The seventh annual BetaShares/Investment Trends ETF Report provides a unique snapshot of the key statistics and drivers in the Australian Exchange Traded Fund (ETF) industry, from the perspective of self-directed investors, SMSFs and financial planners.

This year’s findings signpost a continued rapid growth story, as Australian ETFs shift further into the mainstream market.

Key findings of the report

The insights collected from this round of research are based on responses from approximately 6,000 investors and 500 advisers:

- The number of ETF investors in Australia grew 18% in the 12 months to September 2017, reaching 314,000

- SMSF trustees, the early adopters of ETFs, comprise 33% of ETF investors. Since 2010, the number of SMSF investors using ETFs has grown 288%

- While SMSF usage of ETFs remains strong, there is increasing adoption by self-directed non-SMSF investors

- Diversification, cost-effectiveness and access to overseas markets are the top drivers of investing in ETFs

- Approximately 60% of Australian financial planners recommend ETFs or intend to do so within the next 12 months.

SMSFs, the ‘early adopters’ remain key supporters

The number of Australian investors using ETFs has grown to a record 314,000, up 18%, from 265,000 in the previous year.

The number of investors holding ETFs through an SMSF increased (by 5,000 compared to the year before) to 105,000, meaning that approximately 1 in 6 SMSFs are now investing in ETFs. That said, in aggregate, SMSF ETF investors as a percentage of the total market declined from 38% in 2016 to 33% in 2017. This proportional decline is due to an increase in the number of self-directed investors who are utilising ETFs outside of SMSFs (+44,000).

SMSFs who use ETFs typically cite a wider range of reasons for using them, especially access to overseas markets and liquidity. Diversification remains the primary driving factor, with 72% of investors citing this as a reason for using ETFs.

Other investor categories are growing fast as younger investors enter the market

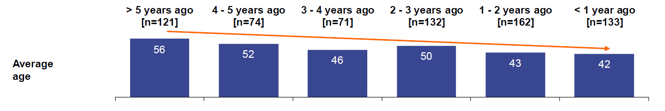

While ETF investors are on average 49 years old, including a quarter who are retired, the average age of those who started investing in ETFs in the last 12 months is now 42, significantly younger than an average age of 56 among those who started investing in ETFs more than five years ago.

This is a prominent statistic showing how mainstream the ETF industry in Australia is becoming, as well as how important the younger or millennial investor will be to the industry in future.

Profile of current ETF investors - by when investors first started investing in ETFs

Source: BetaShares/Investment Trends ETF Report, 2017

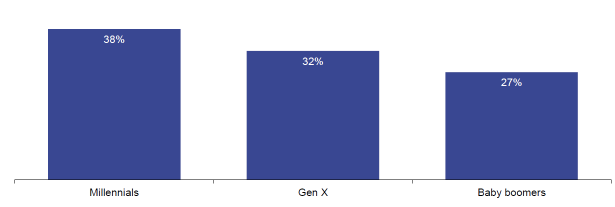

Among the online share investor population, the appetite for ETFs is greater among the younger cohort. About 38% of millennials say they use or intend to use ETFs in the coming year, versus 32% for Gen X investors and 27% for baby boomers.

Proportion of online investors who currently use or intend to use ETFs in the coming year

Source: Investment Trends 2017 Australian Online Broking Report

Strong appetite for continued use of ETFs

Repeat investment into ETFs is high, with 56% of investors indicating they would consider re-investing in ETFs in the next 12 months.

ETFs also play a more prominent role in the investment portfolio as investors gain experience using these products. Investors who invested in ETFs under two years ago have an average of 7% of total assets allocated to ETFs, whereas investors who stayed using ETFs for more than four years have around 13% allocated.

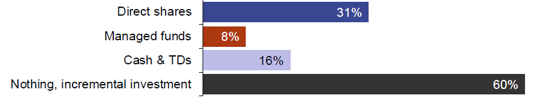

The majority of investments into ETFs represents new money into the industry, with 60% of ETF investors buying the products with incremental investment monies, rather than decreasing their allocation to direct shares or managed funds.

What investments did current ETF investors reduce usage in order to invest in ETFs?

Source: BetaShares/Investment Trends ETF Report, 2017

Financial planners can leverage client interest in ETFs

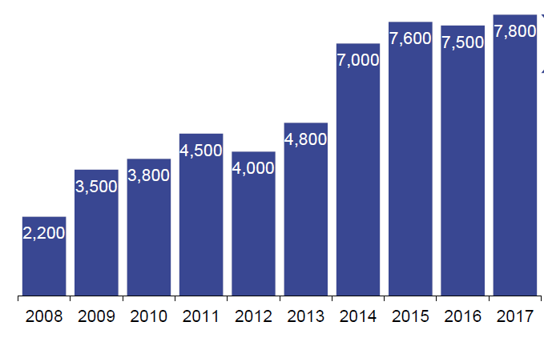

Financial planners are now adopting ETFs in a meaningful way, with approximately 60% of Australian financial planners currently recommending ETFs or intending to do so within the next 12 months.

Planners who currently recommend ETFs typically invest 17% of new client money in them, and are expressing an intention to increase this allocation over time – with this number set to increase to 20% by 2020.

Number of financial planners using ETFs in Australia

BetaShares/Investment Trends ETF Report, 2017

The key motivations for planners recommending ETFs remains similar to those of end investors; low cost, diversification, liquidity, access to specific overseas markets, and access to specific types of investments/asset classes.

While financial planner ETF usage is high, there remains a significant opportunity for financial planners to get more involved in the ETF market, with only 25% of investors saying a financial planner was involved in their most recent decision to invest in ETFs.

Outlook for the sector

The Report projects a record 381,000 Australians will be invested in ETFs by September 2018.

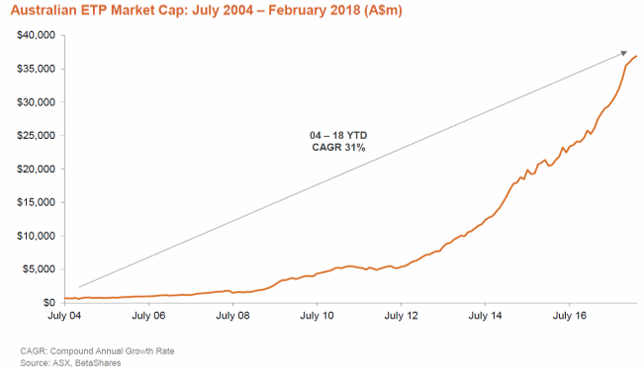

In line with the growth we are seeing, we project the industry will grow from the current $36.9 billion (as at 28 February 2018), and reach $40- $45 billion in funds under management, with approximately 250 exchange-traded products, by the end of 2018.

Ilan Israelstam is Head of Strategy at BetaShares, a sponsor of Cuffelinks. A summary copy of the Report can be accessed here. This article is general information and does not address the needs of any individual.