The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

In the fast media world of quick grabs and clickbait headlines, it takes quality interviewing and a great subject to hold a listener's attention for 4 1/2 hours. While I was on a long drive over the weekend, I listened to The Jolly Swagman's podcast with Ken Henry, Secretary of the Treasury from 2001 to 2011 and later NAB Chairman, and the senior policy adviser who helped Australia to avoid recession during the GFC in 2008. To the credit of host Joe Walker, he allows Henry (a former university colleague of mine) considerable freedom to talk about economic policy, politicians and a wide range of other subjects and it's well worth the time commitment.

Among many highlights, at about the 2'15" mark, Henry talks about the heavy responsibility for raising interest rates before the 1991 recession (when Treasury and the Keating Government were active in interest rate policy), after which it was reported that 50% of men above the age of 45 who lost their jobs never worked again. Henry says:

"Yeah, it’s brutal. It is brutal. And yeah, that’s haunted me for a very long time and it was certainly playing on my mind during 2008. You know, actually, my father is now deceased, and actually died 18 years ago, but in that period, in the late 1980s, as we were having these discussions in the office, I did say to him, ‘Look, this economy is just going nuts’. And it was I mean, were just having this extraordinary boom in the late 1980s. Inflation was one consequence of it, but it was only one consequence of it. The place was going absolutely nuts. And I said, ‘Maybe it is the case that the only thing that’s going to stop this is a recession. Maybe that’s unavoidable.’ And he said to me, and it stuck with me, particularly in the months that followed, he said, ‘Nothing excuses a recession. You can’t allow yourself to think like that.’ (my bolding)

My father had that sense and had obviously seen it of colleagues of his who had lost their jobs and it just destroyed their lives. Destroyed it. That was it. They lost the capacity, not just the opportunity to find another job, but they lost the functional capacity to go and look for another job. They’d just been so devastated by the experience. I mean, I don’t know if it’s like many of those who went to war and were not functional when they returned from war, but it’s something like that. I think, the trauma that people suffer and there are just so many elements of loss, aren’t there? Loss of respect or self-respect and certainly loss of pride in what they’re doing for their families and so on, you know, truly devastating."

Ken Henry is still haunted by decisions made in 1991 and Reserve Bank Governor Philip Lowe now faces the same anguish. He wants to preserve the employment gains made in recent years, but by raising rates to control inflation, he may bring on a recession and job losses, and hence his much-referenced 'narrow path'. Lowe is an honest and honourable person and he is aware of the pain some of his decisions are causing and it will become worse.

There's another lesson in the Henry podcast. He also talks about the different obligations and roles of politicians versus policy and economic advisers. Lowe risks straying too much beyond his remit on monetary policy into the realm of political story-telling.

Consider Lowe's recent advice to struggling young borrowers facing rapidly-rising interest rates and million dollar mortgages. It might not feel like it but the Baby Boomer Governor genuinely believes he is saving borrowers from a worse fate by raising rates for the 12th time in a little over a year. But in moving beyond economic commentary, he is not bringing people with him using what Ken Henry describes as the great political skill of Paul Keating to tell stories. Keating's ability was unique, such as convincing voters of the dangers of debts and deficits. For example, Lowe has given at least five pieces of advice for renters or borrowers on finding some extra cash:

1. Don't move out of the family home

2. Don't have a home office

3. Rent out a spare room

"The way that this ends up fixing itself, unfortunately, is through higher housing prices and higher rents. Because as rents go up people decide not to move out of home, or you don't have that home office, you get a flatmate."

4. Spend less on other things

“People are having to cut back with spending, and I think that’s going to be the environment we’re operating in for a while.”

5. Find additional work

“If people can cut back spending, or in some cases find additional hours of work, that would put them back into a positive cash flow position.’’

While Philip Lowe has every right as the Governor to guide interest decisions and explain them, he is doing himself few favours making obvious and gratuitous suggestions to younger generations.

The past month is evidence that central banks should remain independent of government, as politicians make decisions based on popularity rather than economic merit. Regardless of Lowe's past mistakes, he comes at his role from a place of his best judgement, but in buying into these lodger/get a job/spend less solutions, he opens the door for the politicians to attack on non-economic grounds.

