While anticipation of devastation from Cyclone Alfred saw the PM ditch plans to call an election for 12th April, we are effectively in an election campaign with the Government announcing numerous spending promises since January and the Coalition often matching them. And with the election due by 17 May, this will ramp up with the now to be held budget in two weeks. Budgets are often tedious affairs loaded with politics but are more so when they are just ahead of elections. Policy uncertainty going into the election is low, but this belies the challenges facing Australia.

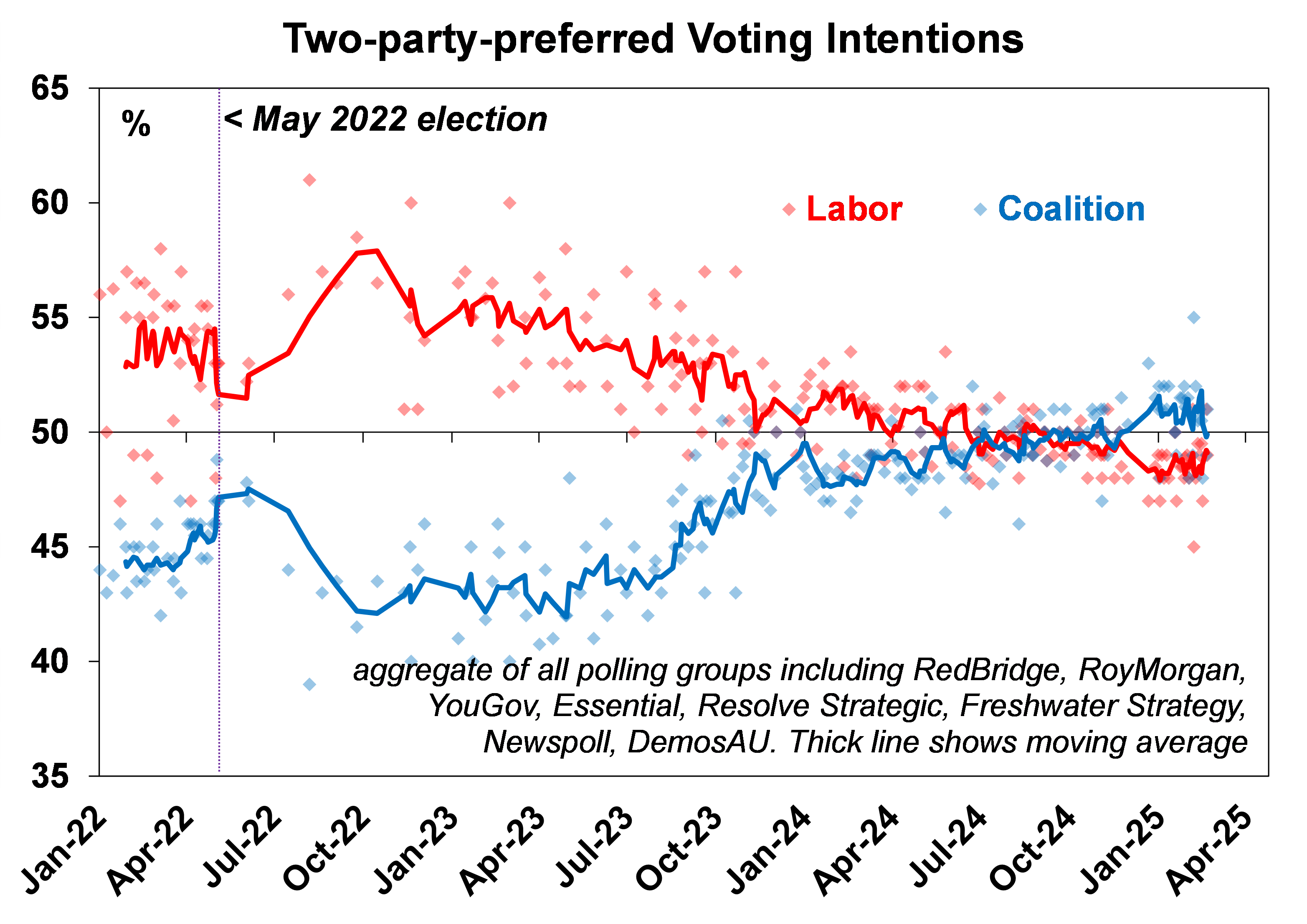

Polls point to a close outcome

Labor has been trailing in two party preferred polling averages although the gap may be narrowing. Current polling suggests both parties may struggle to get a 76-seat majority raising the prospect of a hung parliament and minority government. The ALP has 78 seats and could easily lose three, whereas the LNP gaining the 22 seats needed to win is a big ask.

Source: Polls as indicated, AMP

Elections, the economy and markets in the short term

There is anecdotal evidence that election campaigns cause households and businesses to put some spending on hold. However, hard evidence is mixed with election years since 1980 seeing average economic growth of 3.3% pa, greater than the 3.1% pa average over the whole period.

