Emerging markets are at the forefront of global technology growth. Many emerging market tech companies are the most innovative and fastest growing in the world, driven by young, increasingly affluent and tech-savvy populations. The MSCI Emerging Market Index now has the largest technology weighting of any global index, with its share rising from 13% at the end of 2010 to 28% by the end of January 2018.

Here are five key reasons why emerging markets leads the tech revolution:

1. Huge appetite for tech

The sheer size of populations in emerging markets is itself an opportunity. While internet-user growth has been blistering, there’s still plenty of room for expansion. China’s 730 million online population is larger than that of the European Union and US combined but represents only half of the country.

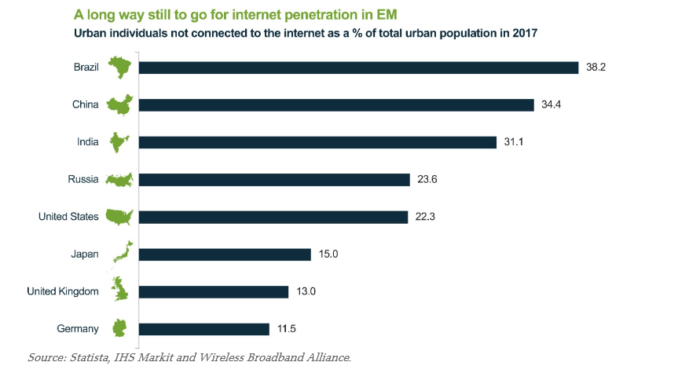

A significant percentage of the ‘unconnected’ in China and other emerging markets like India, Brazil and Russia are urban dwellers (see chart below), which means they can be added relatively fast and cheaply. The youthful demographic profiles of many emerging markets are a real tailwind for technology, given faster adoption and creativity that characterises younger generations.

2. Power of the mobile phone

A large proportion of the population in emerging markets is accessing the internet via smartphones, and this has spurred phenomenal innovation. China’s Tencent, for example, has built a whole content-driven social-networking ecosystem through mobile internet. This includes e-finance, e-commerce, ad-platforms, online-to-offline services, travel and mobile gaming – effectively making it a Facebook, PayPal, WhatsApp, and Amazon all rolled into one. US companies may have spearheaded personal computer internet services, but emerging market tech firms are leading the mobile internet revolution.

3. Taking the lead in FinTech

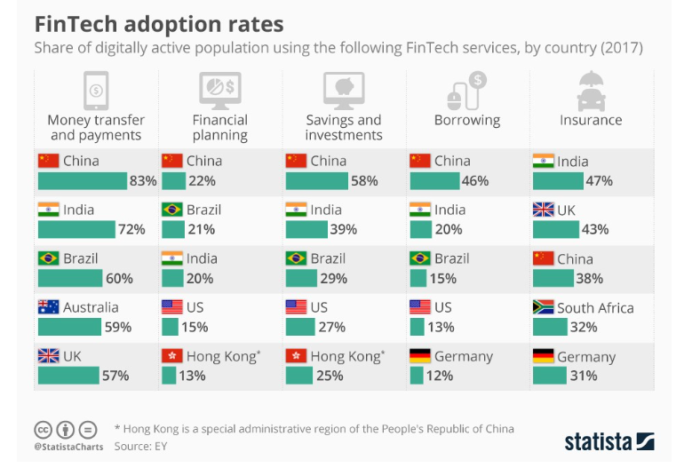

FinTech – the fusion of finance and technology – is a prime example of an area where emerging markets are outpacing their developed counterparts by some margin. This is assisted in no small measure by the mobile revolution, but also broader efforts to improve financial inclusion. Whether it be money transfer & payments, savings & investments, insurance or borrowing, emerging markets exhibit more enthusiastic use of FinTech than elsewhere.

Emerging market financial institutions have also been quick to embrace technology, making them world leaders in the use of electronic distribution channels. The bank with the largest Twitter following in the world is not of developed-world provenance, but India’s Yes Bank.

4. Governments are on board

Emerging market governments are keen to use technology to increase efficiencies and reduce cost. What’s more, demographic pressures have forced governments to focus on their young and increasingly affluent populations. This rise in income and social mobility is most starkly illustrated in Asia, where the Brookings Institute estimates that over two billion people will join the middle class by 2030.

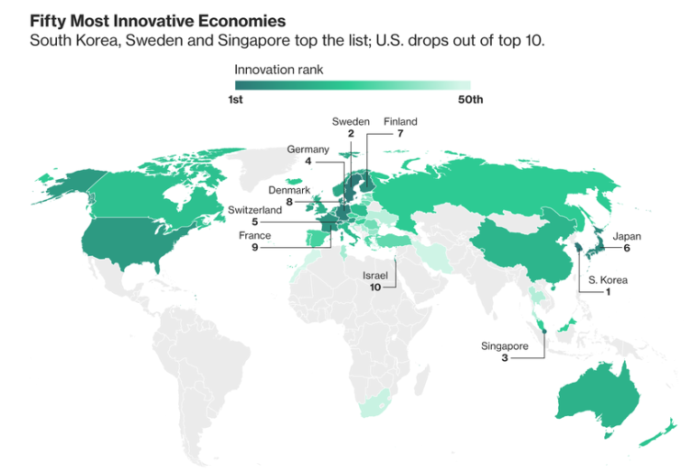

A focus on education and innovation has also helped some emerging markets steal a march on developed market competitors. In Bloomberg’s latest index of the world’s most innovative countries, South Korea again led the field, topping the international charts in Research & Development intensity, value-added manufacturing and patent activity, and with top-five rankings in high-tech density, higher education, and researcher concentration.

Source: Bloomberg, International Labour Organisation, International Monetary Fund, World Bank, Organisation for Economic Co-operation and Development, World International Property Organisation, Jan 2018.

5. Emerging market tech titans

Emerging markets today boast world-class technology firms in both the hardware and software space. Chinese names like e-commerce giants Alibaba and Tencent have built huge footprints domestically (note that in China, US tech giants like Facebook, Amazon, and Google are peripheral players in their respective areas of social media, e-commerce, and search engines).

Both Alibaba and Tencent are now extending their coverage across Asia. Armed with Asia-centric games, social networking, and e-commerce platforms, we believe they will give the formerly dominant US names very tough competition. Meanwhile, other emerging market tech firms, like colossus chip-maker Taiwan Semiconductor, are central players in global supply chains – providing components for major brands like Apple.

Emerging markets – the new destination for tech exposure

Rather than catching up, emerging markets are now taking the lead in a whole raft of different areas of technology. With plenty of untapped growth left, and the highest-quality firms widening their competitive moats, we believe this area presents some of the most attractive long-term opportunities for investors.

Kim Catechis is Head of Emerging Markets at Martin Currie, a Legg Mason affiliate. Legg Mason is a sponsor of Cuffelinks.