In large companies, if the Chief Executive is straying into areas which do not help the company, it's the Chair's role to have a word and limit the scope to the company's core competencies. The recent Review of the Reserve Bank showed the Governor dominates discussion and decisions, and it's unlikely anyone on the Board will suggest he should limit his comments to monetary policy.

When the Prime Minister, Anthony Albanese, speaking at the Sky News-The Australian Economic Outlook Conference, was asked why the recent Budget assumed a cash rate of 3.85% for the next year when it was already at 4.1%, he could not resist joining the pile on.

“That’s not the only prediction on interest rates that have not been correct ... It’s not as incorrect as the one saying there’d be no increases until 2024. So these things are all relative ... Interest rates were never going to stay at 0.1, that was never going to happen.”

Treasurer Jim Chalmers was similar after the latest cash rate rise, saying:

"I do expect there will be a lot of Australians who find this decision difficult to understand and difficult to cop. Ordinary working Australians are already bearing the brunt of these interest rate rises, they shouldn't bear the blame, too."

"Ordinary working Australians". Not the most dignified sentence ever uttered by a Treasurer, and the Government passing the 'blame' to Lowe is obvious.

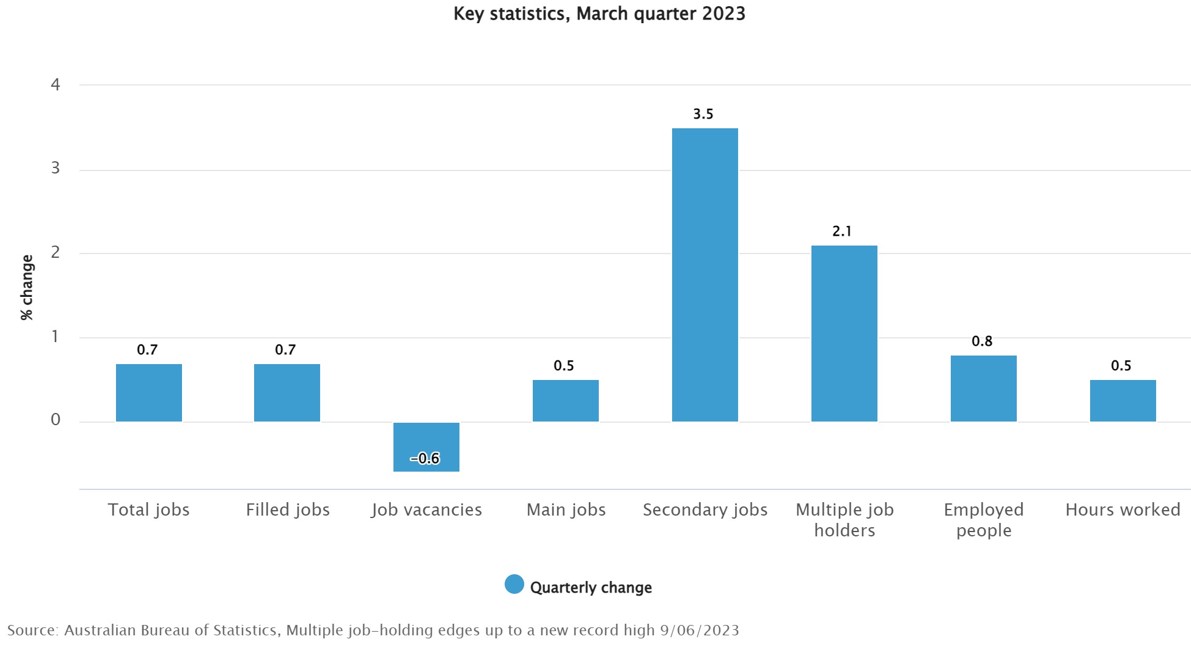

While the full impact of rising rates has yet to hit many borrowers, the take up of secondary and multiple jobs is a significant data point already in the Australian Bureau of Statistics data.

