The Weekend Edition is updated to include a Friday market summary, plus Morningstar adds free links to two of its most popular articles from the week, including new stock-specific ideas. It's a chance to catch up on articles you may have missed. Previous editions are here and contributors are here.

***

Weekend market update

From AAP Netdesk: Shares extended all-time highs on the Australian market, and overseas inflation data appears the only immediate obstacle to rising portfolio values. The ASX200 benchmark index rose as high as 7,300 then eased slightly to close up 35 points, or 0.5%, on Friday. The ASX had its third consecutive week of gains and rose 1.6%. Low interest rates have encouraged many to enter the share market to seek better returns and low rates have also encouraged spending. Inflation concerns will be tested next week when the US and China issue inflation figures. In Australia, home lending rose to a record high in April, according to data from the Australian Bureau of Statistics. A 3.7% increase helped the record to $31 billion as investors continue swooping on the low rates.

From Shane Oliver, AMP Capital: Global share markets were mixed over the last week with US shares up 0.6% helped by a solid but less than expected rise in employment, Eurozone shares up 0.6% as reopening continues, but Japanese and Chinese shares down -0.7%. The 1.6% rise in the ASX 200 was led by energy stocks (on the back of the rising oil price), utilities, consumer staples, property and industrial shares. Bond yields fell in the US as softer than expected payrolls were seen as taking some pressure of the Fed despite ongoing taper talk and yields were flat to down elsewhere. Just as the rebound in shares has surprised many so has the rebound in GDP and in Australia both are now at record highs. The stronger than expected 1.8% March quarter GDP growth rate in Australia on top of nearly 7% growth in the second half of last year has delivered a Deep V economic recovery. It is underpinning a strong rebound in profits which is being magnified by the impact of past corporate cost controls.

***

At the Morningstar Investment Conference last week, founder of GMO, Jeremy Grantham, lamented the consequences of high prices of everything for younger people looking to build wealth. A longer extract from his interview covers his views on markets, technology, commodities and venture capital, but he also said:

"Having high priced assets is great for retirees and old folks like me, for selling off my assets, but for everybody else, it means you compound your wealth more slowly. And if you don't have any wealth, you pay twice what your parents paid for a house, you pay twice for a portfolio in the sense that you get half the yield. It's a fairly miserable world so I welcome lower asset prices which I'm confident will come from these very high prices."

I was reminded of Powderfinger's 'These Days' and the struggle many people feel about buying a home or investment. At the moment, each month goes by (the slowly creeping hand of time) with further price rises (shadow in my face) leaving the market out of reach (it's slipping right through my hands).

It's coming round again

Slowly creeping hand

Of time and its command

Soon enough it comes

And settles in its place

Its shadow in my face

Puts pressure in my day

This life well it's slipping right through my hands

These days turned out nothing like I had planned

(Extract from These Days by Powderfinger)

If there's comfort for those feeling they have missed out, Grantham strongly believes a major correction is coming. Then one day, interest rates will rise and higher loan repayments should put downward pressure on home prices. Maybe it will turn out as planned.

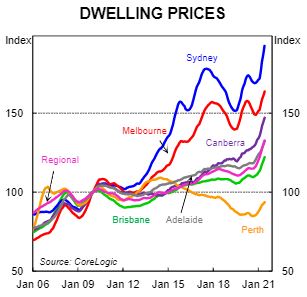

But for now, the latest CoreLogic data gives no respite, but it does show how prices fell in 2018 around the time of the Hayne Royal Commission and tighter lending rules, and then again at the start of COVID.

CBA Economics reported on the latest results:

* Dwelling prices rose by 2.3% in May across the 8 capital cities combined, with Hobart and Sydney rising strongly.

* Over the year dwelling prices have risen by 9.4%, but the rises range from 5.0% in Melbourne to 20.3% in Darwin.

* We are starting to see trends in the market shift; capital cities are now outperforming the regions and the top end of the market is outperforming the more affordable end of the market.

* The leading indicators of the housing market remain strong and point to continued growth in prices.

"Looking ahead we expect dwelling prices to continue to rise. We have a 14% lift in dwelling prices in 2021 and 2022 with a stronger increase for houses relative to apartments. Auction clearance rates have softened a little but remain very high. Very low interest rates and the recovery in the labour market are supporting dwelling prices."

