Investors are often trained to look for size as a proxy for safety. Blue chips, household names, and index leaders dominate portfolios not only because they feel familiar, but also because of herding bias – the psychological pull to follow the crowd rather than stand apart. But history shows that tomorrow’s champions are often built quietly, well before they attract mainstream attention.

Canva’s rise offers a case in point. Barely more than a decade old, the private design platform is now worth around $65 billion. It is more valuable than Telstra, Brambles, and Rio Tinto – companies that have taken over a century to build. While Canva is exceptional in scale, it highlights a broader trend: founder-led firms with aligned incentives and disciplined cultures will continue to reshape Australia’s corporate landscape.

Why incentives matter

The way leaders are rewarded has a direct impact on the way businesses grow. According to the Australian Council of Superannuation Investors, 91% of Australia’s top listed CEOs received a performance bonus last year, typically vesting over three years. This structure often drives short-term priorities.

Founders, in contrast, are rewarded only if their businesses thrive over decades. Their ownership stakes and reputations are tied to long-term outcomes. Their long-term motivation is reflected in bolder decision making, leaner organisational structures, and faster responses to change. For investors, understanding these differences is critical in assessing why some companies compound value more effectively than others.

Telltale signs of founder behaviour

Founder-led firms are not immune from challenges. Some stall, others remain niche, and a few will fail outright. But collectively they demonstrate a pattern of behaviours investors can analyse:

- Capital discipline: prioritising sustainable margins and reinvestment over empire building.

- Alignment: boards, executives, and shareholders cohesively building long-term value rather than chase personal gain.

- Strategic patience: committing to opportunities that compound over decades, even when short-term sentiment resists.

- Scalable structures: setting up organisation structures that ward off corporate bureaucracy and continue to proliferate the founder’s philosophy

These traits do not guarantee success, but they are observable markers that investors can use when evaluating businesses and management team’s decision-making.

