Investing, like life, is full of surprises. Whether those surprises are rewarding or terrifying, our response to them has a large bearing on future investment returns. Market shocks can be unsettling. This article will discuss practical strategies that help maintain clarity when portfolios face unexpected turbulence. Then, I’ll shift focus to the other end of the spectrum - strong market rallies. It might sound counterintuitive, but periods of soaring share prices can present their own set of risks. It's critical to manage performance and sentiment when everything seems to be going right.

Not panicking during market shocks

If you can, cast your mind back to the COVID-19 pandemic. The financial sector hadn’t built a model that incorporated a global economic shutdown. Private investors reliant on the income from their AREIT holdings and those advising them were in uncharted territory.

When online shopping boomed during lockdown, there were fears for the future of shopping centres while work-from-home (WFH) had the same impact on the office sector. History has proven much of these fears overdone. Retail quickly recovered and while WFH has had long term consequences, high quality, well-located offices have been performing well.

During a crisis, humans naturally gravitate to the worst possible outcome. Usually, it doesn’t happen.

The same was true in 2008-09 when the AREIT sector was struggling under the weight of excessive debt and overreach, and the financial system was on the edge of collapse - parallels were being drawn with the Great Depression.

We survived the Global Financial Crisis (GFC) and the pandemic. Given the bargains available at the time, some even prospered.

We did so by maintaining a long-term view. We knew that at some point, people would return to their offices (if only two or three days a week), that they would go to their local shopping centres, drop the kids off at school and go about their daily lives. The recovery from the GFC took longer and required more patience but it did recover.

The day-to-day movements in stock prices are less important than this essential fact. At some stage, things will return to ‘normal’. By focusing on this rather than how much the value of a portfolio fluctuates in any given day, week or month, we make better decisions. This is the key principle of active management. While income may or will be reduced in the short term, it will at some point return to more normal levels. At a time when many investors are panicking, being calm by maintaining a long-term perspective is a strategic advantage.