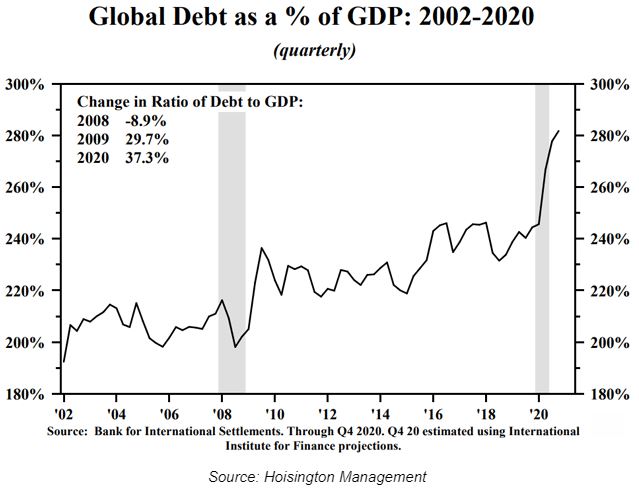

The possible resurgence of inflation is dividing economists, with prominent minds on both sides. Dr Lacy Hunt of Hoisington Management (as quoted by John Mauldin) has a strong multi-decade record on inflation (there will be little or none), interest rates (flat or down) and Treasury bonds (bullish). Says Mauldin:

"In Lacy’s view, today’s core problem is that excess debt suppresses economic growth, without which demand can’t rise enough to generate inflation or push up interest rates over the medium term. This is a structural problem, which at this point we really can’t fix."

The other, more practical side of the argument is that inflation is evident across many sectors. In the US, there is excess consumer demand from the stimulus cheques and a huge backlog of orders. Spending and travel are rising, and resources such as copper and lumber are in short supply. Wages for unskilled workers are rising and businesses cannot find people to hire. The argument is that these are temporary factors with Federal Reserve Chairman Jerome Powell describing the recent rise in inflation as “transitory”. But will he be forced into action within a year if inflation takes hold?

Professor Tim Congdon, Chairman of the Institute of International Monetary Research, wrote in his newsletter this week on US inflation:

"The average monthly increase in the CPI so far this year has been just above 0.6%, while business surveys indicate price-raising pressures are at their most intense for over a decade. Evidently, there is a possibility that the annual rate of consumer inflation will soon go above 5%."

Transitory or not, that's well above the range wanted by major central banks.

In addition to the interview with Jeremy Grantham, two prominent Australian fund managers lead this edition.

Marcus Padley provides evidence that analysts are largely wasting their time studying the merits of mining companies such as BHP versus Rio. Overwhelmingly, the fortunes of miners depend on the main commodity they produce, and know that and the share price follows.

Then back on the inflation issue, Roger Montgomery answers a reader question on how the value of a company might fall as rates rise and fund managers discount future earnings at a higher rate. Roger explains how rising rates look fine at first until they start to slow activity.

Robert Almeida holds similar concerns as higher real yields feed into lower risk asset valuations, forcing the fundamentals of companies to come to the fore again.

In case all this talk of inflation is a bit confusing, Richard Montgomery gives a basic explainer on the impact of inflation on financial assets and what sectors to consider as a defence.

Then Michael Buckland has checked the numbers when members withdrew their superannuation under the Early Access Scheme, showing their losses are even worse than reported, and offering a better alternative.

Looking longer term and more strategically, Geoff Warren reviews the main drivers of wealth and gives a framework for focussing away from volatility to achieving long-term goals.

A reminder that the Government has announced that the temporary reduction in pension drawdown rates by 50% will be extended another year to 30 June 2022. This will make it three years with the lower minimums. These are minimums, not recommended levels, and higher amount can be drawn if needed for your lifestyle.

And if you have been working from home, you may be eligible for extra tax deductions. There is a shortcut method of a deduction of 80 cents for each hour WFH over FY2021, or a fixed-rate method. You may be able to claim for the work-related proportions of household costs.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

Growing investor angst around rising inflation has led to a decline in technology stocks. This has created some rare buying opportunities for investors looking to add or expand exposure to the sector, writes Vikram Barhat. Meanwhile, Emma takes a look at Magellan's hotly-anticipated retirement income fund FuturePay.

This week's White Paper is from Epoch Investment Partners (an affiliate of our sponsor, GSFM) and it looks at the famous Moore's Law and implications for technology and computing and the growth in semiconductor revenues.

And finally, Comment of the Week comes from publisher and journalist, Greg Bright, having a good snoop around our dogfooding article.

Graham Hand, Managing Editor

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website