Hybrids are the cane toads of the financial markets, and just as cane toads have evolved to survive in a range of climates, hybrids have adapted to changing regulatory and interest rate environments. The similarities do not end there because like cane toads, hybrids have good, bad and ugly characteristics.

The good

Hybrid margins (the difference between the interest earned and the benchmark interest rate) are higher than what has been offered historically and are attractive, especially in a very low interest rate environment (the bank bill benchmark rate is currently about 2%). Interest is calculated quarterly and all ASX-listed bank hybrids are floating rate. Back when interest rates were high, hybrid margins were relatively skinny. NAB’s National Income Securities (ASX: NABHA) were issued in financial ‘pre Jurassic times’ in 1999 with a margin over the bank bill benchmark of just 1.25% pa and investors were happy to invest at that level.

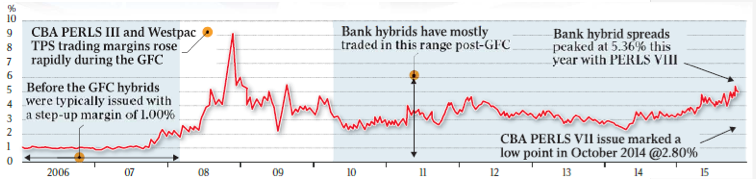

Figure 1: Paying better returns – hybrid spreads widen

Source: Bond Adviser

In more recent times, margins have increased. All of ANZ’s five listed hybrids were issued in the 3% range. But returns hit a low point in October 2014 with the CBA Perls VII issue offering a margin of just 2.8% over the benchmark. This issue was a big one with CBA raising $3 billion. Since then investors have sold down hybrids and the price of Perls VII trades well below its $100 par value and is often in the high $80s to low $90s, pushing the margin up for new investors to over 5%.

While CBA wins the prize for the lowest margin hybrid on issue, Perls VIII issued in February 2016 was at the other end of the scale with a 5.2% pa margin, perhaps rewarding tolerant investors for past mispricing. This issue has tended to trade above par, implying investors would be satisfied with a lower rate.

The most recent Westpac issue, Capital Notes 4 (ASX: WBCPG), settled at a 4.9% margin and raised $1.45 billion, well over the targeted $750 million, a good result for investors and the bank. Next horse out of the gates was NAB with margin set at 4.95%, a small sweetener over the Westpac issue.

Separately, ANZ has announced a USD hybrid, a first for any Australian bank. Considerable work would have gone into marketing the issue, but they will reap the benefits of expanding their investor base and having issuance in another currency. The fixed coupon in USD is 6.5% and the cost of the issuance is rumoured to be higher once swapped back into Australian dollars as a premium for a new market is fairly typical.

The success of the heavily-oversubscribed ANZ deal will open another market for the majors and could mean reduced issuance here. Depending on demand, this could push hybrid prices higher. The issue will provide an international comparison of margins and terms for our own insular, domestic market.

The bad

The complexity and range of terms and conditions in hybrids makes them hard to assess. Comparing older hybrids that were more debt-like with new ones is extremely difficult. For example, the ANZPC and WBCPC were issued soon after Basel III was implemented and contain capital trigger clauses but not a non-viability clause that was mandatory from early 2013. So what extra return do you require over and above the margins on those securities to compensate for the additional risk?

The non-viability clause is important for investors to understand, and we have prepared this fact sheet for those requiring more information.

The ugly

The conversion terms and conditions especially those following a ‘loss absorption’ event are ugly. Practically every hybrid has variations to these terms and percentage conversion rates can differ, even if issued by the same bank. It’s part of the evolution of hybrids.

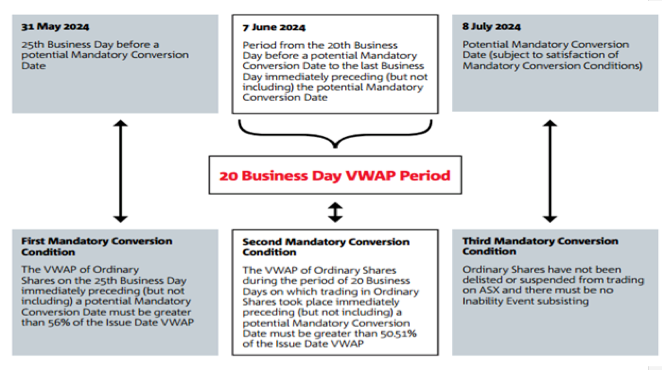

Investors should be aware of multiple possible outcomes, and follow the share price of the bank as it determines conversion or not. For example the NABPD requires that “The VWAP (volume-weighted average price) of ordinary shares on 25th business day immediately preceding (but not including) a potential mandatory conversion date must be greater than 56% of the issue date VWAP”. All new hybrids have similar clauses. It means hybrids aren’t set and forget investments and you need to keep track of share price movements. Those hybrids issued when share prices are high are at greater risk of non-conversion. For an example of the complexity, consider the terms of the NABPD conversion.

NABPD conversion conditions

Source: National Australia Bank, NABPD prospectus, page 24

The success of all the recent hybrid issues shows investors are willing to accept these ‘ugly’ terms and conditions as they search for yield, but in financial markets, there’s no reward without risk. Remember that cane toads were originally introduced to Australia to control a major pest, the sugar cane beetle, and many decades later, that has turned very ugly indeed.

Elizabeth Moran is Director of Client Education and Research at FIIG Securities. Click on this link for a free copy of FIIG’s 2016 Smart Income Report designed for income-seeking investors. This article is general information and does not consider the circumstances of any individual.