Imagine you have found a stock you think is likely to rise relative to the overall market, possibly because it is either technically oversold or fundamentally cheap. To trade this view, you could simply buy the stock outright, though that opens you up to the risk that its price could still decline during a market sell-off. To hedge against this risk, the alternative would be to enter a ‘pair trade’ whereby you buy the stock outright while also simultaneously taking a short position against the overall market. While usually the domain of sophisticated and institutional investors, exchange traded products allow individual investors to implement such trading techniques.

Stock versus market pair trade using the ‘Bear’ fund

Assume you expect the overall equity market to enter into a period of sluggish price growth or even price declines. In this environment, you might also expect relatively ‘defensive’ stocks such as Telstra to outperform. For example, in the two months from 13 October 2014 to 15 December 2014, the S&P/ASX200 traded largely sideways, rising by only 0.6%. During this same period, shares in Telstra rose by 9.5%. If you felt Telstra’s price was likely to continue to outperform, you could implement a pair trade by shorting the S&P/ASX200 and buying Telstra shares.

But how do you short the S&P/ASX 200 in a simple way? To obtain short exposure to the S&P/ASX 200, an investor could use the ASX-traded ‘BEAR’ fund, which is an Exchange Traded Product which sells the S&P/ASX 200 SPI futures contract (it invests nearly all its assets in cash and cash equivalents and obtains its ‘bearish’ exposure by selling SPI200 futures contracts). This means the price of the Bear fund is expected to move up when the S&P/ASX 200 falls and vice versa. Importantly, compared to short selling the physical shares or futures contract directly, the Bear fund does not impose margin call requirements on investors. All margin call requirements are met within the fund.

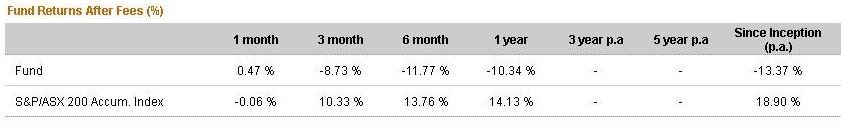

Figure 1: Returns of the BEAR fund after fees to 31 March 2015 (inception date 6 July 2012)

Bear Fund 2

(Returns are calculated in Australian dollars after fund management costs, do not include brokerage or the bid ask spread, assume reinvestment of any distributions and do not take into account tax paid by investors. Returns for periods longer than one year are annualised).

The Bear fund should not be expected to provide the exact opposite of the market return over any time period. In the 12 months ending 31 March 2015, for example, the fund fell 10.3% even though the S&P/ASX 200 accumulation index rose by 14.1%. The reason is that, although the fund follows a rules-based strategy, these rules allow the fund’s market exposure to vary between 90% to 110% short on a given day. Therefore a 1% fall in the Australian share market can be expected to deliver a 0.9% to 1.1% increase in the value of the fund (before fees and expenses). The fund's approximate exposure to movements in the S&P/ASX 200 index, as measured by the futures contracts held in the fund, is quoted on the BetaShares website. For example, if the fund's portfolio exposure is -105%, and the S&P/ASX 200 index goes down 1% that day, the fund would be expected to go up approximately 1.05% that day, before fees and expenses. Note that the futures contract does not always align perfectly with the S&P/ASX200, and the fund is actively managed on a daily basis, affecting returns over time.

Sector versus stock pair trade using a sector ETF

For investors with access to stockbrokers providing short selling services, another pairs strategy could be used to take a view on a stock’s performance relative to that of its relevant sector. For example, if you believed BHP’s share price was likely to underperform the overall Australian resources sector, you could short BHP through your stock broker and buy a fund which provides broad sector exposure, for example, a resources sector ETF.

Another potential strategy for a portion of a portfolio is allocating 50% of investment capital to the Bear fund, and 50% of capital to a financials sector ETF. Investors could expect to generate ‘alpha’ provided the financials index outperformed the market – irrespective of whether the overall market rose of fell over the investment period. Replacing the financials ETF with the resources ETF, investors could expect to generate ‘alpha’ if the resource sector outperformed the market irrespective of overall market performance. In other words, if investors have a strong view that interest rates will continue to fall, they can take a view on the relative outperformance of the sector alone, using a combination of the Bear fund and the Financials Sector ETF. And if instead investors had a strong view that commodity prices would rise, they can take a view on the relative performance of that sector alone, using a combination of the Bear fund and the Resources Sector ETF.

While the premise of pairs trading is simple – simultaneously buy and short sell different shares or indices - there are more advanced pairs trading strategies which look at hedging or managing volatility. And, of course, investors in the Bear fund need to understand that, while it is expected to rise when markets go down, it is also expected to fall in value when market rise.

David Bassanese is Chief Economist at BetaShares, a leading provider of Exchange Traded Products on the ASX. This article is general information and does not address the personal needs of any individual. Pairs trading may be unfamiliar to many people and may not be suitable for everyone. Consult a licensed financial adviser before implementing any investment or trading strategy.

See this video interview with Alex Vynokur, Managing Director of BetaShares, for an explanation of pricing and liquidity for ETFs.