In Part 1, we looked at some of the potential benefits of hedge funds, while Part 2 focusses on the criticisms. Investing in hedge funds is one of the more polarising topics in the investment world. The advocates of hedge fund investing paint a rosy picture without acknowledging the negative aspects, while the critics paint the opposing view without acknowledging the potential benefits. There are also many different types of ‘hedge’ funds and these comments apply to a general portfolio of hedge funds.

Diversification

As mentioned in Part 1, a hedge fund can sometimes produce a return stream that has a low level of correlation with the general risk assets like equities, although the relationship is variable.

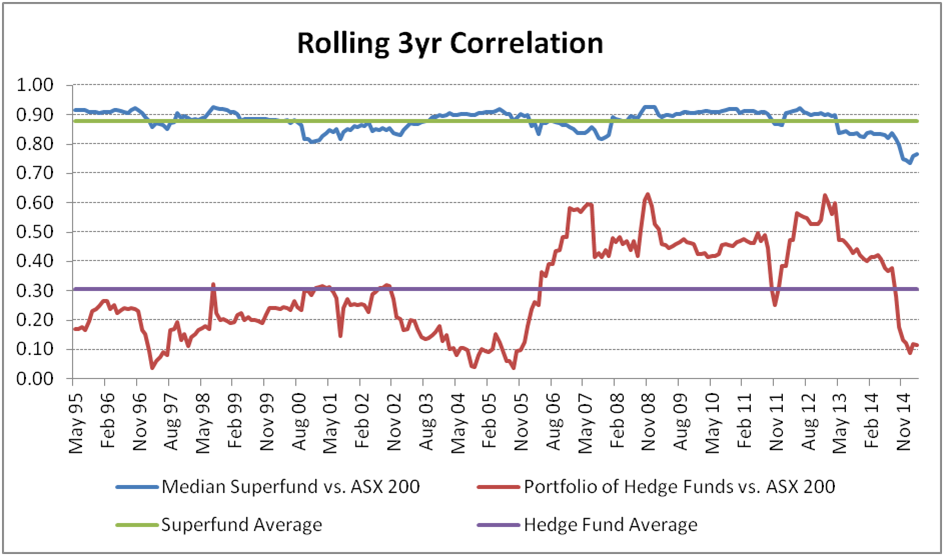

It pays to be careful when interpreting correlation statistics, because correlation is not the same as causation. With this in mind, this figure shows a standard measure of correlation between the ASX 200, the median superfund and the portfolio of hedge funds. The correlation levels for superfunds and equities are extremely high, indicating that equities are probably driving more of a diversified portfolio’s risk than is generally recognised. It also shows that hedge funds show lower levels of correlation but with considerable variation. Despite a recent period of higher correlations for hedge funds and equities, this has reduced to more normal levels.

Not all hedge funds are created equal

Notwithstanding the positive attributes mentioned in Part 1, we also believe that not all hedge funds are created equal, and factors involved in selecting hedge funds should be left to experienced, competent professionals.

The first factor is an understanding of the hedge fund manager's advantage, expertise, and ability. It's important to be able to understand why a particular manager is able to execute a strategy better than competitors, and determine how durable any advantage may be.

Another key factor is integrity, probably best summarised by Warren Buffett when he commented: “Somebody once said that in looking for people to hire, you look for three qualities: integrity, intelligence, and energy. And if you don't have the first, the other two will kill you. You think about it; it's true. If you hire somebody without (integrity), you really want them to be dumb and lazy.”

Alignment of interests is also important. Hedge funds generally charge a performance fee, which allows the manager to earn a significant percentage of any gains without having to give back a similar percentage of any losses. This asymmetric fee structure means that there is always the risk that the manager may be tempted to act in their own best interests, instead of those of the investor.

A final key aspect of hedge fund assessment is operational capability. A number of hedge fund failures can be traced to deficiencies on the operational side of the business, so an institutional-grade infrastructure and competence are critical to helping minimise this risk.

