The US Federal Reserve's (Fed) cut in interest rates last month is expected to generate a positive tailwind for emerging market (EM) equities as lower US rates and a potential US dollar weakening have historically created a favourable backdrop for riskier EM assets.

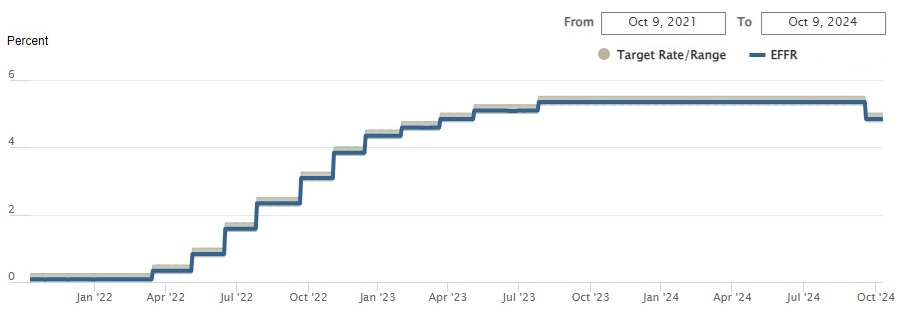

The US Fed has reduced the benchmark federal-funds rate to a range between 4.75% and 5%. While this first move is now done, the scale of more cuts remains open to debate. Still, it signals that the US Fed is winning its fight against inflation.

Effective Federal Funds Rate (EFFR)

Source: Federal Reserve Bank of New York

EM shares have climbed on optimism that their currencies will rise while the US dollar dives as capital flows out of the country. Several other factors are aligning to support EM equities. Notably, a convergence of monetary policy rates between developed and emerging markets could support EM equities as monetary policy is eased in developed nations. Indeed, over the next 12 to 18 months, EM policy rates may sit above those in developed markets, a scenario historically associated with EM equity outperformance.

Reduced uncertainty stemming from the US election cycle passing and a US Fed easing this month, which are likely to lower interest rates and weaken the US dollar. This has also been correlated with stronger performance for emerging market equities in the past, as the purchasing power of domestic currency improves and US dollar debt financing becomes relatively cheaper.

Recession risk may hold developed markets back

While volatility is expected as we head into the final quarter of 2024, EM equities could outperform US equities. We observe widening GDP growth expectations for EMs over developed markets, a trend often correlated with EM equity outperformance. Notably, developed markets (DM) face a risk of recession, especially in the US and Europe because of accumulated rate hikes.

A significant US slowdown would deprive global growth of a key ‘engine’. That said, a severe contraction in the US is unlikely, given that the US has no major structural imbalances and better household balance sheets relative to other DM economies. Nevertheless, the US Fed needed to avoid being late in cutting interest rates, so the US Fed’s decision this month was widely watched.

Another factor supporting EMs is increasing capital expenditure (capex). The global capex cycle has turned up since 2021 and EMs typically outperforms developed markets in a rising capex cycle due to with EM’s higher exposure to commodities and manufacturing.

The strength of the US dollar has hampered this outperformance to date, but it is another supporting factor for EMs moving forward should the US dollar fall. The impact can already be seen as, for the first time in a decade, earnings in emerging markets are growing faster than developed markets – something we think is set to continue.

Historically, low investor positioning in EMs combined with attractive relative valuations has driven stronger EM performance. EM equities are trading at least one standard deviation cheaper than historical averages whereas the US is more than one standard deviation expensive.

All eyes on China and India

Looking at particular markets, idiosyncratic factors helped China and India outperform most Asian markets during the correction in August. We believe that these factors will continue to position these markets favourably during future periods of volatility.

In India, domestic flows have held sway. However, unlike other Asian markets which depend more on foreign inflows, the Indian equity market is more reliant on domestic flows, which tend to be ‘stickier’. Although India is often viewed as a popular market among foreign investors, India has outperformed over recent years and now offers very few attractively valued stocks in our view.

Besides the market sell-off in August, the Indian stock market has remained resilient to two unexpected domestic shocks this year - Prime Minister Modi’s smaller than expected majority in the June election and the capital gains tax increase in India’s July budget.

Given the strength of its domestic inflows, it is unlikely that a US recession would derate the Indian equity market either. In addition, further US Fed cuts could potentially give the Reserve Bank of India room to bring interest rates lower if needed, without stoking volatility in the Indian rupee.

Nonetheless, a value focus should allow investors to participate in the India structural growth story while providing investors with some buffer against potential equity market falls.

Significant improvement in sentiments over China

We believe that the Chinese equity market will also be relatively resilient in the face of global volatility given its trough valuations, low exposures among institutional investors, improving fundamentals in selected key sectors and improved market sentiments triggered by government stimulus.

China still faces challenges and is currently one of the most unloved equity markets amongst investors, with global investor positioning in Chinese equities at its lowest point in 12 years. This suggests that the market has less room to fall if overall investor risk aversion rises, and room to gain in the opposite scenario.

The challenges facing the Chinese economy are well known and well discussed – a weak property market, low consumer confidence and a lack of effective stimulus from the government. We are seeing some signs of change – the Chinese central government has recently responded decisively with a coordinated suite of monetary, fiscal and regulatory measures. Whether the economy is now poised for recovery remains to be seen, but market sentiments have improved significantly.

A convergence of attractive factors

For investors keen to diversify their portfolios, a convergence of factors such as the US Fed's pivot, attractive valuations, and improving fundamentals paint a promising picture for EM equities. Further rate cuts could diminish the US dollar’s appeal and drive more capital into higher-yielding emerging stocks, bonds and currencies.

Our approach to EM equities is bottom-up and valuation-driven. While risks remain, the potential for outperformance, especially in select markets like Brazil, Mexico, South Korea, China, and in select stocks in India, makes EM equities an asset class worth considering for investors seeking diversification and growth opportunities that exceed those available in developed markets.

Samuel Bentley is a client portfolio manager and Yuan Yiu Tsai is a portfolio manager at Eastspring Investments. Eastspring is a fund manager partner of GSFM, a sponsor of Firstlinks. This article is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons.

For more articles and papers from GSFM and partners, click here.