Jamie Dimon, the Chairman and CEO of JP Morgan Chase since 2005, is the world’s most influential commercial banker, and a billionaire in his own right due mainly to his massive stake in his own bank. He writes an annual shareholder letter which is closely followed, and the 2022 version was released last week. This article highlights the views of the man who runs the largest bank in the US, the biggest economy in the world.

Dimon goes from 'hurricane' to 'storm clouds'

A year ago, Dimon’s high-profile worries about the impact of ‘quantitative tightening’ (withdrawal of liquidity by central banks) and the consequences of the Ukraine war on energy prices led to him saying,

“JP Morgan is bracing ourselves and we’re going to be very conservative with our balance sheet.”

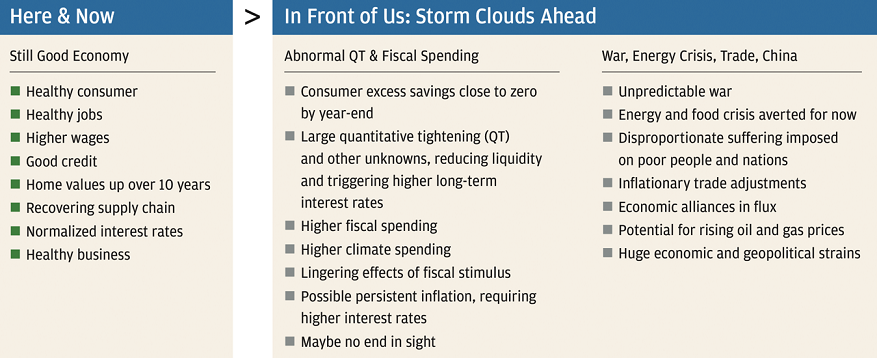

His previous reference to a ‘hurricane’ is now ‘storm clouds’. This time around, he cites US consumer strength, low unemployment and rising wages for lower- paid workers as reasons for more economic optimism. Now he says:

"Businesses are pretty healthy and credit losses are extremely low ... When one talks about risk for too long, it begins to cloud your judgment. Looking ahead, the positives are huge ... However events play out it, is likely that 20 years from now, America’s GDP will be more than twice the size it is today.”

A move from virtuous cycle to vicious cycle

When someone of Dimon’s stature, who has seen most of the problems a major bank can face, says today is different, it’s worth taking notice.

“Of course, there is always uncertainty. I am often frustrated when people talk about today’s uncertainty as if it were any different from yesterday’s uncertainty. However, in this case, I believe it actually is.

Less-predictable geopolitics, in general, and a complex adjustment to relationships with China are probably leading to higher military spending and a realignment of global economic and military alliances.

Higher fiscal spending, higher debt to gross domestic product (GDP), higher investment spend in general (including climate spending), higher energy costs and the inflationary effect of trade adjustments all lead me to believe that we may have gone from a savings glut to scarce capital and may be headed to higher inflation and higher interest rates than in the immediate past.

Essentially, we may be moving, as I read somewhere, from a virtuous cycle to a vicious cycle.” (my bolding)

Surprising numbers on the importance of interest rates

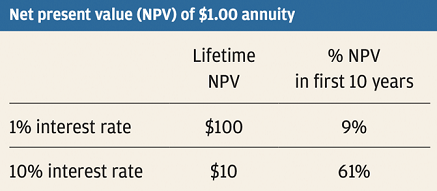

Dimon says that interest rates affect all things economic, and uses the following illustration:

The maths is “immovable and affects all”. Dimon calculates that the Lifetime Net Present Value (NPV) of $1 received every year is $100 now when the discount rate is only 1%, but at 10% (which is the cost of funds for many non-investment grade companies now), the NPV is only $10. Furthermore, 61% of the NPV value is in the first 10 years. Dimon explains:

“When you analyze a stock, you look at many factors: earnings, cash flow, competition, margins, scenarios, consumer preferences, new technologies and so on. and affects all.

In a rapidly rising rate environment, any investment where the cash flows were expected in the out years would have been dramatically affected – think venture capital or real estate development, for example. Any form of carry trade (effectively borrowing short and investing long) would be sorely disappointed. Carry trade exists not just in banks but is embedded and is silently present in companies, investment vehicles and others, including situations that require recurring refinancing.”

Dimon is preparing JP Morgan to expect higher interest rates for longer.

Risks and opportunities in the global economy

He sees the need to restructure supply chains as benefitting Brazil, Canada, Mexico and friendly Southeast Asian nations. It suggests Australia is not high on his radar. He says the winners are materials that are essential for national security (rare earths, 5G and semiconductors), countries that protect critical industries (EVs, AI and chips) and companies that diversify their supply chains.

Inflation and interest rates do not worry him the most.

“I’m most concerned about large geopolitical events, cyber attacks, nuclear proliferation, large dysfunctional markets (partially due to poorly calibrated regulations; e.g., the U.K. Gilt and U.S. Treasury markets) and failure of other critical infrastructure.”

Major banks will play a smaller role

Dimon expects a decreasing role for US banks in the global economy, with one reason being the increasing amount of regulation and legislation imposed. It’s not difficult to read between the lines that Dimon is completely exasperated by his dealings with regulators, and frustration that a disaster such as Silicon Valley Bank can go undetected in advance. He laments what his business must endure:

“Regulations include stress testing, reporting, compliance, legal obligations and trading surveillance, among others. While the business is the first line of defense on all these issues, we also have 3,700 people in compliance, 7,100 in risk and 1,400 lawyers actively working every day to meet the letter and the spirit of these rules along with the final line of defense - audit.

