The recently passed Inflation Reduction Act (IRA) is poised to have a significant impact on the US economy, especially in the renewable energy sector. The Act includes provisions that incentivise the growth of the renewables sector, creating a “supercycle” of investment and development. Australia is well placed given our close relationship with the US and our resources of critical minerals vital for decarbonisation.

So, what is the Inflation Reduction Act?

The IRA was enacted into law in August. It is one of three pieces of legislation that has been passed since 2021 with the goal of enhancing economic competitiveness, innovation, and industrial productivity. The IRA aligns with the priorities of the Bipartisan Infrastructure Law (BIL) and the CHIPS and Science Act, resulting in the introduction of US$2 trillion in new federal spending over the next decade.

The IRA encourages investment in renewable energy, enhances energy efficiencies, and helps companies tackle climate change via tax credits, incentives, and various additional provisions. The pathway to decarbonisation is expected to be enhanced since the IRA will increase demand for electric vehicles (EVs), clean technologies, and low carbon materials/construction.

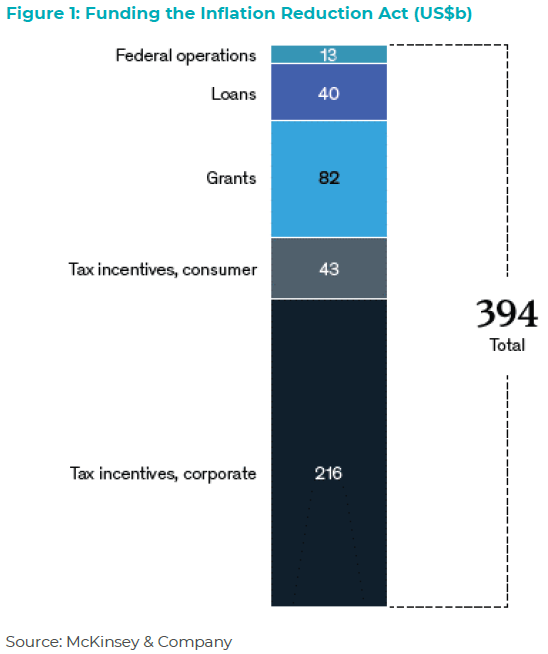

The IRA allocates approximately US$394 billion in federal funding towards clean energy, with the primary objective of reducing the nation’s carbon emissions by the end of the decade. This is primarily accomplished through a combination of tax incentives, grants, and loan guarantees (see Figure 1).

The majority of the $394 billion in energy and climate funding is dispensed in the form of tax credits. Corporations are the largest beneficiary, receiving an estimated $216 billion worth of tax credits. This funding mechanism is aimed at increasing investment in clean energy, transport, and manufacturing in the US.

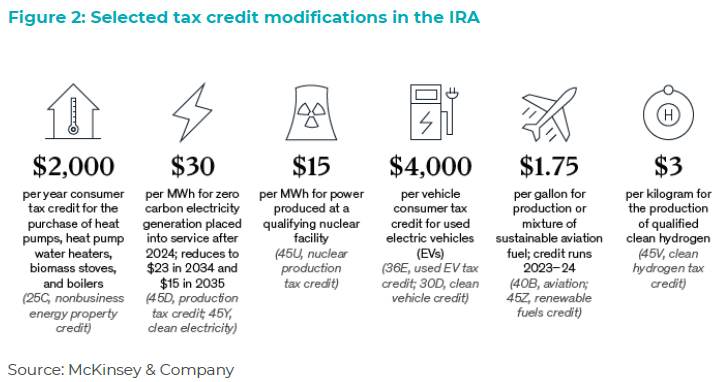

Consumers can take advantage of roughly $43 billion of these tax credits by investing in EVs, energy-efficient appliances, rooftop solar panels, geothermal heating, and home batteries (see Figure 2).

Many of the tax incentives offered by the IRA come with conditions related to domestic production or procurement. For instance, to receive the full EV consumer credit, a certain percentage of the critical minerals in the vehicle’s battery must either be recycled in the US or sourced from a country with a free-trade agreement with the US. The battery must also have been manufactured or assembled in the US.

Europe powers up in response to IRA clean energy push

The European Green Deal established in December 2019 was set up to make Europe the first climate-neutral continent by 2050. The goal of reducing net greenhouse emissions by at least 55% by 2030, compared to 1990 levels, is a bold target. The REPowerEU Plan was launched in response to the Russian invasion of Ukraine, with the purpose of hastening the transition away from fossil fuels and mitigating the economic effects of rising natural gas and electricity prices.

As anticipated, the European Union (EU) has raised concerns that the US IRA will lure investment in crucial green economy manufacturing away from EU-based companies. In response, the European Commission (EC) has introduced a new “Green Deal Industrial Plan” aimed at fostering an environment that attracts net-zero investments by supporting EU manufacturing of green technologies and products. This plan explicitly mentions photovoltaic cells, heat pumps, wind turbines, hydrogen electrolysers, batteries, and carbon capture.

Despite its grand ambitions, the Green Deal Industrial Plan has yet to be fully fleshed out, as limited additional funding has been proposed at this stage and the plan has not yet been discussed by the member states. The plan is built around four key elements: (i) a simplified regulatory framework, (ii) better access to funding, (iii) upskilling, and (iv) open trade to strengthen supply chains. At present, the EC’s primary proposal is to loosen its stringent state aid constraints until 2025, allowing member states to match incentives from other countries (eg. USA). The expectation is that further incentives and improvements to the plan will emerge with negotiations and discussions with the member states.

