Plenty of people want to know if we still call ourselves value investors, or is there a style change in our funds? It's a question we received after our recent roadshow, when we disclosed that about one-third of our Forager Australian Shares Fund (ASX:FOR) is currently invested in tech stocks.

Value can include strong growth prospects

Value investing has always, to me, meant investing in shares of a company at a significant discount to the underlying value of the business. That has often incorporated businesses with strong growth prospects, as long as those growth prospects aren’t reflected in the share price.

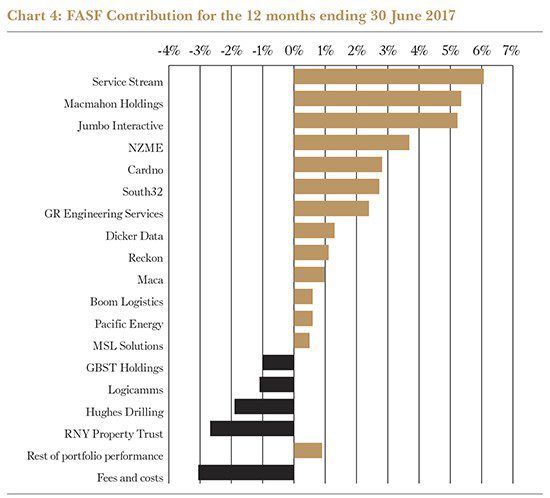

Wind back five years to our 2017 Performance Report, many of the best performers that year were growing businesses and tech companies.

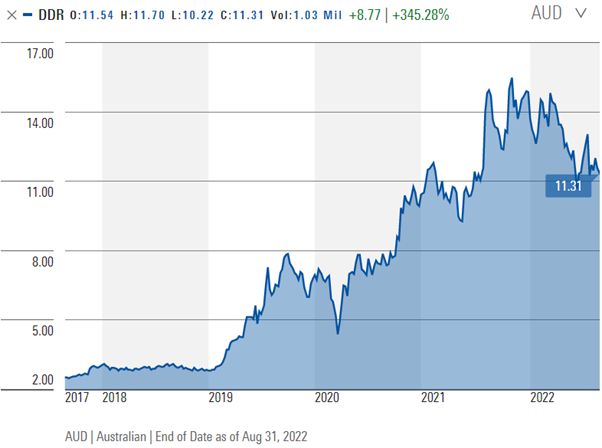

Jumbo Interactive, GBST (since delisted) and Reckon were all tech stocks. Jumbo and GBST were barely profitable at the time we bought them. Dicker Data was a growth stock (albeit one trading on a low earnings multiple at acquisition).

Jumbo Interactive

Dicker Data

Source: Morningstar.com

Most of our historically-successful investments were businesses that grew, even if they weren’t priced to grow at the time of our first investment.

Most famous value investors are perfectly capable of valuing growing businesses. One of Warren Buffett’s most successful investments, the Coca-Cola Company, was one of the 20th century’s greatest growth stocks. Seth Klarman’s publicly-disclosed holdings currently include Amazon and semi-conductor company Qorvo.

Hanging on to the value moniker

The challenge is that the understanding of what constitutes a value investor has changed with the rise and rise of index funds. By categorising the market as either ‘value’, for stocks with high dividend yields and low price-to-earnings ratios, or ‘growth’ for those with the opposite characteristics, index providers were able to offer factor funds.

But I’m not yet ready to give up the moniker. Value investors have appreciated growing companies since before the index fund existed, and the distinction between us and the rest is still important.

Quality and growth are not criteria for our portfolios, simply inputs into our valuations. We want to own quality when it is unloved or underappreciated, not quality for quality's sake. We currently have investments in Seven West Media, mining services and Qantas, and neither would meet a ‘quality’ filter. We simply invest on estimates of future cash returns to shareholders. That is equally true of RPMGlobal, where the earnings are going to grow.

More now, because the time is right

There are two good reasons we have ‘drifted’ towards a higher allocation to growing companies over the past few years.

First, look back at that 2017 list and you will also see Boom Logistics, Hughes Drilling and RNY Property Trust, a cluster of asset-heavy businesses that we invested in at substantial discounts to the ‘value’ of their tangible assets. These did not work out well and were subsequently joined by the likes of Thorn Group and iSelect, similarly ‘cheap’ stocks that never generated the profits we expected. Every business has a price. But the gap between the right price for a shrinking business and a growing one is a chasm. We learned that more than once.

Second, investors should expect us to ‘drift’ a lot. We have a particularly high weighting to tech stocks at the moment but they are all established businesses with predictable and growing revenue streams.

Investors didn’t give a hoot about profits 18 months ago and tech stocks traded on revenue multiples. Today, the share prices have been absolutely hammered and all anyone cares about is profitability.

Change of accounting standards is an opportunity

Yes, some of them are currently reporting losses. But that is largely a function of significant investment in attracting new customers, rather than any reflection on the profitability of the existing customers. Twenty years ago, the accounting standards allowed companies to capitalise customer acquisition costs and spread the expense over the life of the expected revenue stream. That, predictably, led to a proliferation of aggressive and unrealistic assumptions and overstated profitability.

Today’s accounting standards, where all of the customer acquisition costs get expensed upfront, leads to understatement of economic reality.

For the value investor, therein lies the opportunity. These businesses are no more difficult to value than most, and our estimates have not changed meaningfully over the past 18 months. Yet some share prices are 70% lower, taking them from premiums to our valuation estimates to significant discounts. We buy them when they are cheap.

If those share prices rise a lot, and everyone else becomes optimistic, you should expect us to be moving on to the next sector that is out of favour.

If that gets us kicked out of the value investors’ club, then so be it.

Steve Johnson is CIO at Forager Funds, a Sydney-based boutique fund manager. This article provides general information to help you understand our investment approach. It does not consider your personal circumstances and may not be suitable for you.