The taxation structure of superannuation funds in Australia is curious by world standards. Most countries follow the ‘EET’ taxation structure (Exempt contributions, Exempt investments, Taxable benefits). Australia, unusually, follows the ‘TTE’ structure (Taxable contributions, Taxable investments, Exempt benefits), though the ‘T’ is levied at concessional rates. It will be fascinating to see what will change as the Government moves through its tax reform agenda this year.

Taxation in the accumulation and pension phase

Management of the ‘middle T’ taxation of the investment earnings of superannuation funds is therefore a particularly Australian challenge, and appears alien to our US and UK counterparts. Finding reliable research, expertise and solutions in the area of managing institutional superannuation portfolios after tax is quite challenging, yet the task is an important one. This is true not only for superannuation members in the taxable accumulation (pre-retirement) phase but also for pension phase members who care about that other Australian tax peculiarity, franking credits, along with foreign withholding taxes.

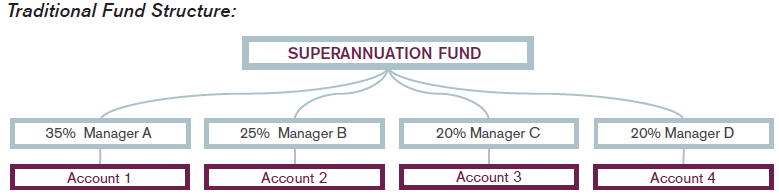

An early challenge large funds face as they move to an after-tax investing focus for their equity portfolios is how this fits within a multi-manager framework. Funds typically spread their portfolios across a range of managers to access different styles and achieve an optimal blend of diversity – an application of the more familiar theme of diversifying across asset classes to reduce risks and increase returns to further improve the overall risk/return profile of the fund’s equity portfolio. This results in the equity portfolio of a large superannuation fund having an architecture that looks something like the diagram below.

Multi-manager structure tax inefficiencies

Naturally, each manager is unaware of the other managers’ portfolio holdings, trading and investment insights. This protects each manager’s intellectual property and the diversity of the structure as a whole. But here’s the rub: it is a very inefficient, possibly damaging way to manage the fund’s overall capital gains tax (CGT) liabilities from equity trading. Each manager can, at best, manage the CGT on their own portfolio, but still have no knowledge of the tax positions of other managers or of the portfolio as a whole. This can generate dysfunctional decision-making.

