In contrast to many recent Federal elections, there are clear policy differences between the major parties this time. Cuffelinks has written extensively on the proposed superannuation changes, and two surveys have canvassed reader reactions and received excellent responses.

Now we turn to negative gearing and capital gains tax on residential property, by far the largest asset class in Australia. It's likely that more people would be affected by these policies than the proposed superannuation changes.

This is not a lightweight issue. According to the Australian Bureau of Statistics, the value of residential property is about $6 trillion, three times the superannuation pool and two-thirds of all household net worth:

"The residential property market is an important part of the Australian economy, with the total value of Australia’s 9.6 million residential properties being worth 5.9 trillion dollars at the end of the September quarter 2015. Residential land and dwellings are also the single largest component of household net worth (65%), comprising more than twice the value of the next most significant component – superannuation (27%). The significance of the residential property market can also be seen from the perspective of employment as the construction industry is Australia’s third largest employer, employing just over a million people, with a quarter of these being in residential building construction."

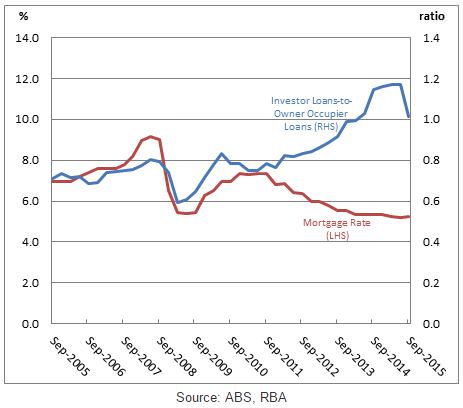

Buying a residential property is often the first investment decision made after fulfilling the dream of owning one's own home, not only motivated by the potential capital gains, but also the tax deductions from negative gearing. About 15% of all taxpayers report a net rental income loss. The recent growth in loans has been driven by investors, with the ratio of the value of investor loans-to-owner occupier loans rising from about 7% in 2009 to 12% at its peak in June 2015. The rise since late 2011 mirrors reductions in the RBA cash rate, as shown in the graph below.

A brief reminder of the policy positions of the two major parties:

Existing Coalition policy (no change)

Let's go direct to the ATO website on negative gearing:

"A rental property is negatively geared if it is purchased with the assistance of borrowed funds and the net rental income, after deducting other expenses, is less than the interest on the borrowings. The overall taxation result of a negatively geared property is that a net rental loss arises. In this case, you may be able to claim a deduction for the full amount of rental expenses against your rental and other income (such as salary, wages or business income) when you complete your tax return for the relevant income year. Where the other income is not sufficient to absorb the loss it is carried forward to the next tax year. If by negatively gearing a rental property, the rental expenses you claim in your tax return would result in a tax refund, you may reduce your rate of withholding to better match your year-end tax liability."

It's so good, a taxpayer can even carry forward the loss into the next year. And a reminder of how the capital gains discount works. When an individual or a trust sells an asset for a profit, they make a capital gain equal to the amount of profit. They pay tax on that gain (adjusted for inflation) at their marginal tax rate. Individuals and trusts are entitled to a 50% discount on the capital gain if they have held the asset for more than one year.

Proposed Labor policy, including on capital gains

"Labor will limit negative gearing to new housing from 1 July 2017. All investments made before this date will not be affected by this change and will be fully grandfathered. This will mean that taxpayers will continue to be able to deduct net rental losses against their wage income, providing the losses come from newly constructed housing. From 1 July 2017 losses from new investments in shares and existing properties can still be used to offset investment income tax liabilities.

Capital gains tax

Labor will halve the capital gains discount for all assets purchased after 1 July 2017. This will reduce the capital gains tax discount for assets that are held longer than 12 months from the current 50 per cent to 25 per cent. All investments made before this date will not be affected by this change and will be fully grandfathered."