'Retrospective' has become the riskiest word in the election campaign. It’s easy not to take sides in the superannuation retrospectivity debate because both major political parties are obfuscating. In recent months, both have explained what 'retrospective' really means, and the policies of both meet their own definitions.

Let’s start with the words directly from our leaders in recent months:

Scott Morrison said

On Thursday, 18 February 2016, at 4.45pm, I sat about 20 metres away from Treasurer Scott Morrison while he presented to the SMSF Association National Conference in Adelaide. I wrote this article and his exact words are here. He said:

“One of our key drivers when contemplating potential superannuation reforms is stability and certainty, especially in the retirement phase. That is good for people who are looking 30 years down the track and saying is superannuation a good idea for me? If they are going to change the rules at the other end when you are going to be living off it then it is understandable that they might get spooked out of that as an appropriate channel for their investment. That is why I fear that the approach of taxing in that retirement phase penalises Australians who have put money into superannuation under the current rules – under the deal that they thought was there. It may not be technical retrospectivity but it certainly feels that way. It is effective retrospectivity, the tax technicians and superannuation tax technicians may say differently.” (my emphasis)

There was little doubt among delegates that we had just heard the Treasurer say there would be no changes to super rules in the retirement phase.

What is most notable here is that the Treasurer actually defines retrospectivity: “… under the deal that they thought was there … It is effective retrospectivity.”

Bill Shorten said

Five days earlier, on Saturday 13 February 2016, Bill Shorten gave a press conference where he said:

“I'm old school, brought up with the principle that laws should not be retrospective. If you've entered into financial arrangements and investments based on current tax law, I don't believe you should retrospectively change that law. In other words, when you make a new announcement in the future, it shouldn't change the circumstances of the people who are already invested under the old law.” (my emphasis)

Some other definitions of retrospectivity

“Looking back on or dealing with past events or situations.” Oxford Dictionaries

“The term is used in situations where the law (statutory, civil, or regulatory) is changed or reinterpreted, affecting acts committed before the alteration.” Wikipedia.

The Australian Government’s own Australian Law Reform Commission (ALRC) has issued a note on retrospective laws which includes the following common law interpretation (courtesy of ‘bigjulie’ in our comments section):

“People should generally not be prosecuted for conduct that was not an offence at the time the conduct was committed. More generally, it might be said that laws should not retrospectively change legal rights and obligations.”

John Daley of the Grattan Institute put it this way:

“’Retrospectivity’, a legal concept, applies if a government changes the legal consequences of things that happened in the past.”

Both political parties are arguing their own policies are not retrospective.

What are the major changes in super policies?

Consider the two policies of the parties for capturing revenue from large super balances:

Government proposal

The Government has a $1.6 million ‘transfer balance cap’, described in full here. It states:

“From 1 July 2017, the Government will introduce a $1.6 million cap on the total amount of superannuation that can be transferred into a tax-free retirement account … Superannuation savings accumulated in excess of the cap can remain in an accumulation superannuation account, where the earnings will be taxed at 15 per cent … Subsequent fluctuations in retirement accounts due to earnings growth or pension payments are not considered when calculating cap space … Individuals who breach the cap will be subject to a tax on both the amount in excess of the cap and the earnings on the excess amount.”

In addition, there is a new lifetime cap on non concessional contributions (NCC) of $500,000, capturing amounts contributed backdated to 2007.

Opposition proposal

The Opposition’s policy is linked here. It states:

“The proposed measure would reduce the tax-free concession available to people with annual superannuation incomes from earnings of more than $75,000. From 1 July 2017, future earnings on assets supporting income streams will be tax-free up to $75,000 a year for each individual. Earnings above the $75,000 threshold will attract the same concessional rate of 15 per cent that applies to earnings in the accumulation phase.”

