Never stand between a product promoter and a bucket of cash. The sharemarket has a good rally after falling for most of 2011 and the first half of 2012, and market commentary quickly turns to how much further it can run in 2013. Suddenly, the focus switches away from dowdy capital protection, since it’s too painful to sit in cash at 4% when the market delivers 20% in 2012 and then 5% in January 2013 and, to make it worse, another 5% in February 2013.

And then come the inevitable noises, in a market that swings more than an unlocked gate in a storm – what about a bit of gearing. If the market is rising, and funding costs are low, let’s have more of the action.

Before any investor takes this step, regardless of whether it is appropriate in a world which has done little to address its fundamental problems, there is one question a potential borrower should ask: how well must the market perform for a geared portfolio to perform better than a normal, ungeared portfolio? Or put a different way, if the market index rises or falls 10%, how much will a geared strategy change in value?

Surely, that’s easy. If I borrow $100,000 to add to my own $100,000 and invest $200,000, don’t I simply double the return? And if the market is down 5%, then my return will be down 10%. I can live with that risk, so let’s have a chat with my nearest margin loan provider.

Sorry, the returns don’t work like that.

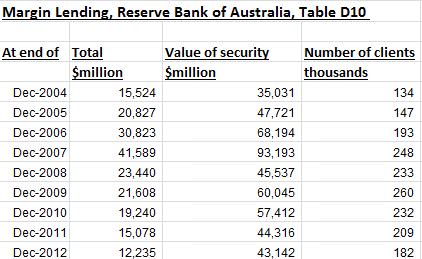

First, let’s take a look at the recent history of margin lending in Australia.

At the market’s peak, a quarter of a million Australians borrowed $41 billion secured against $93 billion of shares, and this is only one part of the equity gearing market. There is also an unknown amount of drawings against the equity in home loans, internally geared share funds, and other products such as instalment warrants. And when investors do not fully understand the risks, a scandal such as Storm Financial is created, where the Townsville-based adviser had 13,000 clients with $4 billion invested, much of it borrowed by people without the means to repay.

With exquisite timing, SMSFs became allowed to borrow in September 2007. The market peaked in November 2007, so it was probably a blessing that more SMSFs were not caught by the GFC falls. There is not yet much evidence that SMSFs are increasing gearing into equity markets. For example, SMSF administrator, Multiport, issues an SMSF Investment Patterns Survey, and in December 2012, reported only a small increase in the number of financial asset loans. In fact, the average loan size decreased from $96,000 in June 2012 to only $76,000 in the latest Survey.

Borrowing to invest will increase if market remains strong

While gearing into shares is less popular than it used to be, it is still a massive industry with healthy margins, and if the market continues to rise, the product providers will be out banging the drum again. More media stories will appear on the benefits of gearing, especially targeting the one million trustees of SMSFs. So is gearing into shares likely to be worthwhile on a returns basis?

According to interest rate website www.ratecity.com.au, there are currently 68 margin lending loans available in Australia, with rates ranging from 7.65% to 8.13%. The cash rate is currently 3% and the yield curve is relatively flat, so these loans carry healthy lending margins of up to 5%. If a borrower chooses a protected equity loan, which includes option protection against falling markets, the interest rate can be 10% or more, depending on the loan to valuation ratio.

It is usually cheaper to borrow against the value of a property, and home equity loan rates are currently around 6%. The borrower must be comfortable exposing the family home in this way.

Another way to gear into the sharemarket is by using internally geared share funds, especially popular with SMSFs given the administration complexity of other forms of borrowing. These funds simply build the debt into fund structure. For example, a fund geared at 60% will take $10,000 from an investor and borrow another $15,000 to invest $25,000 on behalf of the unitholder ($15,000/$25,000=60%). The interest cost is significantly lower than in margin lending because these funds borrow in wholesale markets, currently at around 5% or less. However, management fees are charged on the gross assets (including the borrowed amount), so geared funds gross up the fees handsomely. Nice work if you can get it.