The ABS shows almost one million of the country's 14.2 million employees had multiple jobs as at 31 March 2023, an increase of 90,000 over 12 months. This ratio of almost 7% of workers holding multiple jobs is the highest on record.

***

Out of curiosity, I wondered what a second job might look like these days, beyond the gig economy, so I looked through the situations vacant section of the newspaper (yes, I still read printed newspapers). I came across this advertisement for a Deputy Principal at a high school (obviously, not a second job). If anyone in financial markets thinks they have a tough job, consider what it would be like to face this every working day:

"You are hardly through the door when news of today’s dearth of casual staff hits your desk. The 5am sports trip to Newcastle calls in to say that the highway is closed and they will miss their game and are turning back. You have two upset parents waiting in reception and no one’s turned up to put the desks up for exams. Some early students have kicked a ball through the library window. You’ve got a presentation on future directions to finish for the Board meeting that afternoon and a difficult conversation to have with a member of staff before their next class. It’s 7:45 am.

If this sounds like the start of a day that you could handle and still be smiling at the end of the day, read on!"

I would roll over and go back to sleep. As if that wasn't tough enough, the job required:

"When making your application you will upload your cover letter, resume and supporting documents, complete the application screening questions and record a short video."

Is that now a thing, a video on what 'value add' you can bring?

And then into my Twitter feed came an interview with the wonderful actor, Richard Burton, whose mother died giving birth to her 13th child when Richard was only two-years-old, and he was raised by his elder sister. This really will sound like Baby Boomer advice, but this long extract shows the shit jobs some people will do.

"As a matter of fact, I've always had this happy knack of acquiring money, even during the bad days of the depression. I would sometimes earn as much as the minimum wage of a miner while I was at school. It meant a very full day, of course. I would get up when the miners went to work, or rather when they got up before they went to work, which would be half past 4 or 5 in the morning. I still do get up at that time. And I would go up to the mountains with a – I remember I had a green sweater especially for the occasion. I'd go up to the mountains with a sack and a shovel and fill up the sack with the horse manure and cow manure and take it back home. Then I would have to take a bath, of course, a cold bath – we didn't have any heat – because I was stinking and put this dreaded green sweater away.

And then, I would go and wait for the express from London and wait for the daily newspapers to arrive. And then, I delivered the newspapers. Then I would have breakfast. Then I would walk to school, the grammar school. And then, I had an arrangement with the fish and chip shop, and with my customers who had the newspapers, I would sell the dung for 6 pence a bucket to the various allotments. People had allotments where they had their own gardens. I got 6 pence a bucket for the dung, and I was paid 1 shilling a week for delivering the newspapers. And then, I would re-collect some, not all, but a great many of the newspapers which I delivered during the week, and deliver them to a fish and chip shop. And on Saturday morning, I would eye the potatoes (in a fish and chip shop). And on a good week with tips from my customers and so on, I could earn as much as 30 or 35 shillings, which was the miner's minimum wage at that time. And so, I always had a happy genius for getting money."

If it's good enough for Richard Burton, CBE, twice husband of Elizabeth Taylor, winner of many acting awards and seven Academy Award nominations, it should be good enough for a struggling mortgagee.

But Phil, let's not hear about collecting bottles for recycling, selling possessions on Gumtree or catching public transport rather than driving a second car. Struggling homeowners will do almost anything to hang on to their castles and the status of the Reserve Bank is not helped by unwanted homilies.

