[Managing Editor’s note: This is Part 1 in a series that Graham Horrocks has written due to “a miserable level of discussion and to relieve my frustration” relating to the Australian tax, dividend and superannuation system. Graham is an actuary and was my first financial adviser 30 years ago, when we spent most of the day talking about strategy and long-term structure, and nothing about picking fund managers or stocks.]

--------------------------

The Government proposal to lower the corporate tax rate in Australia has prompted a heated debate about the impact on shareholders. The widespread inaccuracy in reporting the consequences has prompted me to put together some figures and comments as background. For example, one prominent adviser/commentator recently wrote incorrectly that "at a 25% corporate tax rate, personal taxpayers would suffer because of their higher marginal tax rates and face additional tax bills on franked dividends."

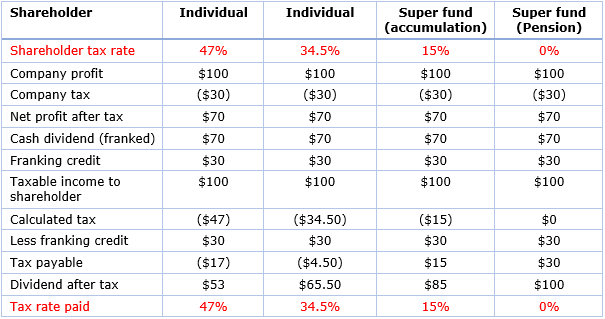

Income tax payable by an Australian investor receiving a franked dividend

The Australian system of full dividend imputation should be front and centre in any debate on the rate of company tax in Australia. Dividend imputation was introduced after a long campaign by business to avoid the double taxation of company dividends. Australian shareholders only pay tax on dividends once, at their own tax rate, but the company tax rate and the amount paid by the company is irrelevant to Australian shareholders.

Calculations in the table below are based on a company tax rate of 30% and tax rates for Australian shareholders of 47% and 34.5% (including Medicare Levy) for individuals, 15% for superannuation funds in accumulation phase (super funds) and zero for superannuation funds in pension phase (pension funds).

Shareholder tax rate and tax rate paid under dividend imputation

The company tax rate is irrelevant because regardless of the level, tax is subtracted from profits and then added back for investors as a franking credit. These figures can be recalculated with a lower tax rate of 25% (or any other figure) and it will reduce the company tax payable, increase the after-tax profit, increase the cash dividend and reduce the franking credit. But, the dividend after-tax received by the shareholder on the various tax rates will be exactly the same: $53 (47% tax rate), $65.50 (34.5% tax rate), $85 (15% tax rate) and $100 (tax free).

Company tax rate has no impact on the after-tax dividend

In each case, the total tax payable and hence the amount of the dividend after tax reflects the profit of the company before tax and the Australian shareholder’s tax rate only. The company tax rate has no impact on the amount of after-tax dividend received by an Australian shareholder.

Some additional comments:

- The value of a company is the present value of the dividends which are expected to be earned in the future, after tax payable by the shareholder. Even when the company is sold, its value then will still be the present value of expected future after tax dividends. The amount of dividend received by an Australian shareholder after tax reflects the shareholder’s tax rate and is independent of the company tax rate, so the value of a company to an Australian shareholder is also independent of the company tax rate.

- In many cases the after-tax position for an overseas shareholder is much the same as for an Australian shareholder. Tax rules in USA, UK, much of Europe and other countries, together with double taxation arrangements generally mean that any tax paid by the company in Australia is offset against tax payable overseas by the parent company. Thus, lower tax paid in Australia by a company will mean more tax paid overseas, i.e. a subsidy from Australian taxpayers to overseas countries – unless, of course, profits are passed through a tax haven on the way. Figures published recently suggest that the proposed reduction in the company tax rate in Australia for large companies would represent a huge subsidy from the Australian taxpayer to overseas countries, hardly in Australia’s best interest.

- The proposed reduction in the company tax rate is expected to result in a significant cost to tax receipts received by the ATO. Some figures suggest that much of this cost comes from the subsidy from Australian taxpayers to overseas companies described above. Another component of the cost is likely to be retained (after-tax) profits within Australian companies where franking credits are retained rather than being distributed to shareholders. This is discussed in Part 2 next week.

Graham Horrocks is an actuary specialising in financial planning and superannuation, and a former General Manager, Research & Quality Assurance, with Ord Minnett. Since 1999, he has been an independent financial adviser. The article was reviewed by Geoff Walker, former Chief Actuary at the State Bank of New South Wales and winner of the 1989 JASSA Prize for published research on the implications of the then relatively-new dividend imputation system.