The Australian regulatory regime covering the complex world cryptocurrency is about to take shape. Assistant Treasurer and Minister for Financial Services Stephen Jones, who describes it as a "very opaque market", recently confirmed this initiative as a major priority for the Federal Government. The current push is expected to bring Australia in line with the US and the UK, who are in the process of tightening regulations following a number of crypto disasters likened to traditional banking crises.

The Government is turning up the heat on Treasury to progress work on the regulatory framework to cover the cryptocurrency industry and this article argues for a more global regulatory framework.

Decentralised Finance (DeFi) - the new Shadow Banking Market

If it looks like a duck, quacks like a duck, and acts like a duck, then it is a duck. This applies to the new era of shadow banking.

The modern era of shadow banking involves crypto platforms which facilitate borrowings and deposits in cryptocurrency. This is known as Decentralised Finance (Defi). The deposits which are made in cryptocurrencies offer higher rates of interest than are available from traditional banks. The funds raised by the crypto deposits are then directly loaned to speculators in the cryptocurrency of choice who bet on the price of the crypto asset going up. This market came into prominence in 2017 and has since gained in popularity, particularly with users who mistrust the banking system and the excessive fees charged by banks.

Faith in the DeFi network is based on the use of smart contracts and software protected by complex algorithms. The algorithms ensure that money is not released until all terms and conditions of the contract are honoured. Is this protocol enough to protect investors?

Celsius – a case study of DeFi failure

Celsius is a failed US-based DeFi company founded in 2018 by two fintech entrepreneurs, Alex Mashinsky, and Daniel Leon. It offered depositors lucrative interest rates of up to 17%. The company would advertise that:

"the only things that are certain in life are death, taxes - and the weekly payment from Celsius".

Here are the tweets where Alex Mashinky reassures investors prior to collapse.

Celsius filed for bankruptcy in July 2022. At its height, its volume of deposits peaked at $28 billion and the company boasted 1.7 million customers. The DeFi lender committed the major banking sin of mismatching the denominations of its crypto loans and collateral. So when the value of a borrower’s collateral was hit hard relative to the face value of their loan by the recent crypto crash, their loans were called-in. The negative sentiment surrounding the company’s financial situation sparked a ‘bank' run and investors sold down their investments in Celsius as fast as depositors closed their accounts. The realisation by customers that Celsius was not a licenced bank and protected by the US system of deposit insurance, accelerated its demise.

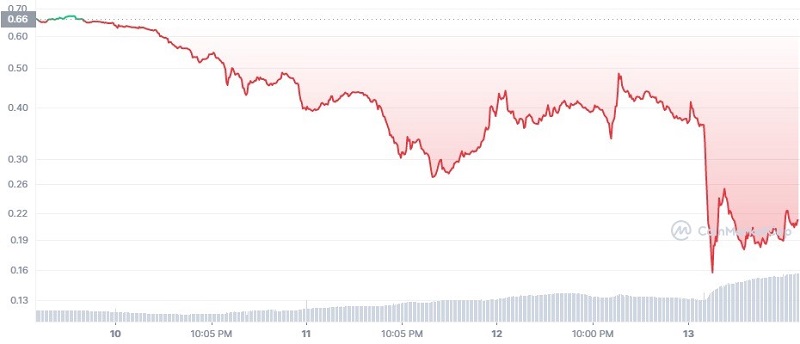

Here are the prices of Celsius over a few days and also six months.

Celsius (CEL/USD) price from 10-13 June 2022 (Source: CoinMarketCap)

Celsius (CEL/USD) price for 6 months to 11 October 2022 (Source: CoinMarketCap)

The regulatory journey

Unfortunately, Celsius is not the only DeFi network that has failed. Others such as Babel Finance, Three Arrow Capital and Voyager Digital have suffered the same fate.

The call for regulation of the crypto market is deafening and has prompted government enquiries across a number of jurisdictions such as the current Senate hearings in the US. Nascent attempts at regulation, for example in the UK and US, have to date been found grossly inadequate as disasters such as the Celsius debacle persist.

However, some headway is being made, particularly in the US by the introduction of the Lummis-Gillibrand Responsible Financial Innovation Act (RFIA), a bill that would create the first comprehensive regulatory framework of digital assets in the United States. Additionally, the US publication of a recent report titled “Crypto Assets - Implications for Consumers, Investors and Businesses” identifies risks in the crypto markets and makes some further regulatory recommendations.

Australia is trailing the US in establishing a comprehensive crypto regulatory framework. Its first concrete efforts began in 2021. At this time, the Liberal Government undertook public consultation in respect to a licensing and custody regime for crypto asset secondary service providers. This initiative was a piecemeal approach which ignored an array of other market vulnerabilities.

The current Albanese Government is furthering this effort with a ‘token mapping’ exercise. Token mapping involves uncovering the characteristics of all digital asset tokens. This can only be seen as a first step in the regulatory process aimed at facilitating a more targeted approach. Public consultations will commence in November 2022.

Lessons from the banking industry

Similar to the banking industry, the crypto market is truly global. However due to its decentralised nature it allows participants to exploit regulatory differences between jurisdictions - that is, the practice of utilising more favourable laws in one jurisdiction to circumvent more restrictive regulation elsewhere.

The failure of DeFi businesses such as Celsius not only reveals flaws in the crypto ecosystem but the inability of regulation to protect the public. It’s important to note that the systemic risks of the crypto world spread beyond jurisdictional boundaries. Citizens globally are at risk of harm.

Lessons could be learned from the global banking system in which a universal approach to regulation setting is adopted - specifically through the Basel Accord. A co-ordinated and collaborative approach between governments in addressing regulatory shortcomings should be a consideration.

Dr. Paul Mazzola is a Lecturer in Banking and Finance in the Faculty of Business at the University of Wollongong, and Mitchell Goroch is a Cryptocurrency Trader and Researcher at the University of Wollongong.

This article is general information and does not consider the circumstances of any person.