***

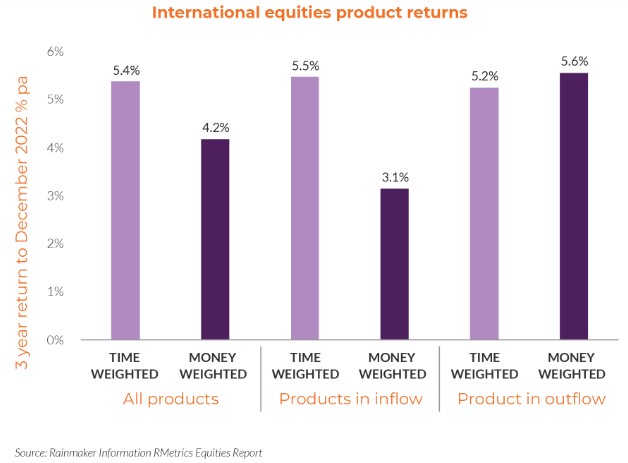

We have often seen research in overseas markets, usually in the US, which shows that investors perform worse than the indexes or funds in which they invest. The reason is that fund performance is quoted in 'time-weighted' terms, where the impact of cash flow timing is ignored. The alternative measure is 'money weighted', where the timing of actual flows into the fund are calculated, reflecting when investors invest and withdraw. The money-weighted results are poor as investors buy high and sell low.

Rainmaker's comparison of global equity funds offered in Australia produces a more revealing result, that it is better to invest in unpopular funds. Overall, the money-weighted performance achieved by investors is materially worse than the time weighted but products in inflow do worse than the products in outflow. Rainmaker's John Dyall, Head of Investment Research, explains:

"Investors often think that a fund in net outflows is a red flag, indicating that other investors are bailing out and that they should follow them. But this may not always be the case. In fact, investing in managed investment products that are in net outflows may be a smart investment strategy, or at least smarter than chasing returns in the popular funds. This means that people invested in these funds after the good times were over."

Rainmaker explains that investors often jump on board following strong performance “just when the party is starting to end". Investors and advisers should realise investing is not a popularity contest.

***

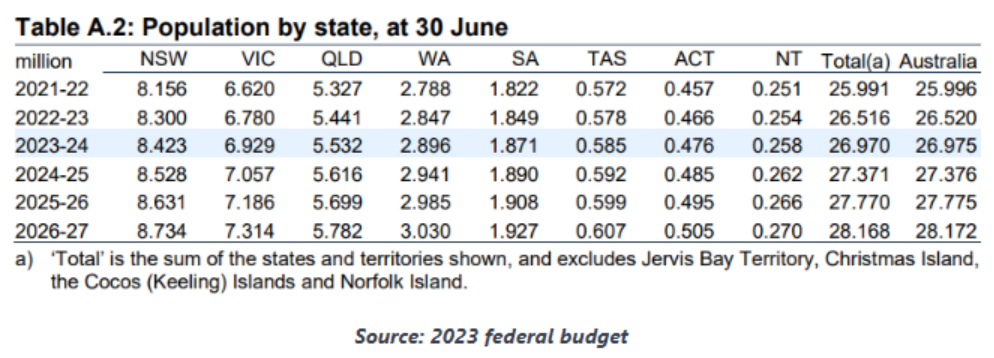

The desperate shortage of residential properties shows no sign of easing as Australia is forecast to take in 1.75 million net migrants in the next five years, amid a population explosion. We take a closer look at the arguments that the capital gains tax discount afforded to investors in property should be abolished or reduced as there are many different arguments. The home shortage is not going away any time soon, with the 2023 Federal Budget forecasting an increase in population from around 26 million to 28.2 million by 2027.

And returning to the subject of podcasts, following many requests, we start Season 2 of the Wealth of Experience podcast, this time with James Gruber, myself and Peter Warnes, Morningstar's Head of Equity Research. In my section, while we know the new $3 million superannuation tax is based on the increase in the Total Superannuation Balance over the course of the financial year, I explain a part of the calculation that many people are overlooking. We also discuss strategies that now come into play as alternatives to large super balances. Meanwhile, Peter talks through the headwinds for Aussie large caps, as well as the energy transition and its investment opportunities.

Graham Hand

Also in this week's edition ...

At Firstlinks, we like investment topics that aren't just designed for this moment in time, but will endure through time. In that spirit, James Gruber outlines 23 lessons on money and investing, including that if you're excited about an investment it's probably a bad idea, get rich quick and get poor quick are two sides of the same coin, forecasting is for the weather, and never reach for yield.

Meg Heffron is back with her monthly article, this time to discuss the claiming of tax deductions for personal super contributions. She says it's a great strategy that should be considered before the end of the financial year. Yet Meg suggests there are potential traps that people need to be aware of.