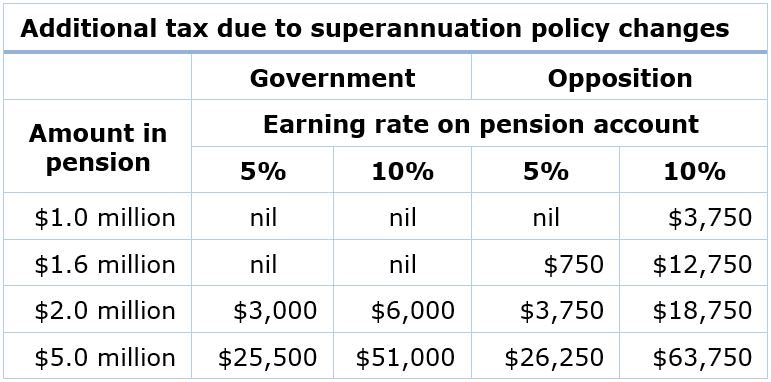

As the table shows, the impact of the new taxes depends on the pension account’s earning rate and the amount in the account.

For example, at a balance of $1.6 million, the Government’s policy creates no additional tax liability, regardless of earnings. However, if the pension earns a healthy 10%, income of $160,000 is well above the Opposition’s $75,000 threshold, and the tax on the $85,000 excess is $12,750. In all the examples above, the Opposition policy raises more tax or nil.

How does the Government argue the policies are not retrospective?

Scott Morrison told the Canberra Press Club on 4 May 2016 (the day after the Budget), addressing the lifetime cap on NCCs:

“I don't believe this is retrospectivity but others can have whatever view they may wish to argue for. If people have contributed more than $500,000 up until this point, well we won't be asking them to take it out of their superannuation account. It will be able to remain in that account.”

Actually, he will require retirees to take money out of a pension account if it holds over $1.6 million. Mr Morrison went on to say:

“We are not taxing the earnings out of retirement phase accounts. We've set a limit on what can go into those retirement accounts. That's a different position and it's one I'm very comfortable with. I'm not uncomfortable with the fact that we put a cap on how much can go into a tax-free earnings investment made possible by the taxpayer. But I have not changed the tax treatment and nor do I propose to change the tax treatment of retirement phase superannuation accounts.”

But it’s not only how much can go into a pension account. That is arguably prospective. It is also how much can be left in a pension account.

Are the policies retrospective?

The most significant impact of the Budget announcements is the uncertainty they bring to superannuation savings plans. Everyone is affected by this uncertainty. It’s not possible to believe any statements on policy stability, making planning for the next 30 to 40 years problematic.

If we apply the test that it is retrospective if it changes the consequences of things that happened in the past, then both the Government and the Opposition are making retrospective changes.

The proposed transfer cap of $1.6 million is retrospective because it applies to amounts built up in the past under the prevailing laws. There is no grandfathering and retirees will be forced to withdraw the excess from pension accounts, with no ability to top up if the market falls.

The proposed NCC limit of $500,000 is retrospective because it imposes a cap and counts contributions made before the law was introduced, since 2007. As the Government is now finding, it is difficult to argue backdating a change to 2007 is not retrospective. Before Budget night, the after-tax contributions did not count towards a cap, but then they did. Any 50-year-old who delayed putting money into super while they paid off other expenses expecting to catch up before retirement will now not be able to build a substantial super balance.

The Opposition is introducing a tax on the earnings above $75,000 on existing pension balances that have been accumulated in the past under the existing rules, and so it is also retrospective.

For those who argue a technical point that the policies are not retrospective, let’s come back to the politicians:

Scott Morrison: “It may not be technical retrospectivity but it certainly feels that way. It is effective retrospectivity, the tax technicians and superannuation tax technicians may say differently.”

Bill Shorten: “… when you make a new announcement in the future, it shouldn't change the circumstances of the people who are already invested under the old law.”

I guess that’s politics. It would be better if both parties admitted their policies were retrospective and convinced the electorate they are necessary changes for revenue and equity reasons.

Please have your say

Our survey asks whether you believe the $1.6 million transfer cap or $500,000 NCC lifetime limit are retrospective. Plus, we have identified 12 superannuation changes in Budget 2016 on which we would appreciate your views on whether you support or disagree with the change.

The survey is closed.