In recent years, economies and investors around the world have been operating in a low inflation environment. In recent months, however, rising inflation has emerged as a threat.

Inflation concerns came to a head in April 2021, with a far higher than expected lift in U.S. consumer prices. The markets had been expecting an increase in the core U.S. CPI of around 0.3% for the month and were shocked when the figure came in at 0.9%. That jump, in combination with low price increases during the shutdowns this time last year, meant the annual core CPI rate lifted to 3%, the highest since the mid-1990s.

In this article, we look at why, and how, rising inflation can affect investment markets.

What is inflation?

Inflation is a sustained rise in the price of goods and services in an economy.

There are two widely used indicators of inflation:

- the consumer price index (CPI)

- the producer price index (PPI).

The CPI is a measure of the price of a basket of goods and services typically purchased by households. Changes in the CPI reflect the price inflation faced by consumer households.

The PPI measures the change in the price of goods sold by manufacturers, and so is a measure of prices from the perspective of producers, rather than consumers.

Changes in these indicators are referred to as inflation. So, for example, if from the first quarter of one year to the first quarter of the next year the CPI increases by 2.5%, we say annual inflation is running at 2.5%.

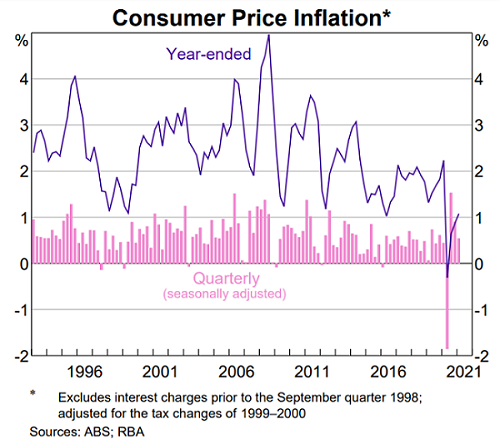

The chart below shows Australian consumer price inflation over the three decades to the end of the March quarter 2021.

Why does inflation matter?

Inflation means increased input costs for businesses.

For example, higher commodity prices mean manufacturers have to pay more for the materials they use to produce their goods, which means they either have to increase the prices they charge for the goods they produce, or they suffer from tighter profit margins.

Rising energy prices are bad for companies, as they have to pay more for the power they use, and the cost of transporting goods increases. These increases typically flow through to the prices manufacturers charge.

Inflation means increases in the cost of living for consumers. Consumers can purchase fewer goods, and they have to pay more for those goods. Unless wages keep up with inflation, this results in a lower standard of living.

The twin dangers – rising inflation, rising interest rates

Higher rates of inflation have an influence in their own right, but just as important, they tend to be accompanied by, or result in, increasing interest rates, which also can have a significant impact.

Governments typically use higher interest rates as a measure to combat rising inflation. High inflation is seen as a sign of an overheating economy, and in response, governments (or central banks) will often tighten monetary policy (increase interest rates) in an attempt to dampen economic activity.

It should be noted that some inflation is generally regarded as a good thing. A moderate level of inflation is seen as a sign of a growing economy. In Australia, the RBA Governor and the Treasurer have agreed that the appropriate target for monetary policy in Australia is to achieve an inflation rate of 2–3%, on average, over time.

How does inflation affect investors?

Inflation eats up the value of money for everyone – not just investors.

Returns can be thought of in ‘nominal’ or ‘real’ terms. The nominal return is the actual rate of return in percentage terms. The real rate of return is the nominal return less the inflation rate.

For example, if you invest in a term deposit paying 4% p.a., and inflation is 2% p.a., your real return is 2% p.a.

A higher inflation rate means you have to earn a higher rate of return simply to break even in real terms.

How are share investors affected?

While modestly rising inflation generally is seen as a positive for the broad sharemarket, as it is consistent with an economy growing at a sustainable pace, inflation above a certain level, or unexpected jumps in inflation, can be a negative – although the effect may vary for different sectors, and for different investing styles.

This is partly because of the effects of inflation itself, and partly because rising inflation often is accompanied by rising interest rates, which also can have a negative impact.

Higher inflation is usually seen as a negative for stocks because it typically results in:

- increased borrowing costs

- higher costs of materials and labour

- reduced expectations of earnings growth.

Taken together, these variables generally put downward pressure on stock prices.

Are all stocks affected the same?

The answer to this question is - ‘No’. There are some sectors that have the potential to outperform in inflationary environments.

Gold is widely regarded as a ‘safe haven’ in inflationary environments, given that it is seen as a ‘store of value’, so an exposure to gold bullion or gold producers may have the potential to outperform.

People need to eat, regardless of whether inflation is rising or falling. Investors can consider exposures to agricultural commodities and food producers in an inflationary environment.

If rising inflation is accompanied by increases in the prices of commodities such as iron ore, this will have a negative impact on the purchasers of those commodities – but is likely to benefit commodity producers such as iron ore miners. Similarly, if there is an associated increase in the price of oil, an exposure to energy producers may provide defensive benefits.

Value versus growth stocks

Inflation has generally tended to affect growth stocks more than value stocks.

A common method used to value stocks is the discounted cash flow (DCF) method. Essentially, DCF values an investment based on its future cash flows. It involves calculating the present value of expected future cash flows, by applying a ‘discount rate’ to those future cash flows, to arrive at a valuation. The discount rate is dependent on interest rates – the higher the rate, the lower the present value of future cash flows, and therefore the lower the valuation attributed to the investment.

The other relevant point is that the further into the future a cashflow occurs, the lower the present value of that cash flow will be.

Many growth stocks have relatively low cash flows now but are expected to generate significant flows in the future, while many value stocks have strong cash flows now, but are expected to grow at a slower pace, or even decline.

Increases in inflation and interest rates are therefore likely to have a higher impact on growth stocks than on value stocks, as the cashflows their valuations are based on will be discounted more.

Fixed income investors

Rising yields (interest rates) are bad for fixed income investments that pay a fixed rate of interest, such as bonds, for two reasons.

Firstly, there is an inverse relationship between a bond’s price and its yield - as interest rates increase, bonds fall in value, so bond holders can face capital losses.

Secondly, the income stream from fixed rate bonds remains the same until maturity. As inflation rises, the purchasing power of the interest payments declines.

Investments that pay a floating rate of return are likely to be better off in an inflationary environment, as the interest rate they pay is adjusted periodically to reflect market rates. If interest rates rise, the interest paid by the investment should also increase at the next reset date. This applies to investments such as hybrid securities, as well as funds (including exchange traded products available on the ASX) that provide exposure to such hybrids.

Inflation is generally regarded as damaging to holders of cash and cash equivalents, since the value of cash will not keep up with the increased price of goods and services.

Richard Montgomery is the Marketing Communications Manager at BetaShares, a sponsor of Firstlinks. This article is for general information purposes only and does not address the needs of any individual. Past performance is not indicative of future performance. Investment value can go down as well as up.

For more articles and papers from BetaShares, please click here.