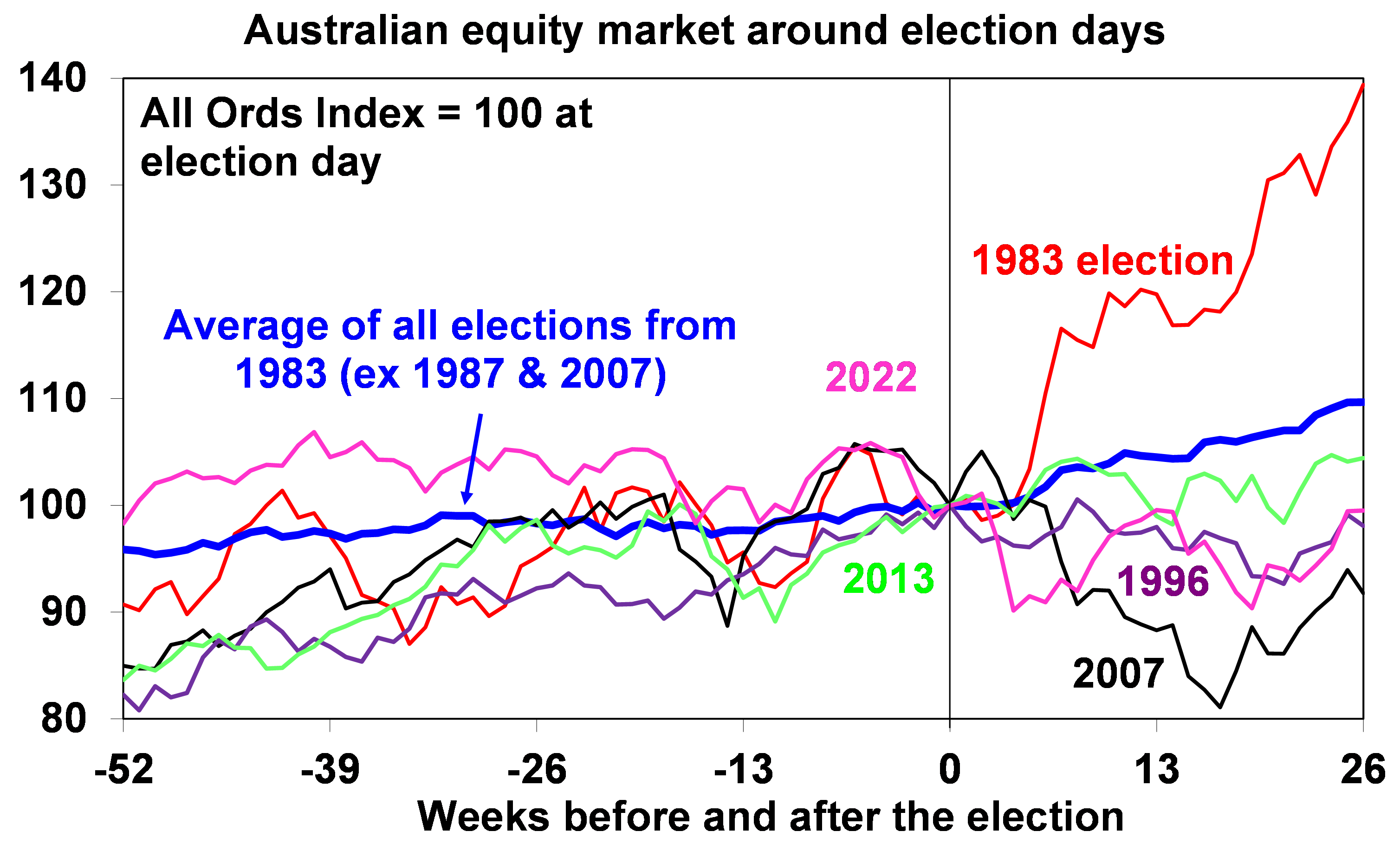

In terms of the share market, there is some evidence of it tracking sideways ahead of elections, possibly reflecting uncertainty and then a relief rally once it’s over. The next chart shows Australian shares around elections since 1983. This is shown as an average for all elections (but excluding the 1987 and 2007 elections given the 1987 share crash and the GFC), and the periods around the 1983, 2007 and 2022 elections, which saw a change to Labor, and 1996 and 2013, which saw a change to the Coalition.

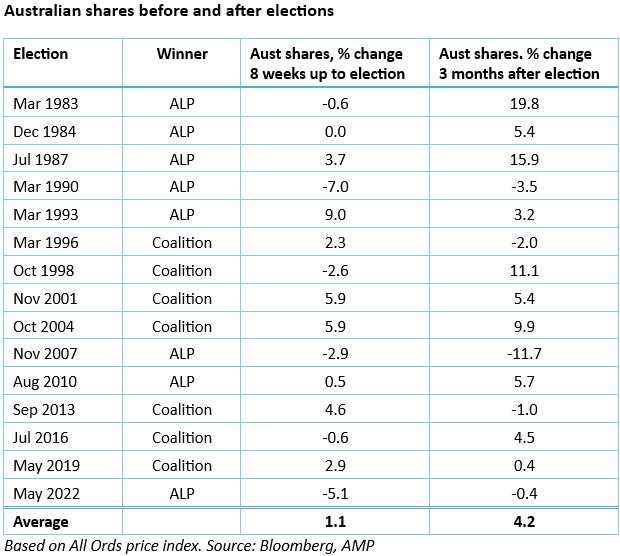

Elections which saw a change of government are highlighted. Source: Reuters, Bloomberg, AMP

However, elections resulting in a change of government have seen a mixed picture. Shares rose sharply after the 1983 Labor win but fell after their 2007 and 2022 wins. After the 1996 and 2013 Coalition wins shares were flat to down. So based on history it’s not obvious that a victory by any one party is best for shares & historically moves in global shares played a bigger role than the election. The next table shows that 10 out of the 15 elections since 1983 saw shares up 3 months later with an average 4.2% gain.

On average, over elections since 1983 the Australian dollar has drifted sideways to down before and after elections, but it’s very messy.

Shares and property under Coalition and ALP governments

Over the post-WW2 period shares have returned (capital growth plus dividends) 12.9% pa under Coalition governments and 9.7% pa under Labor. Labor governments led by Whitlam and Rudd/Gillard had the misfortune of severe global bear markets. And the reformist Hawke/Keating government defied perceptions that conservative governments are better for shares with shares returning 17.2% pa.

Looking at the Australian residential property market, using CoreLogic data since 1980, capital city property prices have risen 7.7% pa under Coalition governments and 4.3% pa under Labor. That said, policies with respect to housing have not been particularly different under both sides of politics.

Once in government, political parties are usually forced to adopt at least half sensible policies if they wish to ensure rising living standards and arguably there has been broad consensus in recent decades regarding key macro-economic fundamentals – eg, low inflation and mostly free markets.

