The Weekend Edition includes a market update plus Morningstar adds links to two of its most popular stock pick articles from the week. You can check all previous editions of the newsletter here.

Weekend market update

From AAP Netdesk: Investors returned to weekly gains on the ASX but the local market was flat on Friday and investors thumbed their noses at a few earnings reports in the last full week of the 2021 season. Wesfarmers revealed shareholders could receive $2 billion under a proposed return of capital but still could not please investors. There were only moderate moves in the biggest share categories prior to US Federal Reserve chair Jerome Powell speaking on Saturday. The benchmark S&P/ASX200 index closed at 7,488. Shares in industrials were the best improvers in the last session of the week, followed by utilities and healthcare. Consumer discretionaries and technology stocks fared worst. For the week, local shares were up 0.4%.

From Shane Oliver, AMP Capital: Global share markets rebounded over the last week with US shares making a new record high helped by Fed Chair Powell signalling that progress towards the Fed tapering its bond buying would likely remain gradual. For the week US shares rose 1.5% (S&P500 up 0.9% on Friday with NASDAQ up 1.2%), Eurozone shares gained 1%, Japanese shares rose 2.3% and Chinese shares rose 1.2%. Consistent with the risk on tone, bond yields rose, as did oil, metal and iron ore prices. The $A rose as the $US slipped.

Share markets remain vulnerable to a short-term correction as coronavirus remains a threat, Fed tapering gradually approaches, supply constraints impact growth and as the next six weeks is often seasonally weak for shares. However, the combination of a likely continuation of the economic recovery beyond any near term interruptions, vaccines ultimately allowing a more sustained reopening and still low interest rates with tight monetary policy being a long way off augurs well for shares over the next 12 months.

***

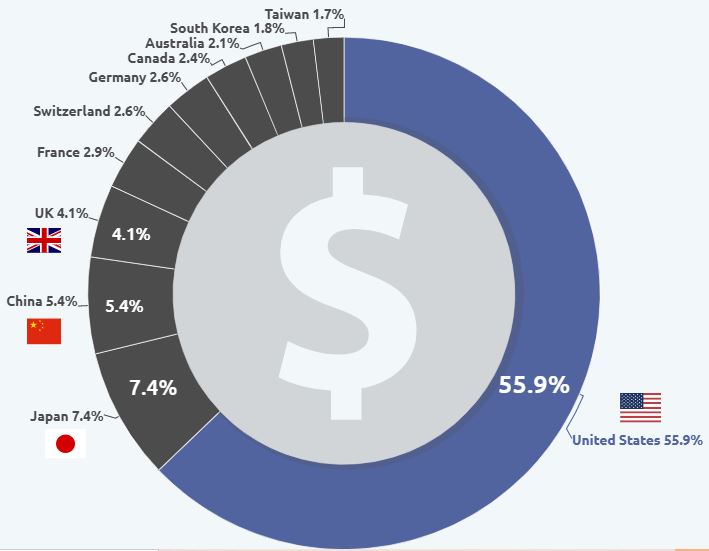

We recently published an article with six stock picks which were all foreign companies, and some people complained that they only wanted to read about Australian companies. Come on, folks. That's like the old days of living in Australia on meat and three veg. The world offers far more variety and opportunity, with a greater range of excellent companies than Australia can ever offer. No investor should ignore the amazing opportunities in the US alone (although it is the home of hot dogs and bad coffee) a country that makes up over half of global stock markets. Australia is a tiny 2.1%.

Sizes of world stock markets by country in 2021

Source: Elroy Dimson, Paul Marsh and Mike Staunton, Global Investment Returns Yearbook, Credit Suisse, 2021, copyrighted. Used with permission.

The move by BHP to list all its shares in Australia creates further concentration risk in the local index. Morgan Stanley estimates that BHP's index weight in the S&P/ASX200 will rise from 7.2% to 11.7%, becoming Australia’s largest company. Financials are weighted at about 28% of the index and materials would rise to about 24%.

That's over half the index in two sectors, one heavily leveraged to housing and the other to China. In contrast, US companies such as Microsoft, Apple, Amazon, Google and Facebook are among the best businesses the world has ever seen. Global footprints, billions of passionate customers, fantastic technology. Plus leading payment companies such as Mastercard and Visa, innovators such as Tesla and Netflix, consumer brands such as Starbucks, Proctor & Gable, McDonalds, Gillette ... the list goes on, and all well-known to Australian investors.

Check these leading US technology industries with their weighting in the Morningstar US Tech Index, and their returns this calendar year. Some Australian techs are impressive but they are relative minnows.

