National Australia Bank's (NAB) recent profit announcement would have been another uneventful example of a large Australian corporate meeting the market’s expectations, but for one big announcement. Some 6,000 people or fully 17% of the company’s workforce will lose their jobs over the next three years due to automation, artificial intelligence and robots, with 2,000 people coming in to execute those goals.

Banks are ‘reshaping’

NAB's cash profit was up 2.5% to a record $6.6 billion. The Net Interest Margin was a little better than expected and the non-interest income worse. What surprised the market was the announcement that costs are expected to grow by 5-8% in 2018 and won’t fall again until 2020 due to investment in programmes designed to cut costs by $1 billion per annum by 2020. Those programmes include ‘significantly reshaping’ the workforce by freeing nearly a sixth of the workforce from their daily obligations.

According to John Maynard Keynes, technological unemployment is the product of:

“… our discovery of means of economising the use of labour outrunning the pace at which we can find new uses for labour”.

Technological unemployment – the kind Keynes warned about in 1933 - just hit middle Australia in the guts again, but it is not the product of computers and Artificial Intelligence. Indeed, Queen Elizabeth I railed against it in 1589, when she denied William Lee a patent for his stocking frame knitting machine because it would:

“… assuredly bring [my subjects] to ruin by depriving them of employment, thus making them beggars”.

Sadly, Queen Elizabeth I is today unavailable to defend 6,000 NAB employees from the same fate. The announcement raises some important questions.

The first is whether our politicians are actually qualified or incentivised to navigate our country through the tempest that has only just begun.

The second is whether the current crop of parents or other advisers have thought sufficiently about whether they’re providing sound career advice to their children.

And third, what, if anything, should we be doing about the societal and economic forces that render large swathes of people unemployable? We don’t have space to tackle the third question here, but we can consider the first two.

Let’s not concede on our world trade

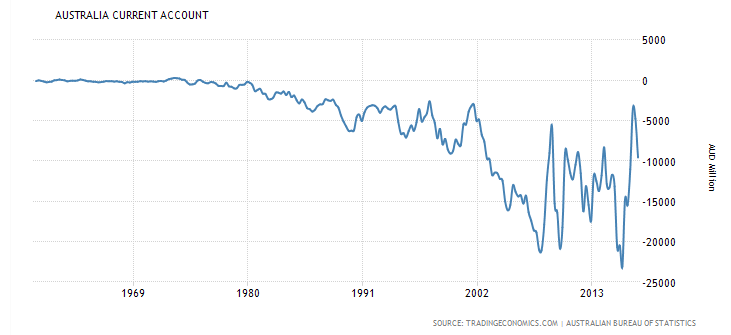

As the chart below reveals, for an inconceivably long and relevant period, Australia’s Balance of Payments (BoP) current account has been in deficit, and a generally worsening trend is evident. The current account records a country’s monetary transactions (trade, net income and current transfers) with the rest of the world.

Australia current account ($A millions)

The extended period of deficits, which reflects the cost of our imports far exceeding the revenue from our exports, leads many politicians in Canberra to claim our current account deficit is ‘structural’. Indeed, former Federal Trade Minister Andrew Robb told me precisely this.

To label the BoP current account deficit ‘structural’ is to resign our country to serfdom.

That is not as extreme as it sounds. We cannot forever continue to spend more on our imports than we earn from our exports unless we fund it by borrowing or selling off the farm. Eventually, our foreign lenders - who partially fund our profligacy - won’t want our IOU’s and they’ll demand our property. Were this to occur on a broad scale, and before deciding to default on our debts, we would render ourselves serfs to foreign landlords.

Exporting eight to ten metric tons of iron ore to pay for one imported iPhone is not sustainable. Our spending on iPhones may not change but we should earn more from exporting finished, branded and highly-prized goods and services to fund that spending.

Of course, with no present solution to the problem, the sale of our prime agricultural properties and businesses to foreign owners is painted by our politicians as a ‘necessity’. According to Canberra’s logic, we ‘need’ the investment foreign acquirers because they bring innovation and advanced technology that improves employment opportunities for Australians. By owning the innovation we’d broaden the opportunities for our labour force.

The wool is being pulled over our eyes. The truth is we ‘need’ to sell our property to fund our spending.

NAB's decision shows Australia at a crossroads

More worrying is NAB's announcement demonstrates that the next phase of investment by corporates will be in automation and will detract from jobs rather than create them. And NAB is a domestic business. How much more ruthless would the ‘investment’ be if we hand control to foreign owners?

All that’s required is to give market forces the opportunity to determine what we are good at and where we can add value. We need a tax environment that incentivises enterprising entrepreneurs to start up, and stay, in Australia. NAB’s announcement is a reminder that Canberra needs to speed up its development of policies that will ensure John Maynard Keynes is wrong, that technological unemployment is not left to a foreign boardroom.

Of course, Canberra’s policy track record - from car manufacturing and energy to the NBN - hardly inspires confidence. With so much to do, it’s disconcerting, if not embarrassing, to witness Canberra’s focus on same-sex marriage and outing dual citizens.

In the past technological unemployment replaced routine intensive occupations, hollowing out middle-income jobs in manufacturing and clerical services, such as in-bound call receptionists and toll collectors, and forcing labour into low-income service roles. In many former manufacturing states of the US, for example, middle-income manufacturing has been replaced by low-income labour. These people now work in servicing the 140 million square feet of additional mega warehouses built to facilitate the doubling of e-commerce sales in the US, from $142 billion to $291 billion since 2010. Where once computerisation was confined to routine manufacturing and service roles, rapid advances in technology, including data mining, machine vision and AI, will render a much wider range of roles redundant.

Consider for a moment that as recently as 2004, Levy and Murnane, in their book The New Division of Labour, noted the challenges associated with replicating human perception. They used the example of driving in traffic as being ‘insusceptible’ to automation and specifically noted that making a left hand turn in front of oncoming traffic would be difficult for an algorithm to replicate judiciously. Just six years after that book was penned, Google announced it had successfully modified a Toyota to be fully autonomous.

Falling computing prices will ensure that cognitive and problem-solving skills are relatively productive, and a polarisation in the labour market should follow. Some of the big changes to the employment landscape will include transportation and logistics as the cost of sensors makes augmentation of vehicles cost-effective.

Elsewhere, algorithms will enter sectors reliant on storing and accessing information. Office and administrative support roles will be threatened. Meanwhile, personal and household robotic technology is advancing rapidly and the comparative advantage of human mobility and dexterity is diminishing. This will threaten a proportion of low paid jobs sending wages down.

Finally, for our purposes, but by no means final, prefabrication will permit more of the construction process to be conducted in controlled environments reducing error rates and injury, while robots that can assemble on-site are already being demonstrated.

NAB's announcement of 6,000 job losses represents the tip of the iceberg while simultaneously bringing the reality of the shift in the employment landscape home. And for investors, navigating this change will be no less challenging.

Roger Montgomery is Chairman and Chief Investment Officer at Montgomery Investment Management. This article is for general information only and does not consider the circumstances of any individual.