October 2014 marks the end of the US Federal Reserve’s monetary policy it called ‘quantitative easing’ (QE) but the rest of us called plain old ‘money-printing’. The Fed’s aim was to create inflation by buying assets with newly printed money (instead of paying for them with cash raised by selling securities into the market) and crediting commercial banks’ reserve accounts in the hope that banks would increase lending to borrowers to invest and spend. A second aim was to depress the US dollar to help exporters (the theory being that money printing should devalue the currency because more paper money is chasing the same supply of assets).

There was much doom and gloom and even panic in the financial media about what QE might mean for markets. The resultant inflation or even hyper-inflation was supposed to be bad for share prices and bond prices, while the prices of inflation hedges like gold, oil and metals should soar. All this was supported by logic, theory, conventional ‘wisdom’ and the weight of opinion.

As it turns out, virtually all of the outcomes predicted by theory, logic and the shrill financial media were wrong. Driven by QE, markets did the opposite of what the conventional wisdom and weight of opinion expected. Prices of shares and bonds soared, the US dollar strengthened, and inflation and inflation hedges (gold, oil, metals) all fell.

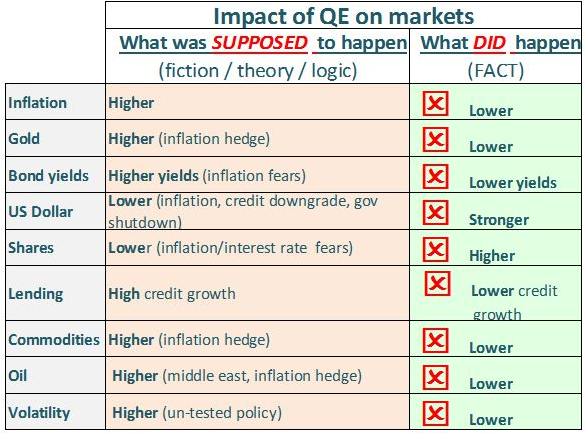

The following diagram shows what was supposed to happen, and what did happen.

But US QE was not a failure. It prevented deflation in the US, which is far more debilitating than inflation. It also provided enough stimulus to bring US unemployment down from 10% to 6%. These benign outcomes inspired central banks in UK, Japan and now Europe to take similar action.

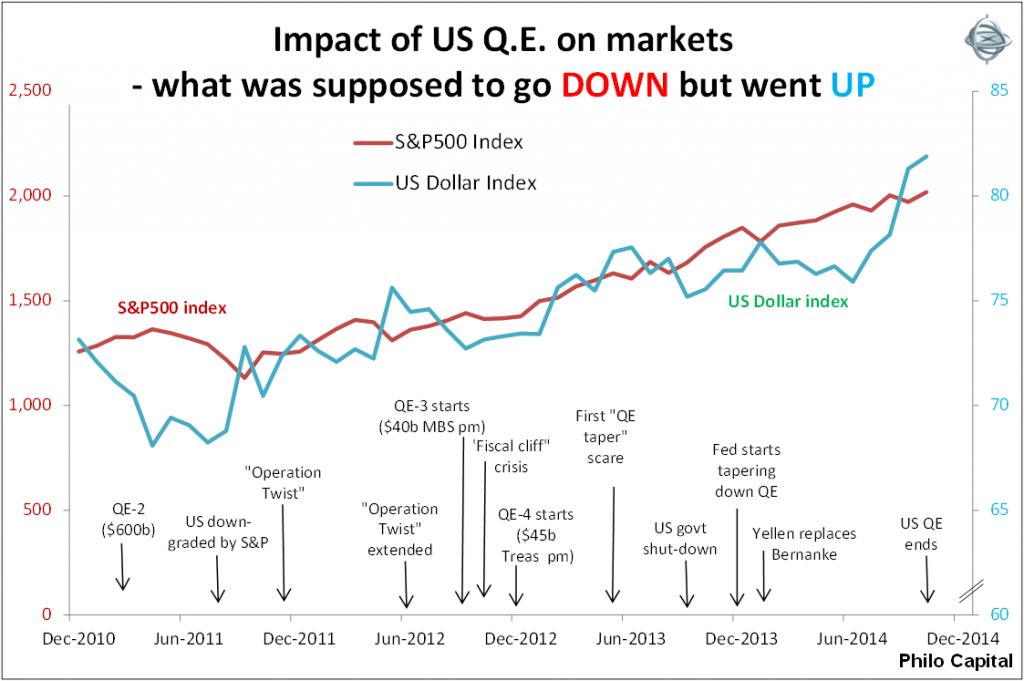

The following charts show the key events and impacts on markets. The first shows what was supposed to go down as a result of the massive central bank money-printing spree but went up instead.

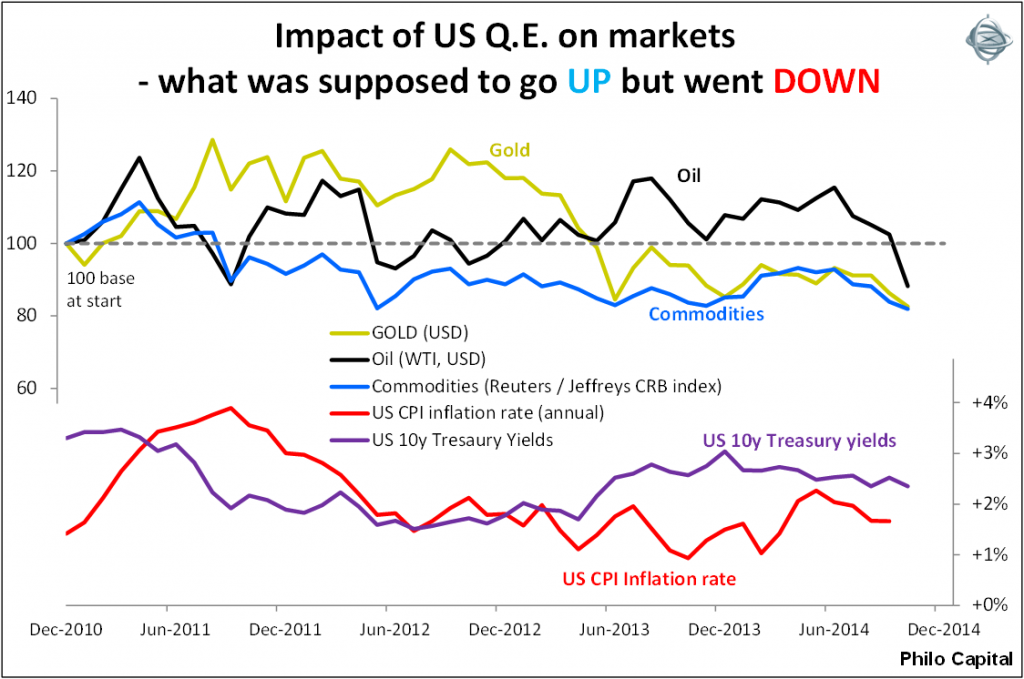

The second chart shows what was supposed to go up as a result of the money-printing but went down instead.

It has been a good reminder that markets do not work according to text-book theories, nor do they follow logic. In the real world markets are driven by humans who in turn are driven by raw emotions and often illogical knee-jerk reactions to events that they perceive to be relevant. Studying these dynamics is far more difficult, interesting and rewarding than studying theory!

Ashley Owen is Joint CEO of Philo Capital Advisers and a director and adviser to the Third Link Growth Fund. This article is for general educational purposes and is not personal financial advice.