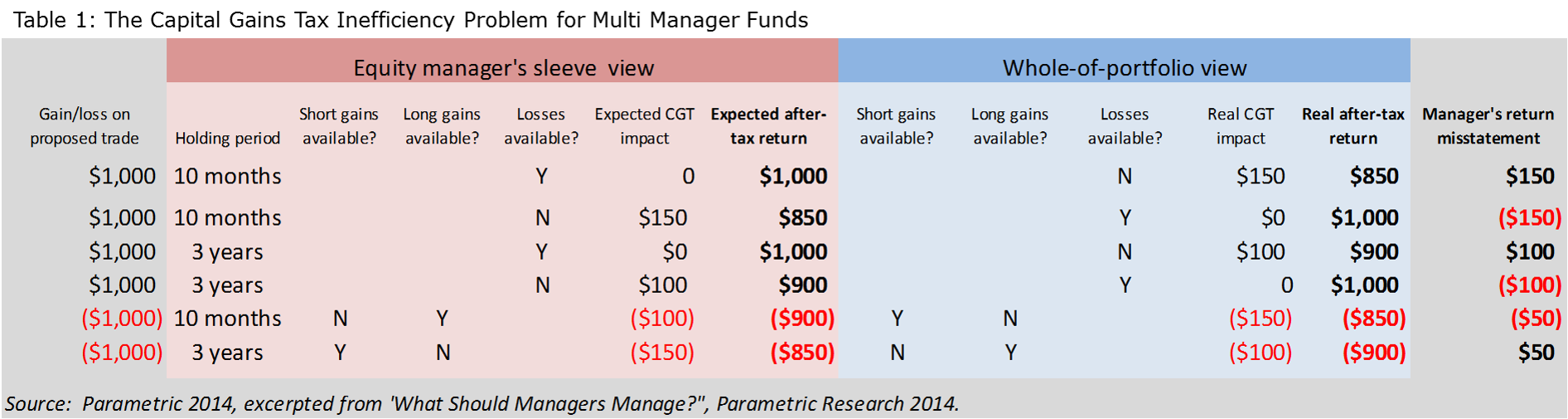

For example, Table 1 below illustrates three types of potentially sub-optimal behaviour by equity managers:

- trading which looks value-accretive but in fact reduces value post-tax

- not trading, hence forgoing active returns, because of an illusory tax hurdle

- delaying the timing of a trade, hence increasing tracking error risk, because of an illusory CGT discount benefit.

Effective CGT management requires centralisation or line-of-sight across the whole portfolio. Superannuation funds may think they are doing the right thing for their members by asking their equity managers to concentrate on after-tax returns, but actually it makes little sense to hold those managers accountable for the fund’s overall CGT liability.

The use of Centralised Portfolio Management

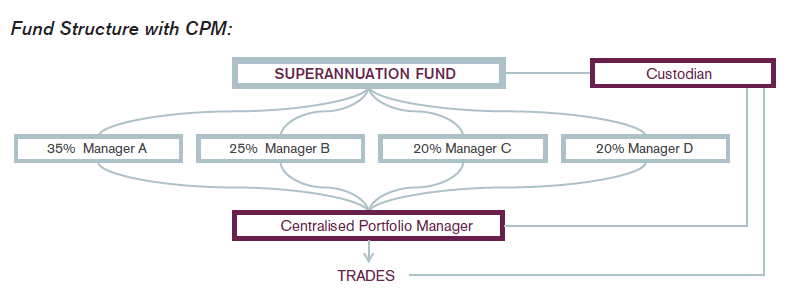

There is a solution, well-established in the US and gaining traction in Australia, which can help superannuation funds with multi-manager equity portfolios solve this problem. ‘Tax-managed Centralised Portfolio Management’ (CPM) combines each manager’s investment insights with a central implementation manager with the job of ensuring

trades are tax-optimised at the whole-of-portfolio level as shown in the diagram below.

In this solution, a large superannuation fund can continue to appoint managers based on the fund’s own objectives, style preferences, and risk and fee budgets. This preserves the multi-manager blending and diversification benefits the fund is seeking. But instead of each manager routing trades separately through their own set of brokers, the execution of these collective manager insights is centralised. Daily, the managers’ recommended trade lists are received and offsetting ‘redundant’ trades identified and eliminated by a single implementation manager (e.g. where Manager A buys BHP shares as Manager B sells BHP shares). The implementation manager, viewing the entire portfolio, can then address tax inefficiencies; for example, by identifying the same stock in a different manager’s portfolio with lower embedded CGT; or by choosing to hold off on a proposed trade so that it qualifies for the CGT discount. There are also numerous other (non-tax) benefits of centralising implementation in this way.

CPM as a dedicated, sophisticated after-tax focused investment solution shows how funds need not be forced to choose between multi-manager diversification and tax efficiency – both important objectives. With a little innovation, a fund really can have both.

Raewyn Williams is Director of Research & After-Tax Solutions at Parametric, a US-based investment advisor. Parametric is exempt from the requirement to hold an Australian Financial Services Licence under the Corporations Act 2001 (Cth) (the “Act”) in respect of the provision of financial services to wholesale clients as defined in the Act and is regulated by the SEC under US laws, which may differ from Australian laws. This information is not intended for retail clients, as defined in the Act. Parametric is not a licensed tax agent or advisor in Australia and this does not represent tax advice. Additional information is available at www.parametricportfolio.com/au.