The NSW Government is pressing ahead with its proposal for a radical reform of residential property stamp duty, with the recent release of another progress paper. The stakes are high for buyers and sellers in the largest asset class in Australia.

Despite widespread public and media discussion, a major point is overlooked. As proposed, the reform not only treats investors and owner-occupiers differently, but the impact on houses versus apartments is materially distinct. Currently, stamp duty is based on the purchase price and it is the same for a $1 million house as a $1 million apartment, irrespective of who buys it (with some exceptions for first home buyers). The proposal will replace stamp duty with a property tax based on unimproved land value (ULV).

Depending on the location and build quality, the land value of an apartment might be only 5% of the purchase price, whereas the land is often around two-thirds of the value of a house.

For the reform to be revenue neutral, house owners will pay far more and subsidise apartment owners. This must be known to NSW Treasurer, Dominic Perrottet, which means it is a deliberate part of the policy, and begs the question: why is the NSW Government favouring apartments over houses?

The numbers are big. Stamp duty raised $8.3 billion in NSW last year, of which 75% was residential purchases. Stamp duty is the largest source of state taxation revenue after payroll tax.

Australians hold most of their wealth in residential property:

- Total value of residential real estate: $8.8 trillion (total superannuation assets $3.1 trillion, total value of all listed stocks, $2.8 trillion, total value commercial real estate, $1 trillion)

- Number of dwellings: 6 million

- Total mortgage debt: $1.9 trillion

- Proportion of household wealth held in housing: 54.3%

- Sales in last 12 months: 592,622 dwellings worth $404 billion.

Source: CoreLogic Monthly Chart Pack, August 2021.

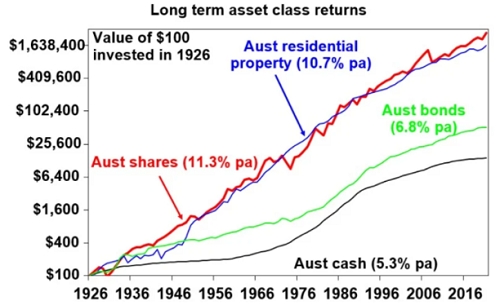

Over the long term, with a few blips, Australian residential property has been a wonderful investment, rivalling shares. Even better, it is easy to leverage into property, creating unbeatable returns on own capital invested. Sydney residents who bought modest three-bedroom homes in the inner west 30 years ago are now wealthy beyond their dreams as their houses now fetch $3 to $4 million.

Source: AMP Capital

What is the stamp duty reform?

The main features of the proposal are to replace up-front stamp duty with:

- An annual tax based on ULV.

- At the time of purchase, buyers can choose to pay the annual property tax instead of stamp duty and (where applicable) land tax. From that point onwards, all subsequent owners must pay the property tax and cannot select the up-front option.

- Price thresholds would initially limit the number of eligible properties to reduce the adverse impact on government revenues. With a desire to ensure 80% of residential properties are eligible, the threshold is likely around $2.5 to $3 million (above which current stamp duty rules will continue to apply).

The proposed annual property tax rate is:

- Owner-occupied, fixed fee of $400 plus 0.3% of the ULV

- Investor-owned, fixed fee $1,500 plus 1.1% of the ULV.

In the latest report, Perrottet makes some ambitious claims:

“It would stimulate home ownership, grow the economy and create jobs. It is estimated that, as a result of reform, more than 300,000 NSW residents could achieve their dream of home ownership and Gross State Product could increase by 1.7% ... The proposal, originally outlined in the November 2020 NSW budget, has generated a groundswell of public interest. Over the past six months we have conducted extensive community consultation, hearing from thousands of individuals and hundreds of community and business groups.”

Apartments versus houses

Let’s consider the example of a house and apartment both with a market value of $2 million, and assume the ULV of the house is 66% or $1.32 million but for the apartment it is only 5% or $100,000 (that is, the total value of the land divided among all the apartments according to unit entitlements).

The current NSW stamp duty is the same for both, at $94,862.40 (stamp duty escalates quickly at a marginal rate of 7% over $3,194,000 but this price is not likely to qualify for the reform).

Under the new rules, here are the annual property taxes for these two properties.

Annual property tax for different owners and types of dwelling

| Type of owner |

House |

Apartment |

| Owner-Occupier |

$ 4,360.00 |

$ 700.00 |

| Investor |

$ 16,020.00 |

$ 2,600.00 |

That's a range of over $15,000 EVERY YEAR that does not exist at the moment. It does not sound much in the context of the total up front cost of a house, but an investor planning 20 years of ownership might consider $320,000 too much of a burden and opt for the up-front stamp duty.

