Of the many challenges in the world of retirement income, one of the most frequently noted is the lack of understanding and engagement displayed by ordinary Australians as they approach retirement. ‘If only pre-retirees engaged more, they’d be so much better off’, industry and regulators say.

But is it possible that this problem has been inadvertently created by industry itself, through the peddling of false dreams and entirely unrealistic retirement affordability targets?

The promise of a ‘worry-free life’ once the money is sorted? And that money can be sorted by simply joining the ‘right’ fund or purchasing the ‘right’ lifetime income stream?

The fact is that consumers aren’t buying this dream.

The overwhelming concern of most Australians is still the fear of running out. FORO continually tops the list of reported retirement worries. Somewhat ironically, this fear, too, is false.

Except for those in extreme disadvantage – no one in Australia actually runs out – the Age Pension ($46,202 couples combined, $30,646 for singles) remains a reasonable safety net for most.

So why do intelligent men and women say this is their greatest concern?

Could it be they have checked out the numbers in the most popularly quoted ‘retirement standard’ target and the amount of money needed for most is just a pie in the sky?

The ‘messy middle’

Let’s zoom out and look at the broader context of Australians in retirement. There are currently 4.5 million retirees with another 2.5 million expected to join them over the next 10 years. Yet many of these Australians are stumbling into retirement poorly prepared, confused, sometimes financially stressed… or simply switched off. An example of poor preparation can be seen in AMP research (2023) which revealed that 70% of over 50-year-olds do not know what an Account-Based Pension (ABP) is.

Those in retirement can be grouped into three different income profiles:

- 20% on struggle street: According to Treasury (Retirement Income Review, 2020), renters represent about 15% of retirees, with about another 5% in share home arrangements or residential aged care.

- The so-called ‘top’ 20%: About 30-35% of Australians entering retirement are self-funded. But as assets are spent down, according to the Retirement Income Review, 80% of Australians will receive at least a part-pension entitlement in their 80s, so only 20% will be fully self-funded throughout their full retirement.

- 60% in the ‘messy middle’: So that leaves us with the 60% in the ‘messy middle’ – the core 60% or so of retirees who enter retirement with Age Pension support and some super top-up.

How do we set retirement saving targets?

Now let’s consider three very different targets:

- ASFA Retirement Standard

- Super Consumers Australia

- Retirement Affordability Index

and how helpful they are for those in the messy middle trying to project a realistic retirement pay cheque.

The ASFA Retirement Standard

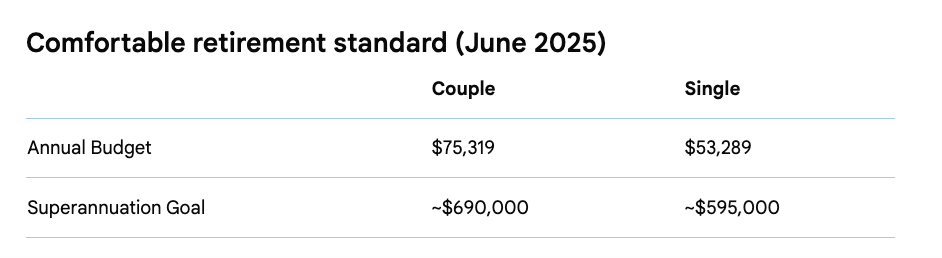

First established by the Association of Super Funds Australia (ASFA) in 2004, initial targets for ‘comfortable’ retirements suggested the need for savings as high as $1 million. That may have been seen as aspirational by a few, but it killed interest in active retirement planning for many more pre-retirees who knew they would never get near that amount. The current ASFA targets for ‘comfortable’ for those aged 65-85 are:

Do these amounts reflect what is happening in real life. As released by the Australian Tax Office (ATO) earlier this year, the median male super savings at retirement age (65-69) is $218,000 and for a female, $199,000. So actual super savings, for about half the cohort, represent barely one third of the amount in the ASFA targets for ‘comfortable’. Does this force us to assume most Australians will not be comfortable in retirement? This comfort relies, of course on fully owning your own home. But the sharp increase in household mortgages has been well documented by Rachel Ong ViforJ and Harry Chemay – more than 50% of 55-59 year olds (i.e. tomorrow’s retirees) are carrying mortgage debt.

More recently ASFA has at last acknowledged the presence of renters. But the amounts ASFA suggests are needed by those who rent are surprising - $66,296 for couples and $49,000 for singles. Renters in retirement do not have anywhere near these amounts. They are most likely to be full Age Pension status – singles $30,646, couples $46,202. Even with Commonwealth Rent Assistance, they are a long way from these income targets. As the Grattan Institute confirms, “75 per cent of retired renters have total assets, including any car and personal effects, of less than $125,000.”

