The Turnbull Government’s first Budget has aimed its sights squarely at the superannuation accounts of wealthier Australians, but SMSFs may be well-placed to take advantage of the proposed changes. Retirees have the ability to plan and manage their tax settings in a single vehicle.

How much income does it provide?

Changes proposed to take effect from 1 July 2017 limit the amount that can be held in the tax-free pension phase to $1.6 million. Analysis of Accurium’s database of SMSF trustees preparing for retirement suggests this will impact around a fifth of trustees over 65.

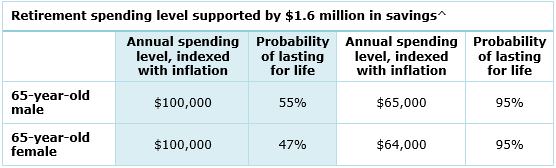

This begs the question of what level of spending in retirement is sustainable for someone with $1.6 million in savings. Around a quarter of SMSF trustees using our services have indicated a desired annual budget in retirement of over $100,000.

Our research shows that superannuation savings of $1.6 million would be sufficient to give a 65-year-old male 55% confidence of spending $100,000 p.a. without outliving his savings. This assumes an asset allocation in line with the average SMSF and average Australian life expectancies. Due to their longer life expectancy, for 65-year-old females, the confidence level drops to 47%. These calculations allow for tax and age pension entitlements.

Many retirees will think a one in two chance of outliving their savings and falling back on the age pension is too great a risk. Retirees looking for greater confidence, say reducing that risk to only a one in 20 chance, would need an annual spending level of only $65,000.

^ Using methodology in Accurium’s SMSF Retirement Insights Volume 3 – Bridging the prosperity gap.

Transfer cap is not a limit on superannuation or saving

On a practical note, the $1.6 million cap on the amount that can be used to commence a pension does not restrict the amount retirees can hold in superannuation. It is just a limit on assets that will preserve a tax-free status. The excess can continue to be held in an accumulation account with earnings taxed at a concessional rate of 15%. For most people this remains an effective and relatively simple tax-efficient structure.

Some commentators have raised concerns about the complexities such as capital gains tax impacts of complying with the cap, particularly for those already in pension phase. However, this is where the flexibility of an SMSF means there is no need to sell or transfer particular assets in order to comply with the new limit. A member of an SMSF can have both accumulation and pension accounts supported by the same unsegregated pool of assets.

SMSF trustees moving into pension phase will need to commence a pension with an amount within the cap, leaving the rest in accumulation. There is no need to identify which of the SMSF’s assets are supporting the pension. For those already in pension phase, excess amounts can be rolled back to accumulation without the assets needing to be sold or allocated specifically, provided they are accounted for appropriately. In order to continue to receive tax-fee earnings, the SMSF will need an actuarial certificate providing the split of the SMSF’s income between tax-free and taxed at 15%.

This will provide flexibility in terms of withdrawals. Retirees who have balances in excess of the cap may want to keep additional withdrawals from the pension account to a minimum. They can continue to draw on their accumulation assets in the form of lump sums if additional cashflow (above the minimum) is needed.

While the introduction of this cap will potentially limit the tax concessions, a retiree with $2 million in superannuation is likely to pay around $3,000 a year more in tax, although they will still be able to use the franking credits from the whole portfolio.

The added complexity of the proposed changes will make retirement planning more difficult, although SMSF flexibility should continue to make them a popular option. Advisers and accountants will have many opportunities to help their clients, and asset ‘location’ may become almost as important as asset allocation for many SMSF trustees and advisers alike.

Doug McBirnie and is a Senior Actuary at Accurium. This is general information only and is not intended to be financial product advice. It is based on Accurium’s understanding of the 2016-17 Federal Budget Report and current taxation laws. No warranty is given on the information provided and Accurium is not liable for any loss arising from the use of this information.