Longevity risk is well known. Australians are getting older and living longer. Recent data released by the Australian Bureau of Statistics confirms that Australia is the latest member of the so-called ‘Longevity 4’ club of countries where the average life expectancy for both men and women is 80 years and over. The other countries are Switzerland, Japan and Iceland and they face similar challenges to Australia – how to cater for longevity risk?

This is a good problem to have with the average life expectancy for an Australian male now 80 years and 84 years for an Australian woman. However, this also brings with it the question of how to provide for an adequate retirement.

Making better investment decisions

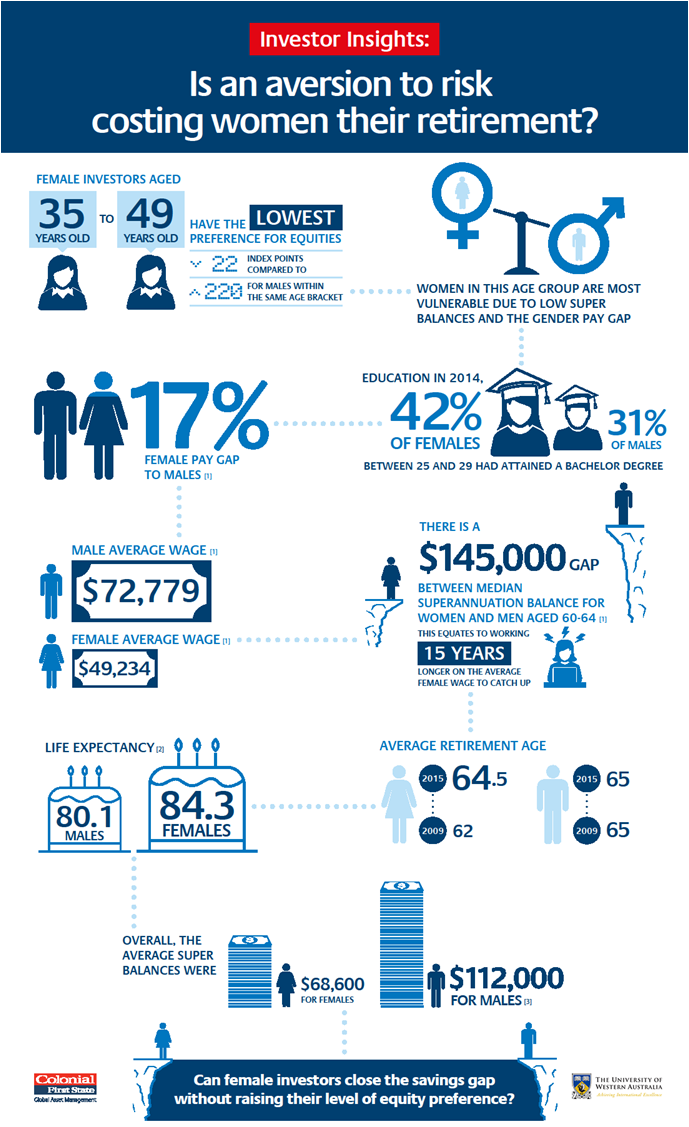

One way to help fight longevity risk is to make smart investment choices during working life and prior to retirement. This is vital to ensure the accumulation of sufficient funds in and outside of superannuation. However it also comes down to income, savings and behavioural biases. Our latest research into Australian investors’ equity preferences in collaboration with the University of Western Australia Business School paints a picture of falling equity preferences amongst Australians, which is crucial for accumulating sufficient funds for retirement.

The research examined investors’ overall moves in and out of equity-based managed funds and switches between asset classes. While there are some increases in SMSF balances amongst younger investors and a move to investment property and global equities, the research indicates that investors aged between 35 and 49 years of age have a low preference for equities. They are at risk of not meeting retirement objectives unless changes are made. It also highlights a large difference between men and women’s overall equity preference which commenced during the GFC and has been maintained since.

Gender bias in taking equity risk

Given this lower bias to investing in growth assets, women in particular are more at risk of not meeting their retirement objectives and managing longevity risk than men. Looking at a range of facts, it is easy to see why women are more likely to outlive their retirement savings:

- Women earn less, with the average wage for males $72,779 compared with $49,834 for women.

- Women often have broken work patterns usually for family reasons

- Women retire with an average super balance of $68,600 compared to $112,000 for Australian males

- Women live far longer, on average, than men.

Combining these factors creates the perfect storm for female Australians and their ability to save and secure a good standard of living in retirement, despite younger women having higher education qualifications.

Gen-Y women catching up

According to the CFSGAM Investor Insights research, Australian Gen-X women (35-49 years old) remain most at risk of not meeting their retirement objectives. It appears that women’s attitude to equities has been negatively affected by the GFC and hasn’t recovered since despite the improved returns, low deposit rates and improved labour market conditions.

Not all is lost. Younger Australian females are showing similar risk appetites to Gen-Y males, which is a unique parallel in our research. Over the last couple of years their equity preference has risen, in line with Gen-X males.

Overall, older women do appear to be less confident in their ability to manage money, less comfortable with their financial situation and more conservative in their approaches to managing money. One approach doesn’t fit all, but as an industry, there is still a lot of work to be done to help women improve their financial literacy and confidence to invest in growth assets to meet their retirement needs and cater for their longer life expectancy.

Belinda Allen is a Senior Analyst, Economic and Market Research at Colonial First State Global Asset Management (CFSGAM).