Property buying is already an inefficient market. Owner-occupiers borrow at cheaper rates and are exempt from capital gains tax on a principal place of residence. Under current laws, stamp duty is not tax deductible for investors but it is added to the property's cost base for capital gains calculations on sale. Land tax is not deductible for owner-occupiers but it is for investors who earn income from the property. The reform would introduce another set of different annual costs which may distort demand further.

Under the proposal, owner-occupiers and apartments have significant advantages. An annual fee of $16,000 on this house is a hefty 17% of the up-front stamp duty. Hold the property for longer than six years and the stamp duty might be a better option. In this house example, an owner-occupier has an advantage of $11,660 over the investor EVERY YEAR, which is clearly what the policy is aiming to achieve.

And here's a twist. If an owner-occupier buys a house and opts for the property tax, a subsequent investor buyer is stuck with the higher annual tax when they might have preferred a one-off stamp duty. Will investors be discouraged from buying houses where they are forced to pay high property taxes, creating a distorted market?

Many people buying a house to live in need as much money as possible at the start and most are likely to opt for the annual tax. The average holding period of a home in both NSW and Victoria is about 12 years.

The policy intentions and distortions are deliberate

The reform would encourage more people to move homes, such as downsizers who have superannuation incentives (eg, a couple can put $600,000 into super) but are discouraged by up front stamp duty. This might have the attractive social consequence of freeing large homes for the next generation of families, and it is preferable if people occupy homes that suit their needs.

Not surprisingly, the peak body that objected to reforms of negative gearing and capital gains tax is backing this change. The Property Council of Australia said in its submission on the proposal:

“Stamp duty distorts business decisions, locks families out of housing choices, worsens housing affordability, suppresses economic activity and leaves governments with highly volatile revenue streams … It is a tax that is a relic from our colonial past, representing a stamp of the state’s authority over property transaction that has absolutely no economic relevance in our modern Australia.”

The latest Government report says:

"Some stakeholders were interested in how the shift to ULV could influence property development. Some stakeholders noted the use of ULV could potentially favour apartment development as it is likely apartment owners would pay less property tax than those that own houses due to the amount of land required for each dwelling."

Specifically, The McKell Institute submission noted (15 March 2021):

“The proposed calculation method on ‘unimproved land value’ would incentivise high-rise development by making low and medium density housing comparatively more expensive. Taxing land rather than capital will encourage substitution of capital for land. In other words, developers will use more capital (building materials, engineering etc.) per unit of land, build up rather than out.”

And the Urban Development Institute of Australia noted (15 March 2021):

“Because property tax is on the unimproved land value, low density homes will pay significantly more property tax than higher density homes in similar locations. This will encourage the construction of more medium density properties. This will be important for planning policies to support this shift, to maintain affordability.”

Some consequences of adoption

The NSW Government hopes home ownership will increase as a prohibitive up front cost would be removed. This should benefit first-home buyers who have had less time and ability to save a deposit. Owner-occupiers are deliberately favoured, and home turnover should increase.

Or is this like many home buyer schemes where the incentives simply lead to higher prices, and nothing is achieved for the buyer? The Government argues:

“While removing stamp duty alone would cause upward pressure on home prices, that pressure would be counteracted under this proposal by the introduction of the property tax.”

I don’t believe that’s how the property market works, at least for owner-occupiers. The reason why residential properties are surging in price at the moment is the ability of purchasers to borrow at low interest rates. Buyers calculate what they can afford, almost irrespective of how expensive homes have become. By taking stamp duty off the table, owner-occupiers can afford to pay more. It's likely owner-occupiers will see the land tax in the same way they see council rates. It’s part of the cost of ownership which has been deeply rewarding for most participants.

And while for social reasons, it’s easy to understand why the Government wants more people to own the home they live in, the policy favouring apartments over housing is more of a mystery. Stopping urban expansion? Increasing density to encourage more affordable housing? This part of the policy is going against the momentum of more people wanting to buy houses and move away from high density dwellings in major cities.

The Government should not assume the switch to a property land tax is best for everyone. It is for an owner-occupier buying an apartment but may not be for an investor wanting a house. And since tax rates and ULVs can rise, a retiree who bought a family home 30 years ago may regret not paying stamp duty up front each time the annual land tax bill comes in.

Graham Hand is Managing Editor of Firstlinks. This article is based on a current understanding of the proposal, which may change in final form if adopted.