Emerging examples

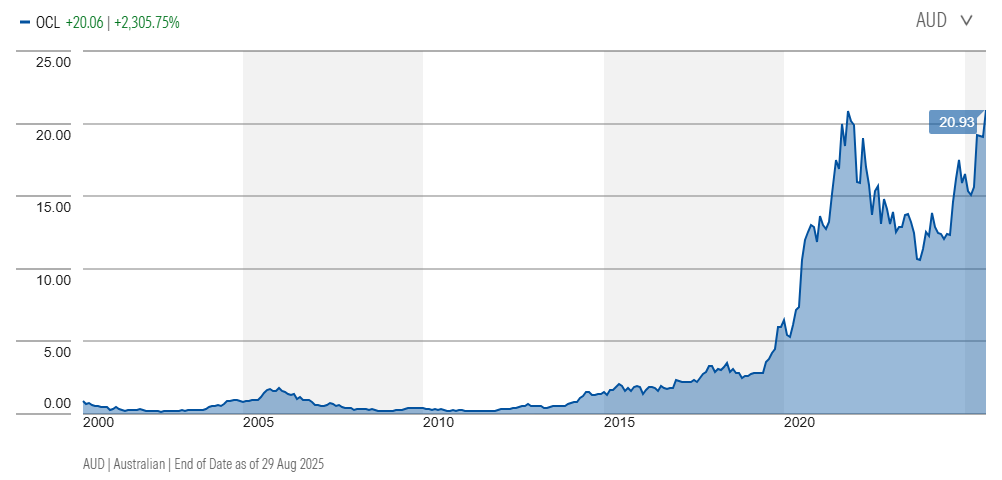

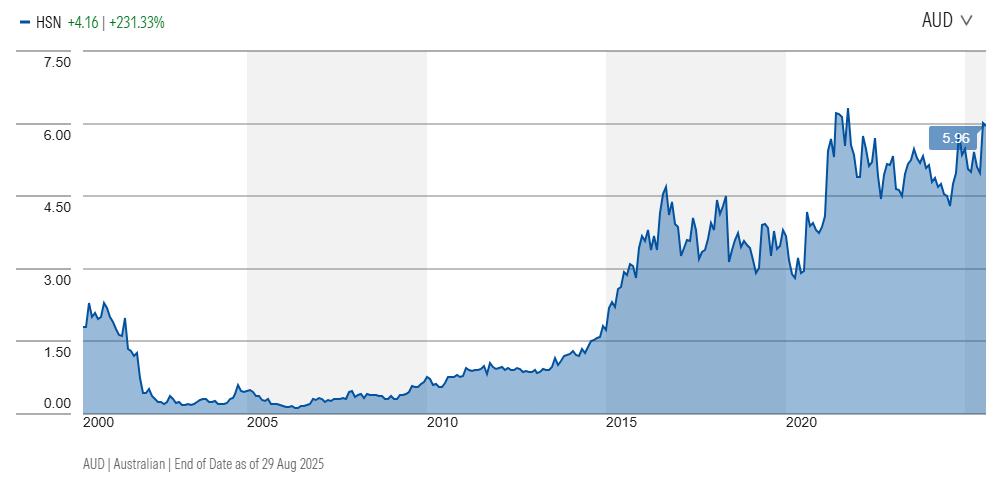

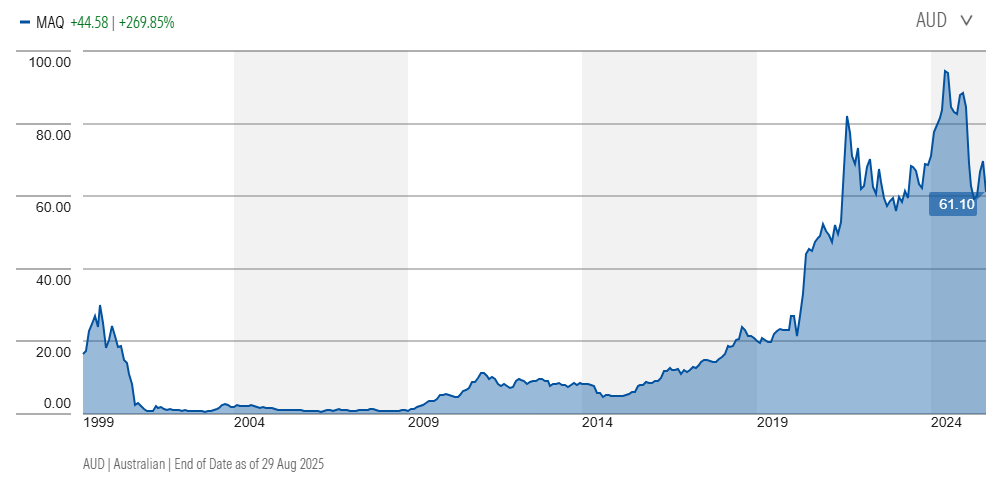

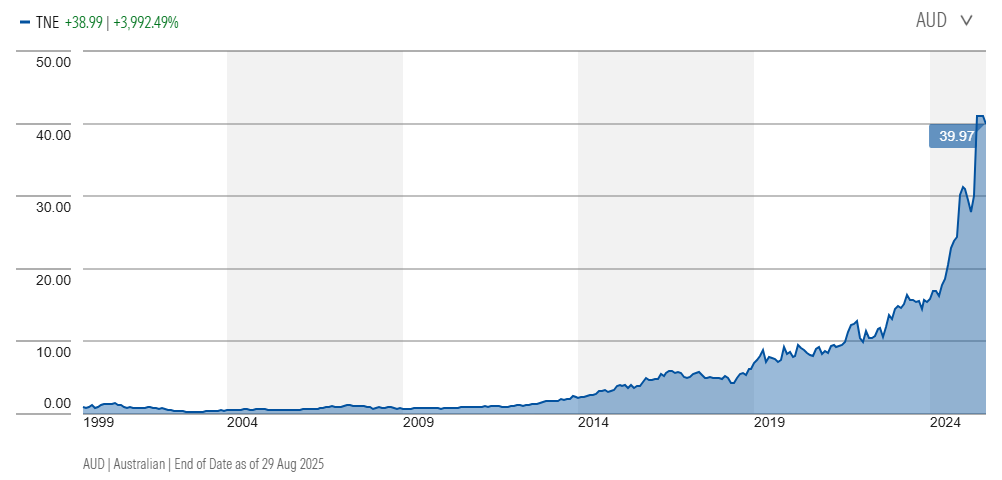

This mindset is visible across a range of Australian companies. Objective Corporation [ASX:OCL] in government software, Hansen Technologies [ASX:HSN] in specialised software products, and Macquarie Technology Group [ASX:MAQ] in cloud and data services have all grown under founder influence. Private firms such as Expert360 and Lakeba are building new models in talent platforms and applied technology. Even mature names like Technology One [ASX:TNE] retain founder DNA in their culture of customer focus and capital efficiency.

Source: Morningstar.com.au

These are not stock recommendations, but case studies of how founder structures can shape performance. For investors, the lesson is not just which names to watch, but what patterns to recognise when allocating capital.

The takeaway for investors

The next generation of wealth creation is unlikely to come from the obvious megacaps. It is more likely to emerge from founder influenced firms that combine scalable models with long-term alignment. By the time these companies appear in index products or attract heavy broker coverage, much of the edge is already gone.

Investors who want exposure to this trend need to build frameworks for identifying founder alignment early, before the crowd does. That means going beyond market capitalisation, looking at ownership structures, and assessing the decision-making culture that sits behind the numbers.

Lawrence Lam is the author of The Founder Effect (Wiley) and Managing Director of Lumenary Investment Management. He writes on leadership, markets, and the traits that define exceptional management. More at lawrencelam.org and lumenaryinvest.com. The material in this article is general information only and does not consider any individual’s investment objectives. Companies mentioned have been used for illustrative purposes only and do not represent any buy or sell recommendations.