So if you were heading into retirement and saw these targets, but you had just the median amount of super for your age – would they be helpful? Would they encourage you to work with an adviser and map out your future? Or would you think, as so many do, ‘I don’t have enough to worry about– I’m probably going to have to work forever, assuming my health holds out.’

Enter Super Consumers Australia (SCA)

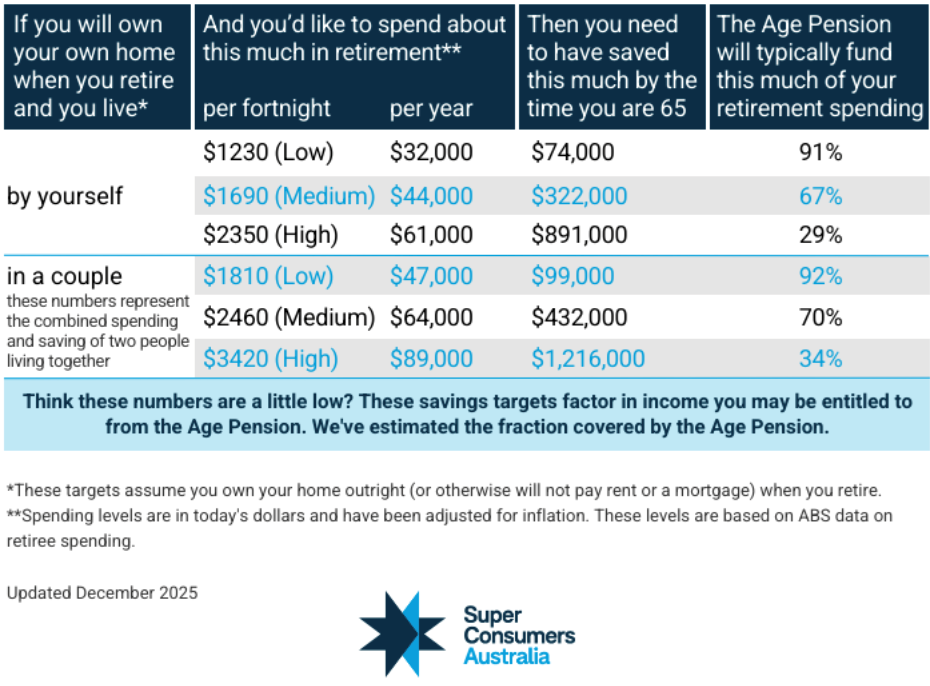

In March 2022, SCA recognised the need for a reality check and conducted a consultative enquiry into what ordinary Australians might need to live on after full-time work.

Here are SCA’s latest savings targets for retirees and pre-retirees*:

Savings targets for current retirees (aged 65)

These target amounts are much more in line with what is happening if we consider the 20/60/20 framework of retirees. The high amounts are higher than ASFA, the low amounts are in line with Age Pension payments and those in the middle, with the exception of singles, are closer to median amounts. They do, however, continue to assume homeownership and/or no mortgage costs or rental expenses.

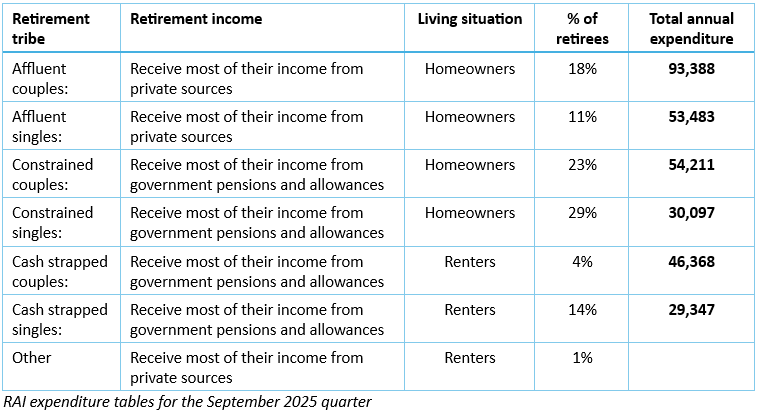

The Retirement Affordability Index

Although somewhat below the radar, I would suggest the Retirement Affordability Index (RAI), first published in March 2017, is much more useful for ordinary Australian retirees. Full disclosure: I took the ‘problem’ of retirement living spending to Matt Grudnoff, senior economist at The Australia Institute (TAI). Matt had previously worked at the ABS and understood their data well. From inception, the purpose of this index was to offer an ongoing report on how much retirement actually costs, depending upon your very individual circumstances or ‘tribe’, including those who rent. This data is based not upon a basket of goods but actual household spending for these different profiles. It is adjusted every quarter for CPI.

