Anyone hoping for some exciting initiatives on superannuation will be disappointed. There’s not much in the 2019/2020 Budget on retirement and super changes. Maybe that’s a good thing given superannuation is often a revenue target and recent amendments have introduced restrictions. There were even calls in recent days for super to be made voluntary.

The industry was hoping for a wide range of eligibility openings, as detailed in Graeme Colley’s article, but little changed this time around.

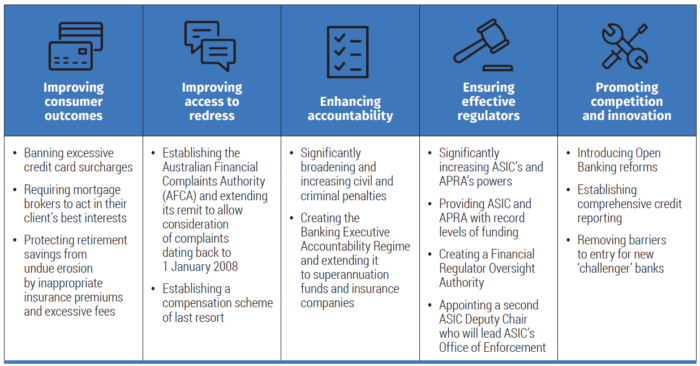

On the Financial Services Royal Commission, the main story is about ‘restoring trust in the financial system’, with the key policies included in this graphic.

Other than the general assistance to welfare recipients, such as the energy assistance payment, the superannuation-specific measures are:

1. Improved flexibility for people aged 65 and 66 (the work test)

At the moment, people aged 65 to 74 can make voluntary superannuation contributions only if they work at least 40 hours over a 30 day period in the relevant financial year. Retirees aged 65 and over cannot access bring-forward arrangements and those aged 70 and over cannot receive spouse contributions.

There is some debate in the industry about the power of the work test, as some people can ‘arrange’ 40 hours of casual work with a friendly business.

Under the change, voluntary contributions (both concessional and non-concessional) can be made by those aged 65 and 66 without meeting the work test from 1 July 2020. They can also make up to three years of non-concessional contributions under the bring-forward rule. Those up to and including age 74 will be able to receive spouse contributions.

It might not sound like a major change but the estimated Budget cost is $75 million over the forward estimates.

2. ‘Protecting Your Super’ Package

These are amendments to the package announced in last year’s Budget to transfer inactive accounts to the ATO, including redefining when an account is considered inactive. The ATO is given a large budget to manage this and the impact on the fiscal balance is $120 million. It’s a software consultant’s dream project.

There is also a delay to 1 October 2019 in the start date for ensuring insurance within superannuation is only offered on an opt-in basis for balances of less than $6,000 and new accounts belonging to members under the age of 25 years.

3. More money for ASIC, APRA and the Federal Court

In total, the Government is providing $607 million to facilitate the response to the Financial Services Royal Commission including ‘taking action’ on all 76 recommendations (even if that means not adopting some of them, such as with mortgage brokers). Expense measures since the 2018-19 MYEFO include $77 million for APRA and $397 million for ASIC for implementation.

APRA’s increased budget includes $34 million to extend the Banking Executive Accountability Regime (BEAR) to all APRA-regulated entities, including super funds and insurance companies. ASIC gets $21 million for a new conduct-focussed accountability regime, whatever that is. Plus there is $8 million for an independent Financial Regulator Oversight Authority. A regulator regulating the regulators.

Welcome to a new world of compliance and looking over the shoulder at every move. The regulators were hit by Kenneth Hayne’s comments, and now they have the firepower to prosecute.

There is also $44 million for funding the Federal Court of Australia following the expansion of its jurisdiction to cover the Royal Commission and corporate crime.

4. Superstream extension

The ATO is expanding the SuperStream Rollover Standard used to transfer information between employers, superannuation funds and the ATO. The start date of SMSFs will be delayed until 31 March 2021 to coincide with the expansion of the overall standard.

5. Permanent tax relief for merging superannuation funds

A previous change due to expire in 2020 is now made permanent to make it easier for super funds to merge. ASIC has been pushing for rationalisation in the industry so this move makes sense. It ensures members are not adversely affected by taxation consequences (such as realising capital gains) when funds merge.

6. Reducing red tape for superannuation funds

Designed to reduce costs and simplify reporting for super funds, trustees with both accumulation and pension phase assets can choose their preferred method of calculating Exempt Current Pension Income (ECPI). Where the proportionate method is used, with all fund members in retirement phase, no actuarial certificate is required.

There is also another $42 million in funding for the ATO to recover unpaid tax and superannuation liabilities.

That’s all, folks.

Not much for the superannuation industry to get excited, or complain, about.