Numerous European countries now have short, medium and even long term government bonds issued in local currencies (including Euros) offering investors negative yields, such as Germany, Switzerland, France, Denmark, Netherlands, Sweden, and even Ireland and Portugal! Why would anyone invest when they receive less back on maturity than the original investment? It’s not for the interest payments – most offer interest coupons of only a fraction of a per cent.

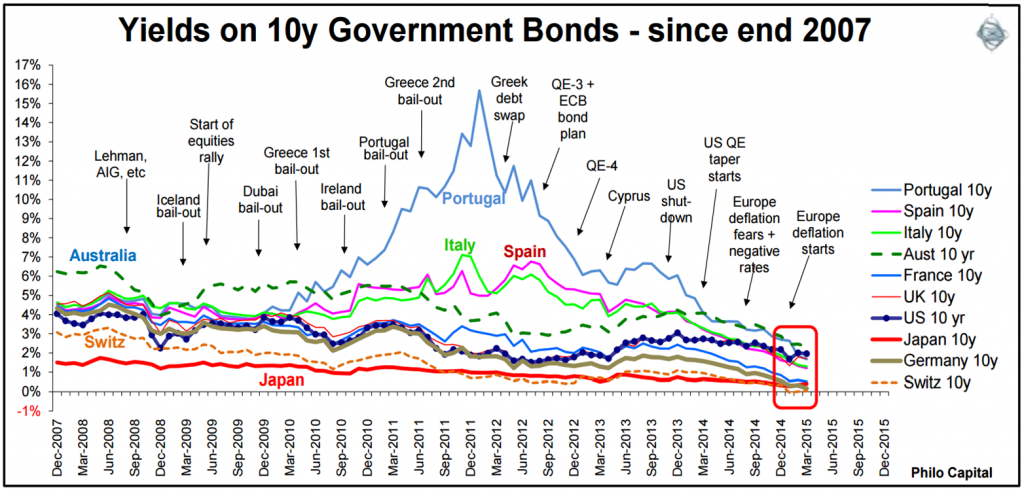

The chart shows yields on 10 year government bonds rising during the 2010-12 ‘PIIGS’ crisis and then declining as Europe slowed into deflation prompting the start of Eurozone ‘quantitative easing’. The PIIGS countries of Spain, Italy and Portugal have experienced dramatic reductions in their borrowing costs. Bond yields fell again in March 2015 in most markets, with the main exceptions being Greece where yields rose as it lurches toward its third bailout or possible Euro exit, and Japan, where yields also rose a little with its money printing efforts and exit from recession.

European investors are either predicting decades of price deflation ahead, so a buyer could make a positive real return (after negative inflation), as Europe entered deflation late last year. Or they are simply terrified of putting their money anywhere else. They prefer buying loss-making bonds instead of just hiding their money ‘under the bed’ or in a safe at home or in a deposit box at their local bank branch, where they would at least get their money back intact. They seem to prefer the certainty of losing money invested in government debt rather than the remote risk of theft if their homes, banks or countries are invaded and plundered. Switzerland makes sense as a safe haven for Europeans, but Germany? Germans tried to conquer Europe by military force three times in the past 150 years!

With yields so low, investors are accepting longer and longer terms in the search for yield, fuelling a boom in multi-decade sovereign and corporate debt. On 10 March 2015 the UK government issued 53 year bonds at an incredibly low 2.62% yield as the UK enters deflation.

It is correct that most government bonds in the world (including Australia) are trading at a premium to par so investors who buy them now are guaranteed to make a capital loss. And that's if the government pays which it probably will, although Australia has defaulted in the past. And that's before inflation. If inflation rises from zero or negative at the moment back to rising a couple of percent, those long term bonds could drop by 20-30% in value.

There is a way out of losing money, of course. When a PIIGS country exits the Euro, its own currency is likely to plummet. If there is a ‘Grexit’, the Greek Drachma will probably drop 30-50%, so Greek investors in Euros will make handsome returns, even if they initially invest at negative yields. The low yields are a bet against the Euro holding together.

That's if the Germans give them their Euros back at maturity. In the meantime, European bonds and shares are generating outstanding returns in the short term under ‘QE Europe’ as yields fall, the Euro falls and share prices surge.

Ashley Owen is Joint CEO of Philo Capital Advisers and a director and adviser to the Third Link Growth Fund. This article is educational only. It is not personal financial advice and does not consider the circumstances of any individual.