Matt created the index based upon the ABS Household Expenditure Survey (HES), but specifically cut into the following six tribes:

Are these annual spending targets perfect?

No. The HES was last published by the ABS in 2015. It was due to be updated in 2020 but skipped due to the Covid lockdowns which would have distorted the data. I am informed that research is in the field at the moment and will be available in early 2026, when we can completely update the Retirement Affordability Index.

That said, both Matt and I believe this index provides fact-based spending information to enable current Australian retirees to calculate their future income needs.

How liveable is a ‘median’ retirement?

Regardless of a preference for one index over another, how can industry provide reliable expectations with those who are struggling to understand what they will need in retirement?

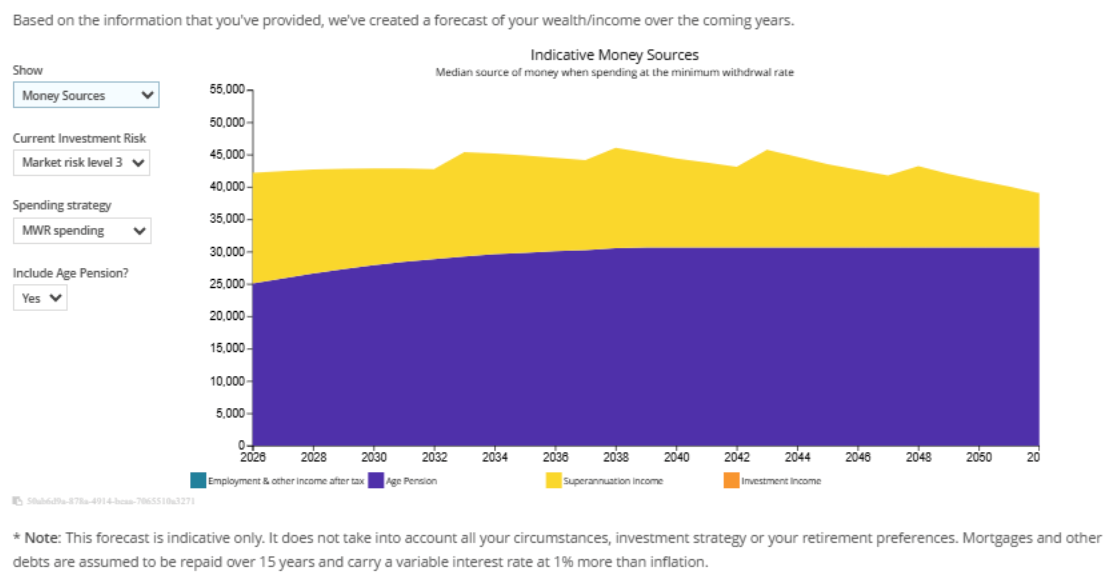

Here is a projection (provided by Retirement Essentials) of what median super savings might provide when combined with an Age Pension entitlement. The case study shows a couple, aged 67, who are homeowners with median combined super of $417,000, $30,000 bank savings and $20,000 in household contents.

This is what situation normal looks like

These median savings will convert to a retirement pay cheque of $40,000-45,000 per annum over time.

- This couple will not have $75,000 to meet the ASFA comfortable standard.

- They will not have $64,000 which would meet the ‘medium’ category from Super Consumers Australia.

- Nor will they have $54,000 to match the ‘constrained’ tribe in the Retirement Affordability Index.

Instead, they will live on about $10,000 less. But nor will they actually run out!

This ‘situation normal’ picture is the one that industry needs to explain in order to encourage interest and engagement from ordinary retirees. Talking ‘real’ targets, not aspirational ones, will help them manage their expectations while making the most of what they have.

And by sharing ‘situation normal’ rather than ‘pie in the sky’ targets we can introduce another important message. That the sooner retirees engage with more achievable, realistic targets, the sooner they can get active on their own behalf. This means learning the rules they need to know, considering mortgage management options, taking advantage of super concessions and perhaps working longer.

Above all else, taking control of spending to maintain maximum control over their own financial futures.

The role of industry is to ensure that our stories are relatable and realistic – and that the targets are truly affordable.

Kaye Fallick is an independent retirement commentator and author, www.kayefallick.com. This article is general information and does not consider the circumstances of any person.

This is an edited extract from Kaye’s presentation at the CEPAR 33rd Colloquium on Pensions and Retirement Research in November 2025 at UNSW.

*SCA targets at CEPAR were from January 2025, now updated to December 2025 for this article.