource bubbles are a fact of life and jolly fun for speculators, but we must not lose sight of the longer-term impact. Index funds will have been selling industrials to buy resource stocks and when the bubble bursts, they will be selling resources to buy back the industrials. I wait to see the impact on distributions from these index funds post the change.

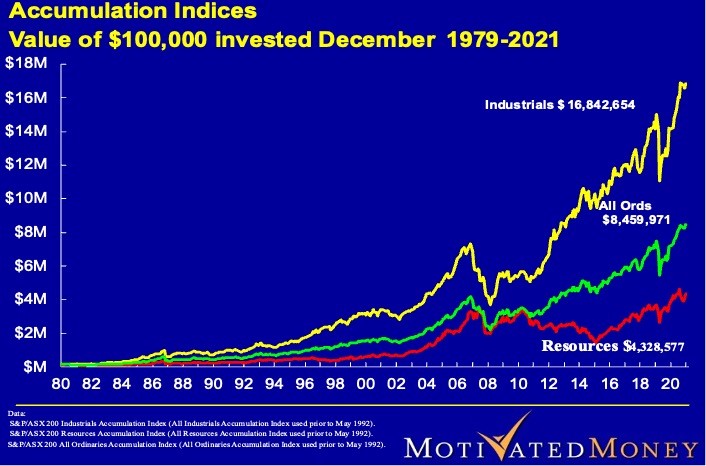

The charts below cover the last 41 years of performance for the price and accumulation indices. A picture is worth a thousand words!

Digging stuff out of the ground is all well and good but the real value add comes from the manufacturing, intellectual and technological inputs, not labour.

Peter Thornhill is a financial commentator, author, public speaker and Principal of Motivated Money. He runs full-day courses explaining his approach to investing "in the vain hope that not everyone is frozen with fear".

Peter extends his thanks to Angus Gluskie, CEO of Whitefield, for his assistance with the data.

This article is general in nature and does not constitute or convey specific or professional advice. Share markets can be volatile in the short term and investors holding a portfolio of shares will need to tolerate short-term losses and focus on a long-term horizon, and consider financial advice.