Fees

The high fees charged by hedge funds are often cited as a reason not to use them, to the point where the risk-adjusted returns after fees are not even considered. There are a small number of hedge funds that are worth paying higher fees for, although we also recognise that the vast majority will not generate returns that justify their higher fees. We don't think that paying higher fees is necessarily a bad idea if it results in a better investment outcome (higher net returns), and it makes little sense to make fee minimisation the focus of an investment program at the expense of a good investment outcome. What seems cheap initially could be expensive in the long run.

Liquidity

Two aspects to liquidity are worth considering. The first is the liquidity offered through a fund's normal redemption cycle. The second and more problematic is the ability or willingness of a fund to abide by its normal redemption terms during stress environments such as 2008.

We don't think of the normal redemption terms as a constraint, since they're known in advance and can generally be planned for, although we expect to earn a return premium for the lower level of liquidity. In any case, the majority of investments in diversified portfolios offer daily liquidity, so having a small portion that offers monthly or quarterly liquidity should have little noticeable impact on total portfolio liquidity.

The second aspect of not abiding by the normal redemption terms is a concern, and was poorly-handled by some hedge funds in 2008 when they used various methods to prevent clients from redeeming. To manage this risk, we compare the redemption terms of each hedge fund to the liquidity of its underlying investments and ensure that these are appropriate.

Transparency

Portfolio transparency can be considered on a number of levels, but the key for most investors is the need to understand how the fund's portfolio is constructed, and what it contains.

Most hedge fund managers we have encountered are comfortable discussing their portfolio and distributing useful summaries of the portfolio's salient features on a regular basis. This information can also be cross-referenced with the fund's audited accounts and administrator.

One touted solution to the transparency issue is the use of separately managed accounts (SMAs), although these come with both advantages and disadvantages. Use of an SMA gives an investor greater security, because the investor owns the underlying assets directly and appoints an investment manager to manage the assets on their behalf. Contrast this with a traditional co-mingled structure where the investor owns units, along with other investors, in a vehicle over which the investment manager has far greater control. One of the key disadvantages we find with SMAs is that the better managers do not offer them, so the choice of funds will be curtailed and the performance outcome could be affected.

Implementation

This is absolutely critical to a good outcome, but is also an area where we have seen corners cut which has resulted in a poor outcome. An unfortunate by-product is that hedge funds are often blamed for the poor outcome, when it was really the investor's implementation that was flawed.

Experience tells us that the better hedge funds do not offer daily liquidity and do not have the lowest fees. Some lower their fees and offer daily liquidity to raise assets, but finding a great fund with low fees and daily liquidity is rare. When leverage and illiquid assets are combined, the outcome can be disastrous. Once again, it would be incorrect to blame this outcome on hedge funds. It is the investor who chooses to lever into the funds.

High investor losses

In the case of hedge fund frauds, there were often a number of red flags which were ignored, or exceptions to the due diligence process were made. The best defence against a fraudulent fund, as we have alluded to previously, is a strong due diligence process implemented by experienced professional investors.

Experiencing trading losses is an unavoidable part of investing, and George Soros perhaps put it best when he said: "It's not whether you're right or wrong that's important, but how much money you make when you're right and how much you lose when you're wrong." It's important to understand how each hedge fund manager thinks about and manages risk, in order to gauge how much they may lose if they're wrong.

Conclusion

One of the key tenets of our investment philosophy is that generating and preserving wealth over time depends on the ability to compound wealth steadily and avoid large losses. We believe it makes sense to allocate some capital (say 5% to 20% of a ‘typical’ diverse portfolio) to hedge funds that are active risk managers with the ability to protect capital in negative market environments. From a portfolio construction sense, it also helps if the hedge fund's returns are driven by factors that are different to the drivers of return in most diversified portfolios, in particular, traditional equities and fixed income investments.

Craig Stanford is Head of Alternative Investments at Ibbotson Associates and is Chair of the Investor Education Committee for the Alternative Investment Management Association in Australia. Ibbotson Associates Australia is a Morningstar company and part of Morningstar’s investment management division. Information provided is for general information only, and individuals should seek personal advice before making investment decisions. The objectives of any individual have not been considered in this article.