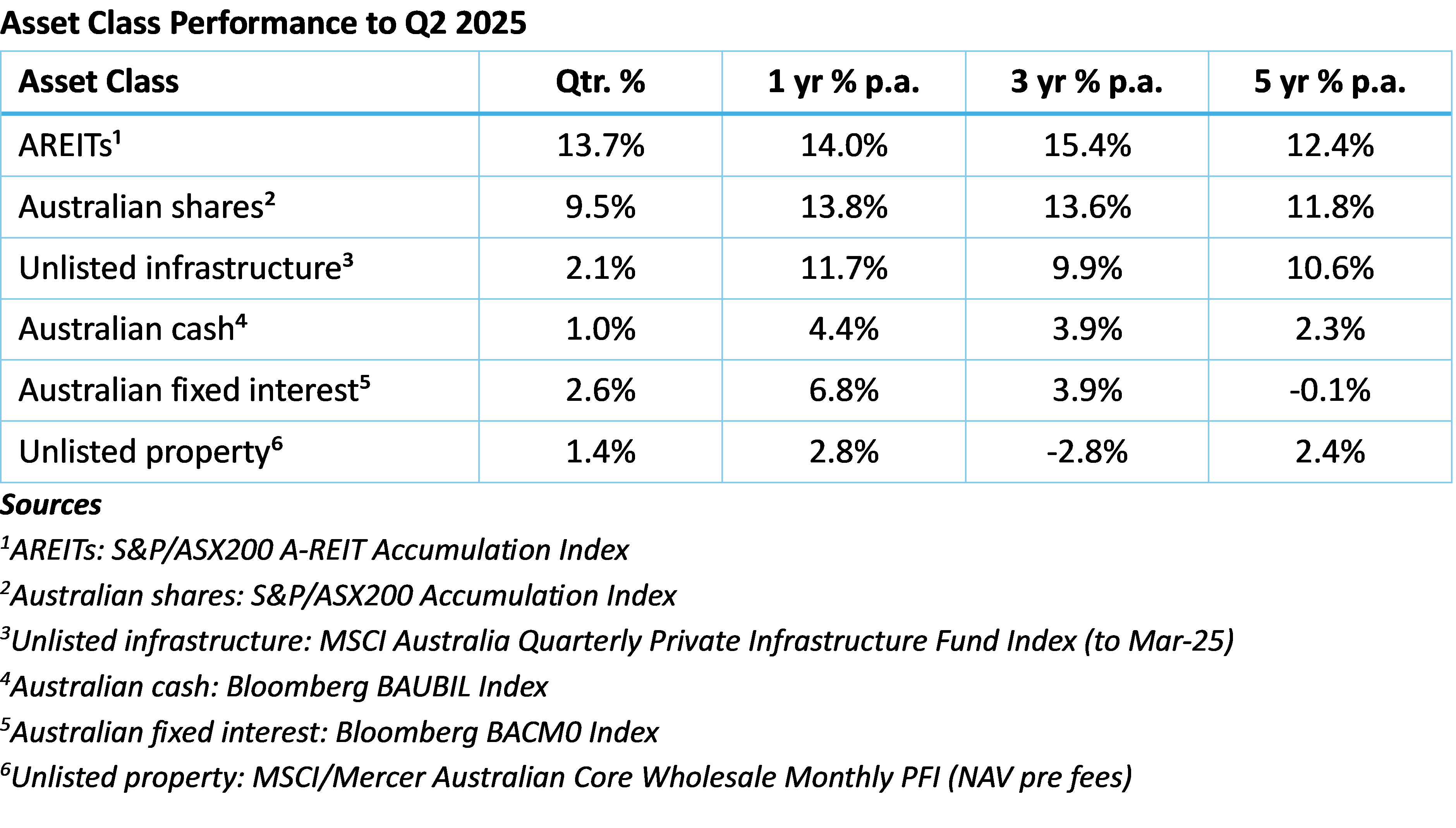

The table below, showing how AREITs have outperformed other asset classes over the past three years, supports this thesis.

Active, not reactive, management

It’s easy to be reactive in environments when share prices are volatile. The newspapers and TV headlines seed fear because that’s what grabs our attention. Constantly checking portfolio movements only feeds this further.

As public market investors, we understand the innate human tendency to act from emotion rather than fact must first be acknowledged, then countered by a tried and tested data-driven process.

First, we tend not to constantly track share prices. Instead, we concentrate on the underlying cashflow prospects of a REIT. This helps us stay grounded in the portfolio, capital structure and operating model of the REIT rather than the emotions of the market, because it’s the former which drive durable earnings, asset valuation and total returns.

Second, unless they help us to act opportunistically, as we did at the beginning of the COVID-19 pandemic when we reduced our exposure to retail in the Dexus AREIT Fund and the Dexus Global REIT Fund, we ignore-day-to-day price movements. Share prices capture the emotion of a market, often at the expense of the underlying fundamentals. Focus on the latter rather than the former.

Third, we recognise that there are some things we cannot control and focus on those things we can. We cannot control global trade policy, geopolitical conflict or ultimate economic data outputs. We can decide what REITs enter and exit our portfolios, the price at which they do so, their respective weightings and the cash levels we hold. This is the core benefit of active REIT management.

These factors are especially pertinent right now. As written in Dexus’s recent Australian Real Asset Review, in Australia “Real estate markets have clearly bottomed. Income growth signals a recovery in values over the next few years. The reporting of positive returns, by itself, should boost confidence and stimulate deal flow.”

We are even seeing the early stages of what a pronounced recovery in the office sector could be. Faced with a recovery in real estate returns, it will be interesting to see how quickly Fear of Acting Too Early (FATE) gives way to the Fear of Missing Out (FOMO).

Not being reactive and focusing on the long-term leads to a degree of equanimity in times like these, knowing that we’re doing the right thing for our investors long term.

Resisting the temptation to chase markets

Navigating the fear of missing out (FOMO) when markets are booming is a difficult emotional hurdle that most fail to mount.

In the U.S., Dalbar research from the Quantitative Analysis of Investor Behavior Study shows that between 2001 and 2020, the S&P 500 produced annualised returns of 7.5%, real estate investment trusts (REITs) delivered 9.5% and average investors achieved just 2.9%. In Australia, Morningstar’s ‘Mind the gap’ research reaches similar conclusions.

