Last week, we published two articles presenting opposing views on the equity market, the bull and the bear perspective. We received hundreds of responses to the survey on reader opinions, with the results summarised below. We have also reproduced a range of comments. Our thanks to the participants and the survey will remain open for a few more days.

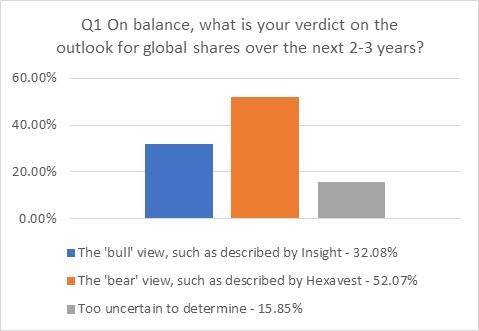

Question 1. On balance, what is your verdict on the outlook for global shares over the next 2-3 years?

Over half the responses backed the more pessimistic outlook.

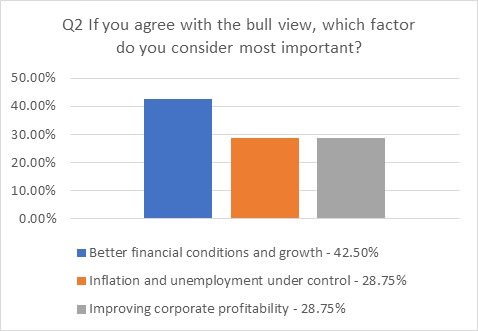

Question 2. If you agree with the bull view, which factor do you consider most important?

Most bulls consider better financial conditions and growth prospects to be the main drivers of the market's prospects.

Other comments highlighted the high levels of cash looking for a home, minerals demand from China, improvement in world-wide standards of living, and central bank policies pushing up asset prices.

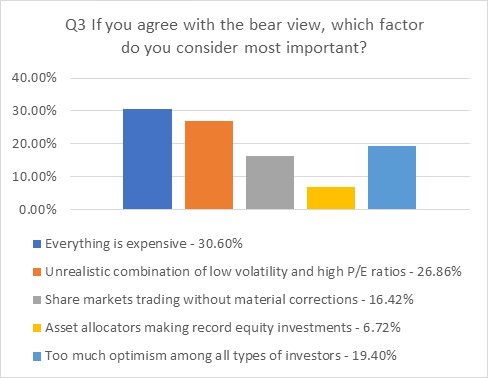

Question 3. If you agree with the bear view, which factor do you consider most important?

Around one third of bears agreed that assets are too expensive in the current market, closely followed by an unrealistic combination of low volatility and high PE ratios.

Other concerns centred around when currently low interest rates will increase, the adverse effects of having a high concentration of equities when markets crash, high levels of household debt, and global tensions.

Question 4. If you are undecided, what are the main uncertainties?

This was an open-ended question. A selection of comments is included here from respondents that remain undecided about where the market is heading.

Global politics

- The ramifications of Brexit or climate change. Can the EU (Germany) keep the PIGS etc countries bailed out? How will the refugee problems in Europe evolve?

- Uncertain global political state

- Too many disruptive forces in the world in government, it just takes one to create a black swan event.

- We cannot be sure of Korea and other world events

- Government action or maybe inaction

- threat of regional war, mass migration not able to be absorbed profitably

- Impact of Brexit uncertainty and Trump

Economy

- How sustainable is the so-called Trump lead US recovery, what will happen when quantitative easing is reversed, what will happen when interest rates eventually rise, what will happen when the debt and real estate and US share market ‘bubbles’ correct

- US tax changes

- I can't see any economic reason for either a bull or bear market.

- low inflation/wages growth

- economic indicators in many parts of the world look positive

Cashed-up fund managers

- Future Fund is 20% cash- and all is well. Mr Buffet is 40% cash- mother of all corrections imminent. I'm with Buffet.

Asset prices

- Bubbles in housing, tech stocks, some Asian markets etc

- earnings not keeping pace with valuations

Investor behaviour

- It is impossible to predict animal behaviour in the markets.

- Keynes: "markets can stay irrational longer than I can stay [on the sidelines]"

- Having endured a lifetime of up and down markets with boom and bust I still lean to a somewhat balanced approach albeit leaning towards being a bull.

Technological

- Cybersecurity risks on financial or national systems.

Question 5. Any other comments?

We had many and varied comments for this question. Here are some of them:

- Rate of technical change and automatic computer trading worry me.

- A healthy correction (>10%) in the US - especially tech stocks, will flow on to other markets; flush out over run stocks and underpin the market for further growth. I worry if the correction does not come before the end of this year. There is some irrational exuberance building and it needs to be brought back to reality for sustainable growth and to avoid a bearish over reaction which will kill consumer and business confidence.

- Interest rates will remain low for longer, again. Economists have forecast 8 of the last 3 recessions and have been consistently wrong about interest rates for the past 3 years.

- End to bond buying by government

- History repeats time and time again. Debt remains, and it’s not going away in a hurry. My economy would be pretty good with low interest rates and a visa that appears unlimited. I feel the 55-day interest free period will end within the next year.

- Emotive and media-influenced purchases now causing rallying which I presume will lead to subsequent correction as everything is too expensive now given the global risks and uncertainties around us at this time.

- Big crash still on the way

- The Trump bump may be followed by the Trump slump.

- Central bankers are making it up as they go

- Asset prices are high compare to Income/wages

- On historic terms the markets have run too hard too fast and are overdue for a correction.

- Such divided opinion would suggest we are in uncharted waters

- By the numbers, the Dow Jones is overvalued and a reversal is on the cards, but not yet.

- When the autopsy of the next market collapse is performed, I'm confident that Bitcoin will feature prominently in the Coroner’s report...

- I expect low growth with a fully priced market and don't expect either a bull or bear market.

- I feel that it is unlikely that global sharemarkets will move in sync over the next 3 years. I would not be surprised if US markets collapsed whilst European and Asian markets improved.

- It always corrects sooner or later.

- US market will have a big drop -say 10-15%-other countries will not have such a big fall -interest rates must go up across the globe. China will become the dominant global leader-The rise of India will keep Australian mining at the fore and offset the decline in retail and the general phasing out of shopping centres as the proportion of online sales increases

- I do find assets over priced but then its relative to the low 10yr Gov Bond rate. Coupled with the unknown economic environment of record debt yet business as usual. I thought house prices would never get this high as a ratio to earnings, yet it appears the high real-estate valuations are here to stay.

- Overpriced US market could be an issue, but Aus market is close to historical averages and there is enough scepticism in the market to keep prices sensible. Any US led pullback should have limited impact here.

- Good well-run companies continue to make profits

- Personal debt may influence the outcome

- I am a Bear because I think that the psychology of the moment points that way rather than the data. It will take very little to happen politically somewhere in the world for sentiment to change overnight. Too many egos and no common sense.

- Australian efficiency and output needs to improve.

- US tax cuts being implemented will have an impact

- To be certain I expect change. I am bullish on new technologies, bearish on established businesses which can't/don't move with the times.

- There are many more factors to consider, and anyone can cherry-pick signals from the data available, but it comes down to when will sentiment change and that will be when interest rates change to an extent that people and companies cannot service their debt.

The survey is now closed, thanks to all participants.

Leisa Bell is Assistant Editor of Cuffelinks.