Supply chains will shift

Car makers in the US will need to eventually eliminate China from their supply chains. POSCO Chemicals and Samsung SDI recently signed a 10-year cathode supply deal, showcasing the shift towards supply chain re-organisation. Value chains will migrate toward the US or nations with trade agreements in place (e.g. Australia and South Korea).

Since the passage of the IRA, several clean ammonia projects have been announced, nearly all located on the US Gulf Coast. The attractive IRA tax credits for hydrogen are driving the growth in ammonia production. For example, Linde has committed US$1.8 billion to supply clean hydrogen to OCI NV’s greenfield blue ammonia project in Texas. This is an example of two non-US companies taking advantage of the IRA by developing projects in the US.

Ford will invest US$3.5 billion in an EV battery plant in Michigan with technology support from CATL, the world’s largest EV battery manufacturer. The factory is due to open in 2026 and will produce enough batteries for 400,000 EVs a year.

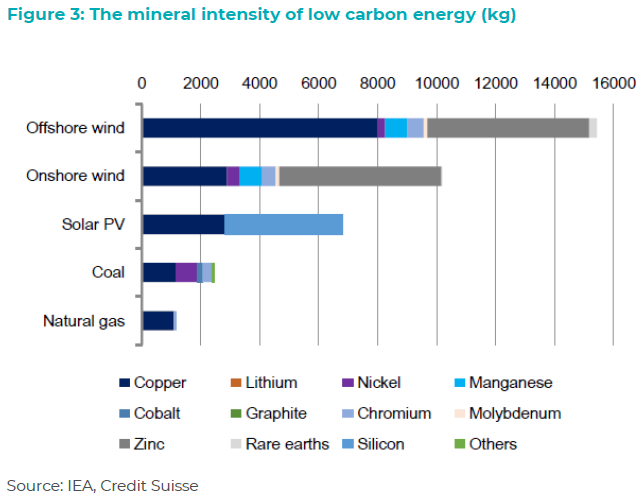

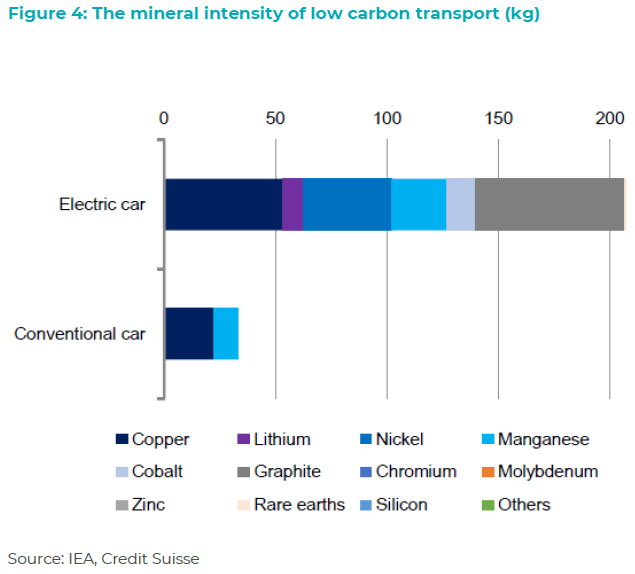

Low carbon technology is mineral intensive

Low carbon technologies and enabling infrastructure are significantly more mineral intensive compared to traditional fossil fuel technologies. For instance, an onshore wind plant requires nine times more mineral resources than a gas fired power plant (see Figure 3), while an EV requires six times the mineral inputs of a conventional car (see Figure 4) according to the International Energy Agency (IEA). Both the IEA and World Bank warn that current mineral supplies and investment plans fall far short of what is required for these technologies to reach their full potential.

Implications for Australia

The current trend sees nations competing to secure supplies of critical minerals required for global decarbonisation. In many ways, it is starting to resemble a global renewables trade war that will be fought both technology and supplies of critical minerals.

It is obvious that China will react to the IRA and Europe’s Green Deal. China has been strategically acquiring supplies of critical minerals through investments in Australia and Africa, as they are the largest manufacturer of wind, solar, and batteries.

As we mentioned in a recent article, an instance of a nation’s efforts to secure the development of critical minerals can be seen in the Australian Federal government granting a non-recourse loan of $1,250m to Iluka Resources to develop the Eneabba Rare Earths Refinery in West Australia. The funding is from the Commonwealth Government’s $2b critical minerals facility. Additionally, lithium-boron producer Ioneer has been one of the early beneficiaries of the IRA, with the US Dept of Energy (DOE) offering a conditional US$700m loan for approximately 10 years to develop its Rhyolite Ridge project in Nevada.

Australia is in a pivotal position given it has a free trade agreement with the USA and is also rich in resources of critical minerals. The IRA – and perhaps eventually the new Green Deal in Europe – support our view that we are entering into a renewables supercycle that will keep the prices of critical minerals elevated for many years to come.

Brad Potter is Head of Australian Equities at Tyndall Asset Management, an investment team within the Yarra Capital Management Group. This article is general information only, it has been prepared without taking into account your personal objectives, financial situation or particular needs.