Challenges for the next government

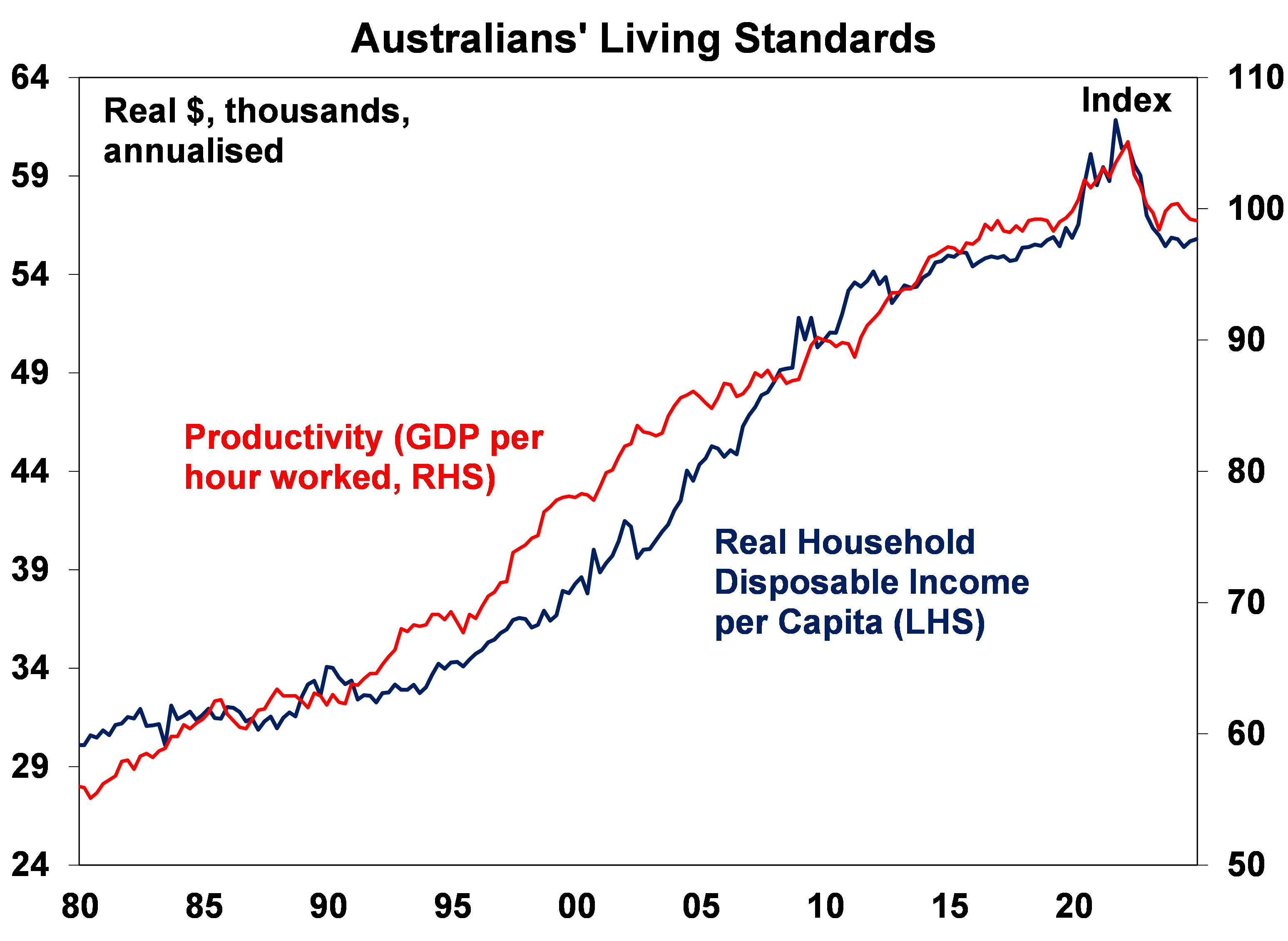

Boost productivity to boost living standards – the ‘cost of living’ is voters’ key concern. It’s reflected in a 10% fall in real household disposable income per person - which reflects wages (+11% over the last 3 years) not keeping up with prices (+15%) and a surge in tax and interest payments – and a broader stagnation in real incomes over the last decade. The key is to boost poor productivity, which is the main driver of decent real wage growth. This requires tax reform, deregulation, competition reform, improving education, etc.

