A recent Bank of America Merrill Lynch listed property (AREIT) conference in Sydney brought many offshore investors together to meet the AREIT CEOs and management teams. Panels discussed topics including how to keep shopping malls relevant, the strength of the Sydney commercial market, policy impacts upon the residential sector and capital flows. Meanwhile, Myer released its revised strategy, offering insights into the department store sector. The key points that I took from these updates included:

Retail

- Successful retail assets will be ‘urban living rooms’, where people go to socialise and get kids out of the house as well as to shop. Landlords are doing whatever it takes to lure people, with some creating architectural features so that the millennials can take their Instagram pictures. Frasers has launched a new Palace Cinema at its Broadway Sydney development (called Central Park) that comprises ten screens, plus three Platinum cinemas and multiple lounge and bar areas. The lounge and bar areas provide food utilising product from existing retailers in the centre in an attempt to make everyone a winner.

- Online retailers don’t necessarily have to open physical stores, but it does help cement the brand. The great advantage of online retailers is that they know where their customers are so they can target their strongest markets by opening a physical presence nearby, typically a collection store. There is acknowledgement that the best way to convert a customer is to have a really good physical experience.

- Mirvac commented that some literature regarding the demise of retail underplays the need for human connection. People don’t buy some items online, such as clothes, and then stay inside their home. They go out to showcase their goods. People need people. Mirvac has introduced a nanny service in some centres, whereby either the nanny looks after the kids or the nanny comes along to shop. The average spend increased four times with the service.

Residential

- Westpac has been surprised about the lack of defaults thus far in the apartment markets. They’ve seen good speed to settlement with Melbourne quicker than Sydney. Some developers have been caught in Brisbane and Melbourne in cases where the banks were paid, but the developer struggled to get their equity back. It is expected there will be more issues next year.

- Around half the development sites 10 kilometres from Sydney and Melbourne are owned by Chinese interests who paid full prices. Some have come to the market seeking to get their money back (via an exit). Local players are sitting back and waiting for an excellent deal.

- Non-traditional financiers have entered the market, beating the banks recently to provide debt. One recent deal in Bondi went to a party backed by a US Teachers Pension Fund.

- Sales remain strong with Stockland and Mirvac both reporting good starts to FY18.

Office

- After many decades of lacklustre growth, Melbourne is looking attractive. It offers cheaper rent and much lower capital values versus Sydney, albeit the cap rates are tight. Docklands is now largely developed which means supply shocks should not be as significant as in the past. It's largely local investors buying in Melbourne as offshore buyers still want Sydney.

- Expect some more REITs to sell Sydney assets with pricing cyclically high. A few expected deals include 20 Hunter St, Sydney which was bought in 2013 for about $100 million, now expected to achieve a sale price between $180-$200 million. Then there's 1 Castlereagh St Sydney that was acquired for about $70 million and could reap around $200 million.

Capital flows

- Australian real estate continues to attract massive amounts of global capital. An Australian working in Asia said that everyone loves the Australian market but when he arrives home, locals are talking it down.

- It's not a homogenous cycle with different rental conditions within sectors. For instance, in the office market, Sydney is in the latter stages of the rental cycle and Perth is at the bottom. In retail there are tough conditions and the industrial is mid cycle.

- In relation to cap rates, there's an argument for this environment to continue ("lower for longer" or as Charter Hall called it, the "Arctic midnight").

- The key issues in past downturns has been oversupply of space, or too much debt. Pleasingly, Australia is well placed on both fronts.

- REITs are happy to develop given comparable pricing for new assets.

Myer and its 128-page strategy update

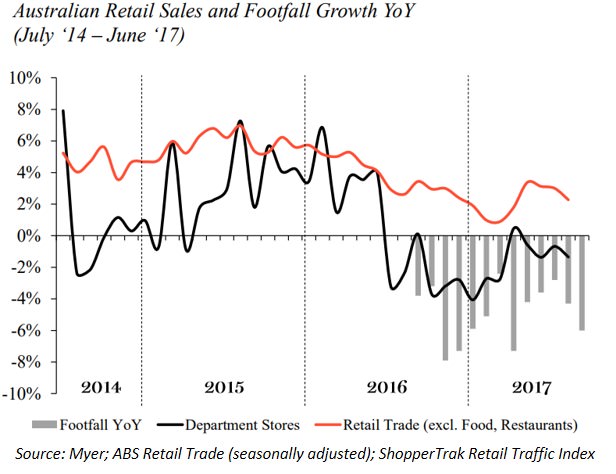

Myer released its strategy update, recalibrating its prior sales targets due to retail sales growth slowing and declining footfalls in malls. In relation to AREITs, they will have reduced their footprint (m2) by 10% in FY18, having already closed three stores and handing back space in four stores, with an additional three store closures to occur (Hornsby, Belconnen and Colonnades). Myer acknowledged it was a tough retail environment but still have growth targets (revised down).

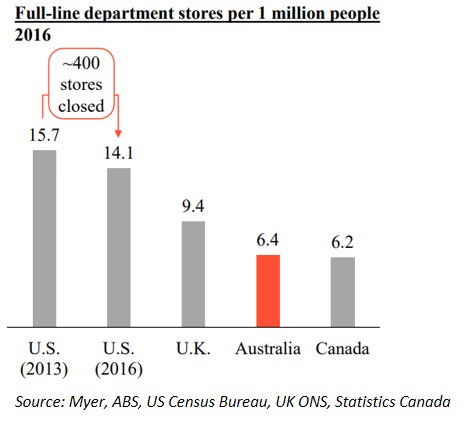

There have been some bad news stories out of the US with JC Penney the latest to struggle but Myer tried to quell the pain by highlighting that Australia has less department store space per person than in other developed countries, plus we have population growth. AREITs have been dealing with this issue for over a decade, with most malls reducing their exposure to department stores. However, the long-term contractual leases in place mean that Myer is liable to pay rents for many years to come.

Pat Barrett is a Property Analyst at UBS, a sponsor of Cuffelinks. This article is general information and does not consider the circumstances of any investor.