A reader requested an article on investing in the energy transition, and Magellan's David Costello believes it is the greatest investment opportunity of our lifetimes. He offers a framework to take advantage and includes stock picks that will benefit.

Shane Woldendorp of Orbis says that if history is any guide, the best of times for investors tends to be followed by the worst of times. Given the post-GFC era was an amazing period for global equities, the next decade could prove much more challenging. Shane says valuation spreads between growth and value stocks are reaching extreme levels, and value could be set for long-term outperformance, even if markets cave.

The long-term retirement system allows super funds to buy illiquid assets, yet this component must be prudently managed. Measuring liquidity is complex but how do our five major funds compare and are their levels safe? Morningstar's Annika Bradley investigates.

Australian small caps have consistently underperformed large caps and the question is: why? Van Eck's Cameron McCormack says structural issues are to blame, including market size, exchange listing requirements and sector exposure. Global small caps don't have the same issues and have traditionally outperformed mid and large caps.

You'd think that with markets nearing all-time highs, investors would be 'all in' for this bull market. Yet new data from Dan Jowett at Openmarkets Group suggests Aussie retail investors remain remarkably defensive. In fact, they're more defensively positioned than at the height of the Covid crisis, crowding primarily into domestic large cap companies.

Two extra articles from Morningstar for the weekend. Joshua Peach looks at three ASX stocks that have an edge over the competition, while Megan Neil reports on opportunities in office REITs as asset values fall.

Australian financial regulators and most investors hold a sanguine outlook for local banks. In this week's whitepaper, Antipodes looks at why Australian bank shareholders are vulnerable.

***

Weekend market update

On Friday in the US, stocks reversed early gains, leaving the S&P 500 by one-third of a percent, while Treasurys also lost ground with tow-year yields settling at 4.7% versus 4.62% the day prior. WTI crude rallied to near US$72 a barrel, gold finished little changed at US$1,969 an ounce, and the VIX retreated back below 14.

From AAP Netdesk:

The local share market's winning streak continued for a fifth straight day on Friday. The benchmark S&P/ASX200 index closed near the high of the day on Friday, up 75.9 points, or 1.06%, to a three-and-a-half week high of 7,251.2. The broader All Ordinaries gained 81.2 points, or 1.1%, to 7,451.2. The market rose 1.8% over the holiday-shortened week, snapping its three week losing streak.

Every sector of the ASX rose on Friday except health care, with energy the biggest gainer, climbing 3.5% on strong gains for coalminers.

Whitehaven climbed 8.3% to a six-week high of $6.94, New Hope added 3.4% to $5.73, and Yancoal gained 3.6% to $4.67.

Also, oil and gas giant Woodside climbed 3.5% to $35.63, and Santos climbed 4.1% to $7.60 as Brent crude rebounded to a one-week high.

In the utility sector, AGL soared 9.7% to a two-year high of $10.60 after Australia's largest electricity generator predicted its profit for 2023/24 would more than double to between $580 million and $780 million as price hikes take effect.

The heavyweight mining sector was up 1% with BHP finishing 0.4% higher at $46.42, Rio Tinto adding 0.2% to $118, and Fortescue edging 0.1% to $22.51.

Goldminers fared better, with Newcrest climbing 1.7% and Northern Star gaining 3.8% as gold prices rebounded from Thursday's sharp dip.

Lithium miner Liontown Resources added 8.3% to an all-time high of $3.15 while Pilbara added 4.9% to $4.89.

Jervois Global soared 25% to a two week high of 9c after the US Department of Defence agreed to fund US$15 million (A$21.8m) in drilling at Jervois' cobalt mine in Idaho, part of a US government initiative to secure a supply chain of the critical miner.

In tech, logistics platform Wisetech Global had also hit an all-time high, climbing 1.2% to $80.08.

Kiwi cloud accounting company Xero was up 2.6% to a one-and-a-half year high of $116.72.

The Big Four banks all finished higher, with CBA up 1.4% to $99.35, Westpac advancing 1.5% to $20.91, ANZ adding 0.7% to $23.28 and NAB climbing 0.8% to $25.85.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website