Source: ABS, AMP

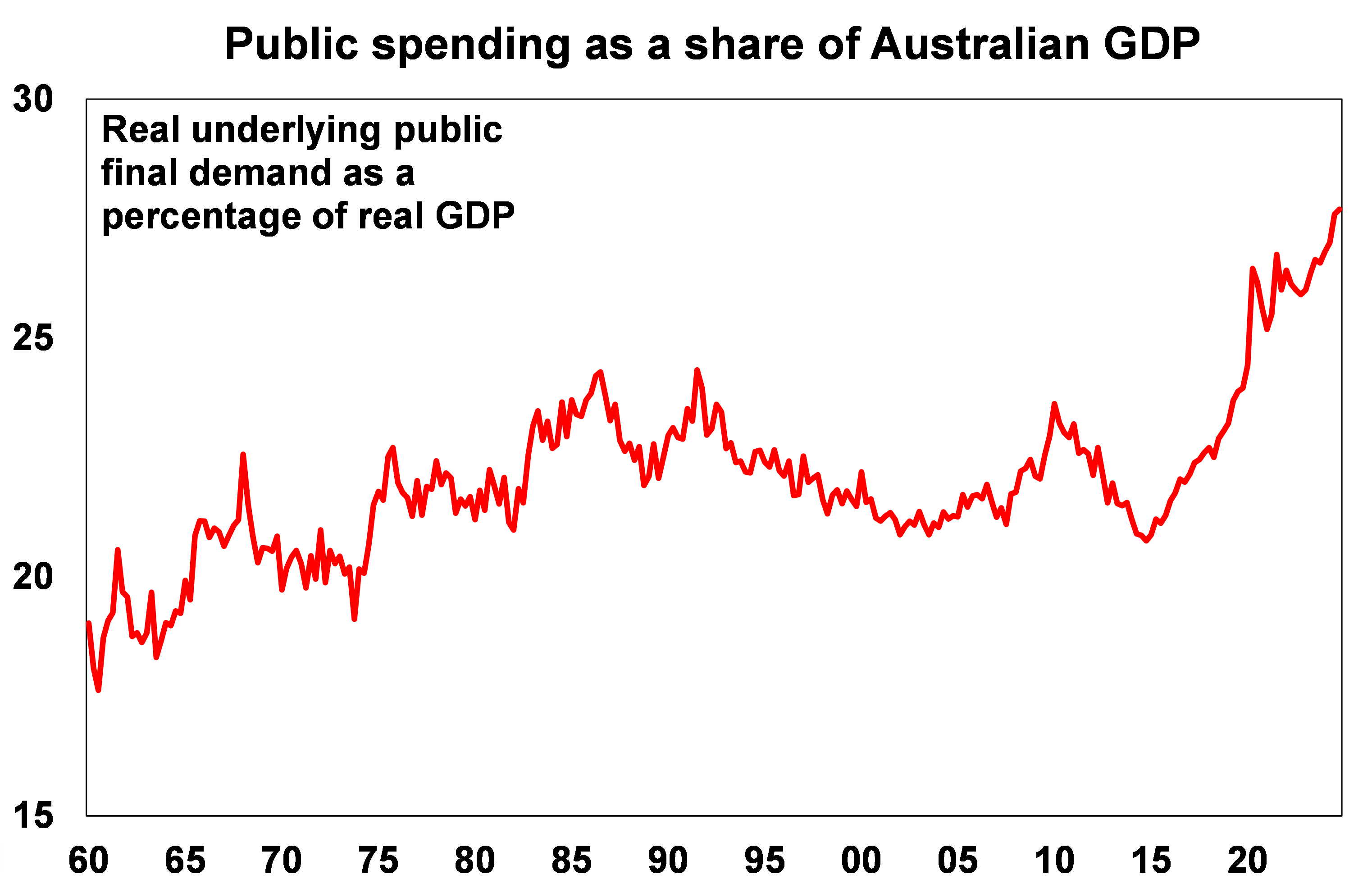

A good place to start would be to cap public spending as a share of GDP as it’s been exploding and crowding out somewhat more productive private sector activity.