Rules are constantly changing and/or being enhanced and are sometimes, unfortunately, driven by political motivations. Relationships with regulators can often be intense, and, recently, we have lost some terrific people in our firm because of this. Regulators know that when banks disagree, we essentially have no choice — there is no one to appeal to, and even the act of appealing can make them angry. We simply ask respectfully to be heard, but at the end of the day, we will do what they ask us to do.”

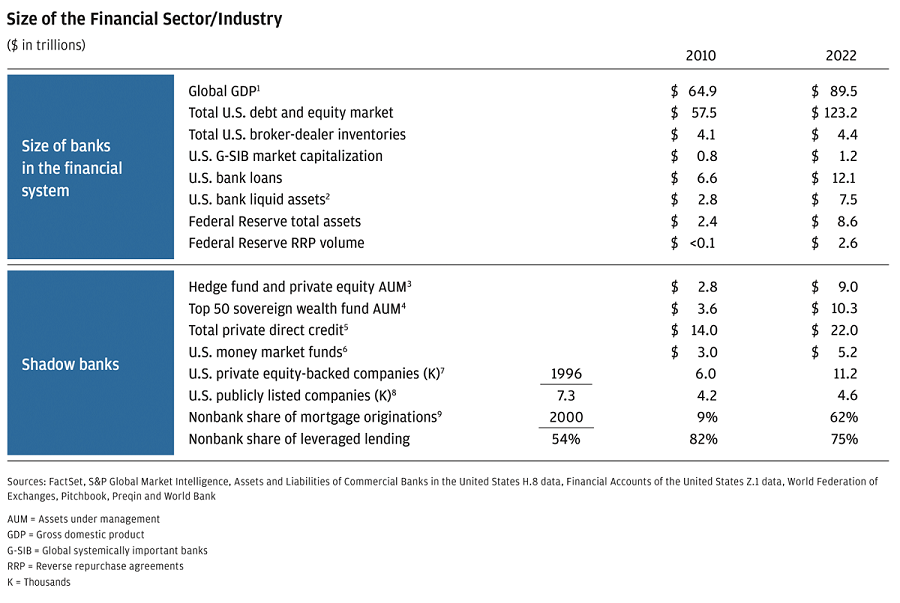

He uses the following chart to show the increasing role of ‘shadow’ banks.

The most surprising numbers here are:

- Non-bank share of mortgage originations, from 9% in 2010 to 62% in 2022.

- Number of US listed companies, from 7,300 in 1996 to 4,600 in 2022 (more on this below).

- And with that, the rise in hedge funds and private equity assets, from US$2.8 trillion in 2010 to US$9 trillion in 2022. Plus a massive increase in sovereign wealth funds.

While crying over spilled milk, the business is changing

And his bank needs to adjust, and he does admit to 'crying over spilled milk'. Changes include:

- Certain types of credit and loans have become less profitable because of the high levels of capital required, so this is better left to a nonbank while JP Morgan focuses on non credit-related revenue.

- It is increasingly difficult for banks to stay in the mortgage business, due to the costs of origination and servicing along with the complexity of regulations. “We are hanging on, continuing to hope for meaningful change.”

- Increasing activity in low-capital revenue streams, such as trading, travel and offers in the consumer bank, wealth management and payment services businesses.

The decline of public companies

Dimon highlights that an increasing amount of economic activity takes place in unlisted companies, as the number of U.S. companies backed by private equity firms has grown from 1,900 to 11,200 over the last two decades, combined with the growth of sovereign wealth funds and family offices.

“Is this the outcome we want? There are good reasons for such healthy private markets, and some good outcomes have resulted from them as well. The reasons are complex and may include public market factors such as onerous reporting requirements, higher litigation expenses, costly regulations, cookie-cutter board governance, less compensation flexibility, heightened public scrutiny and the relentless pressure of quarterly earnings ... the pressure to become a private company will rise."

He criticises aspects of public reporting, ESG information and proxy voting which makes it easy to place disruptive directors onto a company’s board, but who wants to go on a board anyway?

“Corporate governance principles are becoming more and more templated and formulaic, which is a negative trend ... The governance of major corporations is evolving into a bureaucratic compliance exercise instead of focusing on its relationship to long-term economic value. Good corporate governance is critical, and a little common sense would go a long way.”

A unique and complicated future

While Dimon does not believe conditions are as bad as the GFC of 2008, and the ‘here and now’ includes many positives, he worries about the storm clouds.

In the last three years, the Federal Government had a deficit of US$3.1 trillion (2020), US$2.8 trillion (2021) and US$1.4 trillion (2022). This level of spending is unsustainable but there is no end in sight. QE created extraordinary liquidity and a surging money supply that pushed prices higher in all asset classes, but the consequences of winding back the central bank stimulus are unknown.

The governments of the world still have massive debts to finance, while the war means energy and food supply lines are not secure. It may lead to higher prices and large migrations of people, triggering another level of geopolitical dislocation.

Storm clouds, indeed.

The full JP Morgan Chase Shareholder Letter for 2022 is here.

Graham Hand is Editor-at-Large for Firstlinks. This article is general information and does not consider the circumstances of any person.