The calculation which many geared investors overlook

In order for a geared strategy to be worthwhile, the ungeared (or market) return must be enough to cover the interest cost plus any management costs and fees. The formula is:

Geared Return = (Ungeared Return – Gross Fees) - (Gearing Ratio X Interest Cost)

(1 – Gearing Ratio)

The gearing ratio is the amount of debt as a proportion of total assets, so if an investor puts in $40 and borrows $60, the gearing ratio is 60%. Obviously, interest is only paid on the borrowed amount, so the lower the gearing, the less the impact of the loan rate. This calculation ignores the fact that income may be taxable and expenses may be deductible.

A typical example of a geared share fund will have an interest cost of 5%, a gearing ratio of 60% and fees on the gross assets of the fund of 1%. Assume the normal accumulation index (price plus dividends) rises 10% over a year. The Geared Return will be 15%, being 9% return after fees (10%-1%), less the interest cost (60% of 5% is 3%), leaving 6% net return, divided by the 40% equity put in by the investor, to give 15% (6%/0.4).

If the market is flat, the Geared Return would be -10%, being the cost of 1% in fees and 3% interest, divided by the capital of 40% to give -10% (Note that these examples consider total returns, including price, dividends and franking credits, so ‘flat market’ means prices have fallen enough to offset the dividends and franking).

If the index falls 10%, the ‘loss’ on the investor’s capital is a whopping 35%

This is where the asymmetry of returns can shock investors. How can the loss be 35% when the market is down only 10%? It does not seem intuitively correct. It’s the effect of costs plus the 250% gearing.

Consider the exact dollars. An investor puts in $100,000 and borrows $150,000 to invest $250,000. The portfolio is down 10% or $25,000. The fund charges 1% on gross assets or $2,500 and the interest cost is $7,500 (even at a low rate of 5%). That’s a loss of $35,000 or 35%.

By the same reasoning, many investors with margin loans in 2007 lost 100%, even when gearing ratios were lower. They put in $100,000 and borrowed $100,000, and then their shares fell in value by 50%. Their loss was not 50%, it was 100%. All their capital was gone.

Here are the geared returns on a typical geared share fund for various levels of (ungeared) market performance (the same calculations apply to any form of gearing).

| Accumulation Index (Ungeared) |

Geared Return |

Gearing Ratio (debt/assets) |

Gross Asset Fee |

Interest Cost |

| -20% |

-60% |

60% |

1% |

5% |

| -10% |

-35% |

60% |

1% |

5% |

| 0% |

-10% |

60% |

1% |

5% |

| 5% |

2.5% |

60% |

1% |

5% |

| 10% |

15% |

60% |

1% |

5% |

| 20% |

40% |

60% |

1% |

5% |

A margin loan invested on the ASX in, say, cheaper Exchange Traded Funds (ETFs) may save on the asset management fee, but the borrowing cost is likely to be up to 8%, making the above geared returns even worse. For example, if the market loses 10%, an investor with a margin loan at 8% would lose 37%. The ‘break even’ level - the amount the index needs to rise for a geared strategy to give the same return as ungeared - is about 6.7%.

It’s also noteworthy in the above example that the market can rise 5% and the geared investment rises only 2.5%. So it’s not true to say that ‘gearing enhances market rises’, because the market rise must be enough to offset the fees and interest cost before gearing is an ‘enhancement’.

But these numbers also explain why geared funds top the performance lists whenever the market rallies strongly. For example, the geared funds of market leaders Colonial First State and Perpetual are both up around 50% in the last year.

A geared investor needs high risk tolerance

Gearing is not for the fainthearted, especially when many believe single-digit returns will become more the norm. A gearing ratio of 60% will give an investment with 250% of the volatility of the standard equity index.

Of course, the same as above applies to any geared investment, including buying the family home. Residential owners are blessed by not having daily market valuations, so they do not realise when their geared exposure has made a massive loss. Plus they tend to consider property investment longer term, especially the house they live in.

This leads to the type of mindset you need to gear into equities. It is for the highly risk tolerant and based on a long term strategy, because short term losses can be severe. Unless one of the simple geared products is chosen, borrowing within super is complex and expensive, and an SMSF may not be the best structure to learn whether you have the risk tolerance.

So next time a salesman calls promoting an equity loan, ask him a simple question: “If the market is down only 10%, how much will I lose?” When he shrugs his shoulders, show him the answer.