Source: ABS, AMP

Improve housing affordability – this is voters’ number two concern. It’s been deteriorating for decades, impacting productivity and equity.

Get the budget under control – the Labor Government has been lucky with a nearly $200 billion revenue windfall on the back of a strong jobs market, high commodity prices and bracket creep enabling modest surpluses. But much of this has been spent contributing to the surge in public spending leading to higher than otherwise inflation and interest rates. Structural spending pressures around the NDIS, health, aged care, defence and public debt interest are now taking the budget back into deficit when public debt is already high. They need to be checked and/or offset by savings elsewhere. So tough decisions will be needed as we can’t just keep relying on an ever-higher tax burden on Millennials and Gen Z to pay for things.

Survive Trump – his erratic policy making risks: US and global recession; direct tariffs on our exports; less demand for our exports; increased geopolitical threats; pressure for Australia to deregulate and cut taxes; and big pressure to ramp up defence spending from 2% to 3% of GDP. This means making the economy as strong as it can be - so driving a bigger pie should be the key focus.

Economic policy differences

The ALP is offering a continuation of bigger government, a higher tax share to eventually balance the budget, industry policy like “Future Made in Australia” and more regulation. Since the start of the year the Government has promised an extra $35 billion in spending over the next four years (on Medicare, urgent care clinics, roads, the NBN, public schools, the Whyalla steelworks nationalisation, etc). More is likely in the Budget with another round of $300 per household electricity bill relief costing $3.5 billion (without which average electricity bills could rise 25%). And this is before allowing for extra disaster spending flowing from the damage cause by ex-Cyclone Alfred (note the 2022 East Coast floods cost the budget around $7 billion).

The Coalition has committed to matching much of this. But it also promises smaller government, an up to 36,000 cutback in public workers saving $6 billion, lower taxes and less regulation. But - beyond committing to nuclear energy over wind, solar and batteries - its policy details are so far lacking.

Both sides of politics also seem committed to big use of off-budget funding e.g. with Labor’s promise to wipe 20% off student debt and the Coalition looking to use it for its nuclear power stations. But this is just a sleight of hand as while it doesn’t show up in the budget deficit it adds to public debt. Hardly consistent with “Budget Honesty”. The Coalition’s nuclear policy is also a huge return to public ownership of the power industry which is contrary to its small government philosophy.

While the Coalition is getting closer neither side is really committing to a reform agenda to put the economy on a stronger path (which is maybe too much to expect in an election) but both sides should at least be leveling with the public in terms of the need for spending restraint and reforms. Much like Hawke/Keating did a generation ago.

On housing, both sides are now rightly more focussed on boosting supply. The Labor Government is focussed on trying to build 1.2 million new homes under the Housing Accord. The Coalition promises to invest $5 billion in housing infrastructure and cut permanent migration by 25% but its policy to allow first home buyers to access $50,000 of their super will just boost home prices – great for Baby Boomers and Gen X but not much else.

Concluding comment

The relatively modest difference in economic policies between the Coalition and Labor suggests minimal impact on investment markets if there is a change of government. Trump bumps will likely continue to dominate. The main risk for investment markets may come if neither side win enough seats to govern, forcing a reliance on minor parties or independents, further delaying productivity reforms and in the case of a minority Labor government forcing it down a less business friendly path.

Dr Shane Oliver is Head of Investment Strategy and Chief Economist at AMP. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs.