Research company Independent Investment Research (IIR) produces a monthly report on Listed Investment Companies, which Cuffelinks regularly publishes.

In addition to the usual updates on new issues and fund activity, it includes an extensive database on LICs covered in their research.

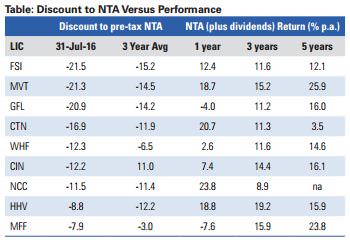

This week, there is a useful article on LICs trading at a discount to their Net Tangible Assets (NTA) value. This does not necessarily make them a 'buy', as explained by IIR:

"LICs can often trade at a discount for a prolonged period and there is no guarantee that share prices will eventually move towards NTA. Before buying LICs at a discount we need to understand why they are trading at a discount and the likely catalysts to move them closer to NTA."

Here is a sample. Despite some of the LICs being managed by prominent fund managers, for various reasons, some LICs fall out of favour.

For example, the portfolio of a LIC such as Flagship Investments (ASX:FSI) has outperformed its index but it has a long history of trading at a discount, in this case over 20%, partly due to its relatively small size (about $40 million). As IIR writes on FSI:

"Large-cap stocks account for around half the portfolio, with the rest split between mid, small and micro-cap stocks. The portfolio (pre-tax NAV plus dividends) has outperformed the ASX All Ordinaries Accumulation Index over one, three and five-year periods. Performance has been helped by exposure to the better performing small cap sector of the market. Tracking error is slightly higher than some of the large cap focused LICs but beta is below one. FSI was at a 21.5% discount to pre-tax NTA at 31 July 2016. This looks an attractive entry point, but the shares have historically traded at a large discount. If the company is able to sustain outperformance this may lead to a rerating over time."

There is no slow down in the number of LICs coming to the market, with total funds under management reaching the $30 billion level. Given there is now a choice of over 80 LICs, it's a segment of the market worth understanding.

Graham Hand is Editor of Cuffelinks. Disclosure: Graham is on the board of the Listed Investment Company, Absolute Equity Performance Fund Limited (ASX:AEG), and holds an investment in FSI. This article is general information and does not consider the circumstances of any individual.