Given the impending superannuation changes, it's worth taking a fresh look at estate and superannuation succession planning arrangements.

Background

From 1 July 2017, individuals will be able to have a maximum of $1.6 million in the tax-free pension stage of superannuation. Amounts surplus to the $1.6 million need to either be rolled back to the accumulation stage of superannuation (tax rate of 15% applies to income and 10% to capital gains) or withdrawn from superannuation where earnings may be taxed at personal marginal tax rates.

To illustrate the changes and new opportunities, consider the following example:

- High net worth retired couple, Simon and Danielle, both age 65 with an SMSF total balance of $3.5 million ($1.6 million for Simon and $1.9 million for Danielle). The SMSF is entirely in pension phase so no tax applies.

- Simon also has an investment portfolio valued at $2 million outside super.

- Simon passes away in June 2017.

- They have two minors as grandchildren who do not have any other income.

- SMSF succession arrangements are such that Danielle can take Simon’s balance as a reversionary pension, lump-sum payment directed to the estate or Danielle, or a combination of the above (the precise mechanics of this will be discussed in another article).

- For simplicity, assume an earnings rate of 5% (all income, no franking credits) on investments regardless of entity holding assets.

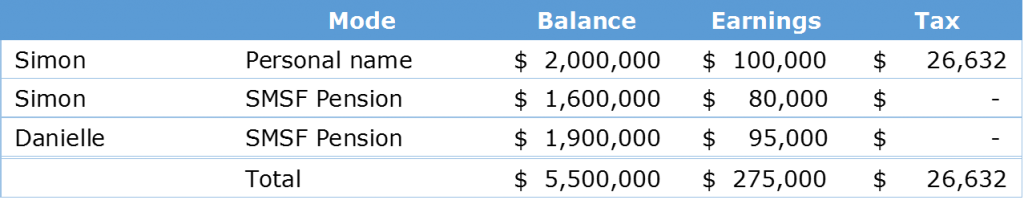

Pre-1 July 2017 consequences

a) Before Simon’s death

In a pre-1 July 2017 world, there is no tax on earnings within the SMSF as it is all in pension stage. Simon pays tax at his marginal rate on his $2 million personal investment portfolio.

b) After Simon’s death

Danielle continues Simon’s pension as reversionary and inherits the $2 million personal portfolio directly. The tax position is the same as when Simon was alive.

Post-1 July 2017 consequences after Simon’s death

Option 1 - Super roll back

Danielle can hold a maximum of $1.6 million in the pension phase. In this example, we assume that the balance above this amount is rolled back to the accumulation stage. Danielle inherits the $2 million share portfolio and pays tax at her marginal rate.

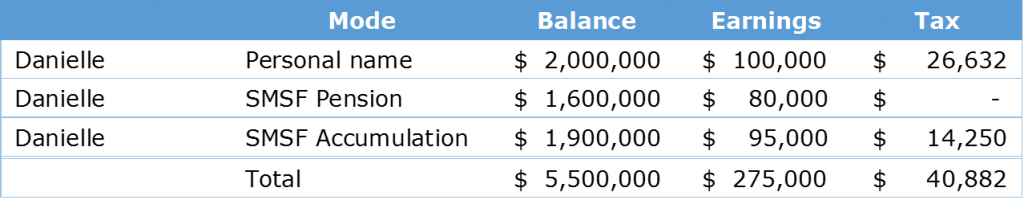

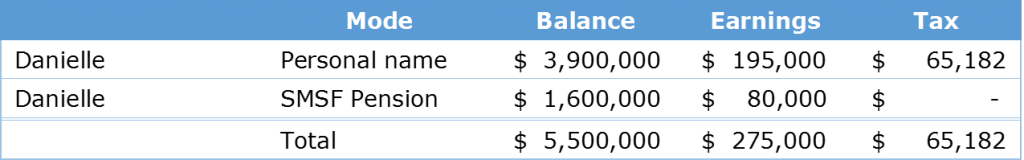

Option 2 - Withdraw excess from superannuation

As a superannuation tax dependant, Danielle is paid a tax-free lump sum death benefit of $1.6 million of Simon’s benefit, withdraws $300,000 of her benefit, and retains a total of $1.6 million in pension stage. The funds withdrawn from the SMSF are invested in Danielle’s name alongside the inherited $2 million portfolio and taxed at her marginal rate.

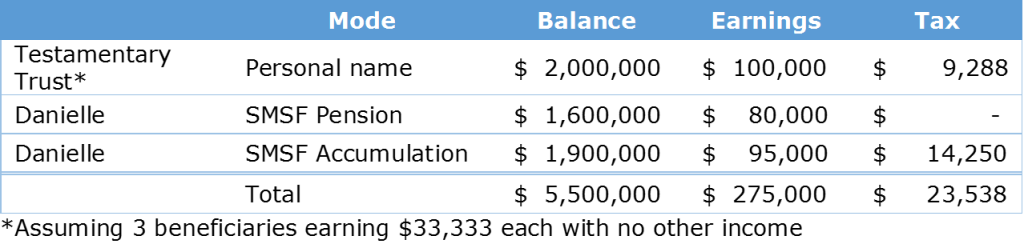

Option 3 - Super roll-back and share portfolio directed to a testamentary trust

[Note: A testamentary trust is a trust which arises upon the death of the testator, and which is specified in his or her will].

This strategy is a combination of the above two with a twist!

- $1.6 million stays in pension stage

- The excess over $1.6 million in the SMSF is rolled back to accumulation stage

- The $2 million investment portfolio is directed to a testamentary trust with flexibility to distribute income to Danielle and potentially two minor grandchildren who have no other income.

Conclusion

In a pre-1 July 2017 world, it was often best to continue a reversionary pension to the surviving spouse given that all earnings would continue to be 100% tax-free. In these circumstances, testamentary trusts may have had limited appeal.

However, from 1 July 2017, given that high superannuation balances will be excluded from the zero-tax pension environment, an individual’s overall tax position may be optimised by using testamentary trusts for estate assets. This, when combined with careful superannuation succession planning, can lead to significantly better outcomes.

Reuben Zelwer is the Principal of Adapt Wealth Management Pty Ltd. Reuben is a CERTIFIED FINANCIAL PLANNER® practitioner and an SMSF Specialist Advisor™. This article is for education purposes and does not consider the circumstances of any person, and is based on an understanding of the legislation at the time of writing.