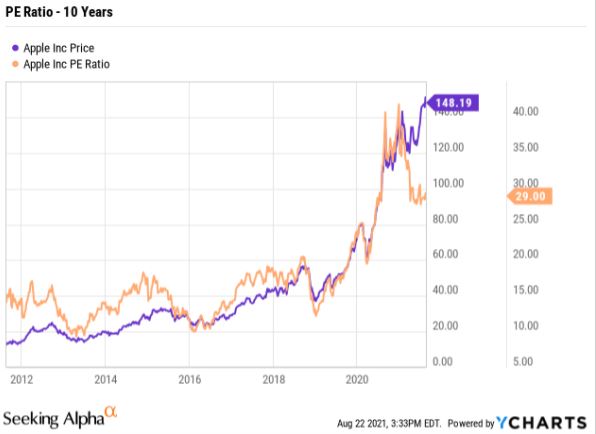

In the case of the largest company in the world, Apple, it's fascinating to see what drove recent price gains. As Stone Fox Capital noted (refer to the chart below to see Apple's P/E expansion versus its share price):

"A lot of the stock price gains in the last few years are attributed to expanding P/E multiples. One only has to go back to 2016 for when Apple only traded at 10x trailing earnings. The stock now trades at nearly 30x trailing earnings, or nearly 3x the multiple from just five years ago. If Apple only traded at 15x trailing earnings, the stock would trade closer to $75, not $150. For this reason, the stock has struggled to break above $150 for a while now ... Investors should easily understand that any growth after reporting a year with 33% growth is impressive, but some post-covid slowdowns shouldn't be surprising."

So Australia has its banks, miners, supermarkets and those franked dividends we all love, but it's long past the time to get over the home country bias. It is now relatively simple to gain exposure to global stocks, such as via managed funds, ETFs, LICs, TraCRs listed by Chi-X in dozens of leading names or via foreign trading accounts with brokers. There are no excuses for a lack of diversification into global names.

Australia loves the 'we punch above our weight' image, but we are not even in the Top 10 stock exchanges with our market cap of less than US$2 trillion. The Top 10 are worth a combined US$91 trillion, up from US$78 trillion in only six months. Courtesy of Finbold, here are the largest exchanges and recent growth:

While the index has its issues, the local market offers plenty of choice for bottom-up stock pickers, and Anthony Aboud describes five stocks which have delivered well for his portfolios in the last year.

And in recognition of the value placed on franking credits by many of our readers and renewed attention as part of the retirement income debate, Jon Kalkman gives a clear explanation of why the current franking system is fair. Critics are missing a major point.

Among the increasing number of people trading directly in the market, many are using the new broking platforms which seem to offer cheap fees with decent functionality. However, like Robinhood in the US, they may be covering their expenses in different ways, and Travis Clark explains what to look for. Maybe saving a few dollars on brokerage comes with other costs.

Emerging markets seem to offer strong growth potential with high commodity prices and cheap exchange rates after more than a decade of relative underperformance versus developed nation stocks. Many leading firms such as Goldman Sachs, Bank of America and Lazard have issued bullish predictions as vaccine rollouts build. James Johnstone explains the opportunities, although stock selection matters as China's regulatory push hangs as a cloud over Asia generally.

One of the great success stories of the last year is thematic ETFs, allowing investors to back a theme, commodity, sector or trend. Kongkon Gogoi and Zunjar Sanzgiri take a deep dive into what these ETFs offer and how they sit in most portfolios.

The Sponsor White Paper this week from BetaShares takes this a step further by exploring its range of thematic ETFs and how they may meet particular investment needs.

And since we still love our residential properties ...

For all the attention we give to equities and stocks, for most Australians, nothing beats their love of residential property and all the more so as prices go gangbusters. But much like the ACT did a few years ago, NSW is planning a major overhaul of up front stamp duties in favour of an annual property tax. How will it work and why is the NSW Government picking favourites?

Then Julie Steed explains how some people can access funds under the First Home Super Saver scheme, which is growing in usage since the increase in the maximum to $100,000 a couple. All governments continue to look for ways to help first home buyers into the market.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

As discussed above, Australian index investors may become even more exposed to resources sector-concentration risk, writes Nicki Bourlioufas. And as investors pile into clean energy stocks, Lewis Jackson has cut through the hype to find four names that give exposure to this growing trend.

This week's Comment of the Week comes from Steve on our article with three great tables on long-term investing, which has received over 11,000 views and many requests from financial advisers to republish. Steve asks a legitimate question for retirees facing drawdown and not only accumulation:

"How does the argument hold up (re number of years with no capital losses) if we assume dividends are spent to fund retirement and not reinvested? Further, what is the impact on capital if a fixed level of money is taken each year (say 4% or 5%). This might start to approach a real world post-retirement situation.

Anyone can grow assets if they never spend anything, but that only covers the accumulation phase. What about the retirement phase?"

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Monthly Report from Morningstar

LIC / LIT Monthly Report from Risk Return Metrics

LIC Quarterly Report from Bell Potter

Monthly Funds Report from Chi-X

Plus updates and announcements on the Sponsor Noticeboard on our website