Typically, retail investors will sell out at, or near, market lows and buy in at, or near, market peaks due to fear of missing out. With REITs now showing improving returns across office, retail, industrial and logistics, and alternative property sectors, for many investors the temptation to chase the return is back.

On the surface, FOMO looks like greed: A rush to buy because others appear to be making easy money. Underneath lies a deeper emotion - the fear of being left behind. Behavioural finance research shows that loss aversion, or the pain of missing out, often feels twice as strong as the pleasure of making a gain. This is often how bubbles form.

Since ‘Liberation Day’ in early April 2025, the shift from caution to optimism is evident in many areas of the market. These factors risk triggering a classic FOMO cycle.

For REIT investors, it’s a little different. After a bruising 2022–23 when rising interest rates depressed valuations, the recovery is gathering momentum. Cap rates have stabilised, rents are firming in logistics, shopping centres are crowded, and the office recovery is underway.

Focusing on long-term compounding, not short-term excitement

FOMO thrives on short-term enthusiasm, often backed by what the professionals call ‘hockey stick’ charts. REIT investing is different or at least should be. Conservative investors instead focus on the steady compounding of income and capital because they know the power of it.

Had you invested $10,000 in the ASX 200 AREIT index in 2000 and reinvested distributions, it would now be worth roughly $45,000. During that time, you would have endured the dotcom crash, the global financial crisis (GFC) and the COVID-19 pandemic; each of which offered the temptation to sell at the bottom.

Mark Mazzarella is Head of Real Estate Securities at Dexus, a sponsor of Firstlinks. This article is for general information purposes only, does not constitute financial product advice, has been prepared without taking account of the recipient’s objectives, financial situation and needs, and does not purport to contain all information necessary for making an investment decision. Accordingly, investors should seek independent legal, tax and financial advice before acting on this information.

Click here for full disclaimer and important notes: This document (“Material”) has been prepared by Dexus Asset Management Limited (ACN 080 674 479, AFSL No. 237500) (“DXAM”). DXAM is a wholly owned subsidiary of Dexus (ASX: DXS). Information in this Material is current as at March 2025 (unless otherwise indicated), is for general information purposes only, does not constitute financial product advice, has been prepared without taking account of the recipient’s objectives, financial situation and needs, and does not purport to contain all information necessary for making an investment decision. Accordingly, and before you receive any financial service from us (including deciding to acquire or to continue to hold a product in any fund mentioned in this Material), or act on this Material, investors should obtain and consider the relevant product disclosure statement (“PDS”), DXAM financial services guide (“FSG”) and relevant target market determination (“TMD”) in full, consider the appropriateness of this Material having regard to your own objectives, financial situation and needs and seek independent legal, tax and financial advice. The PDS, FSG and TMD (hard copy or electronic copy) are available from DXAM, Level 5, 80 Collins Street (South Tower), Melbourne VIC 3000, by visiting https://www.dexus.com/investor-centre, by emailing [email protected] or by phoning 1300 374 029. The PDS contains important information about risks, costs and fees (including fees payable to DXAM for managing the fund). Any investment is subject to investment risk, including possible delays in repayment and loss of income and principal invested, and there is no guarantee on the performance of the fund or the return of any capital. This Material is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives. Any forward looking statements, opinions and estimates (including statements of intent) in this Material are based on estimates and assumptions related to future business, economic, market, political, social and other conditions that are inherently subject to significant uncertainties, risks and contingencies, and the assumptions may change at any time without notice. Actual results may differ materially from those predicted or implied by any forward looking statements for a range of reasons. Past performance is not a reliable indicator of future performance. The forward looking statements only speak as at the date of this Material, and except as required by law, DXAM disclaims any duty to update them to reflect new developments. Except as required by law, no representation, assurance, guarantee or warranty, express or implied, is made as to the fairness, authenticity, validity, suitability, reliability, accuracy, completeness or correctness of any information, statement, estimate or opinion, or as to the reasonableness of any assumption, in this Material.