The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

There is almost universal acceptance of the need to define an objective of superannuation, and after a decade of delays, it is finally happening. The 2014 Financial System Inquiry (FSI) kicked off the process and the Government is again seeking comments on the draft legislation for the Superannuation (Objective) Bill 2023. However, there is a sting in the tail, especially for large balances.

The FSI's original wording was simple:

“to provide income in retirement to substitute or supplement the age pension“

Then the 2020 Retirement Income Review went further, suggesting:

“to deliver adequate standards of living in retirement in an equitable, sustainable and cohesive way“

This introduced greater aspiration and guidance, not only focusing on the income of the retiree, but that the system as a whole should be 'equitable, sustainable and cohesive'.

The 2023 version continues this expansion, with several critical components open to interpretation.

The words will mean different things to different people. 'Dignified' and 'equitable' should not be equated to everyone receiving the same. The role of superannuation is a deliver some smoothing to lifetime consumption, removing income from early years and adding it later. It should be replacement income for retirement years, and each person will have their own replacement rate to maintain their living standards. The more someone earns and saves in their working life, the more they will have in retirement. Equitable is not equal.

What is clear is that the Government intends the objective to guide future policies.

"The draft legislation ensures that future changes to the superannuation system are compatible with its objective by requiring policy-makers to assess proposed changes to super legislation for compatibility with the objective."

The industry is hoping that this somehow means the objective will provide stability and confidence in the superannuation system, which is often criticised for its continuous changes. In fact, the objective opens doors for further amendments.

If future superannuation policies are framed by what the government of the day considers equitable and sustainable, then any treasurer can judge that a concession is no longer appropriate due to budget demands. This is recognised, for example, in AustralianSuper's submission in February 2023:

"The proposal will increase equity in rebalancing superannuation tax concessions toward low and middle income earners. At high balance levels, it becomes appropriate to compare the tax status of superannuation accounts with the tax payable by individuals who use other investment vehicles."

The super fund also says that the (February) discussion paper notes that an equitable superannuation system "targets support to those most in need".

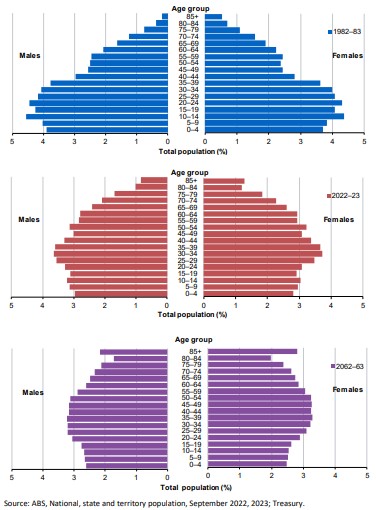

'Sustainable' will be challenged by the needs of an ageing population and increasing demands on health, pensions and super concessions. This chart from the Intergenerational Report shows the dramatic changes in the ages of Australians, from a country with a bulge up to the age of 34 in 1983. Many of those people are now in their 60s and 70s and the bulge moves up the age groups over the years, with a significant new top of people over 85 expected in coming decades.

Australian age structures in 1983, now and 2063 (e)

Far from giving the superannuation system the stability and certainty that everyone seems to assume will follow from the objective, it opens the way for further measures such as the additional tax on balances over $3 million.

Retirees with large superannuation balances should not be sanguine about the objective, and large balances may drift away from the super system. Advisers report many clients are already planning for the $3 million cap, especially due to the inclusion of unrealised capital gains. Maybe that's what the Government wants.

One person who is not as enamoured with the objective of superannuation as drafted is Emma Higgs, a Senior Associate with law firm Mills Oakley. Emma asks valid questions about what the objective is supposed to achieve.

The Government and its advisers need to recognise that this focus on superannuation for retirement income fails to adequately consider savings outside super and the role of the family home. There is a looming threat to millions of future retirees who will become caught in the rental market. The Grattan Institute estimates the proportion of people over the age of 65 who are homeowners will fall from 76% now to 57% by 2056, and housing policy is as important as superannuation in retirement.

My article this week drills into many of the reports and reviews issued by the Government in the last month to show when and why people retire, and how they invest in retirement.

If future policy will be guided by the need to preserve savings, how does this sit with recent improvements in the First Home Super Saver (FHSS) Scheme, which allows access to voluntary super contributions up to $50,000 to buy a first home? And how will it influence this suggestion? ...

Superannuation and the Voice

I have no intention of giving a personal opinion here on the referendum on the creation of an Indigenous Voice to Parliament so I simply quote this exchange on possible implications for superannuation. ABC Podcasts is running a series called 'The Voice Referendum Explained' with presenters Fran Kelly and Carly Williams. In the first full episode on 23 August 2023, there is this exchange with Tony McAvoy SC who specialises in native title claims and is a strong supporter of the Yes vote.

Carly Williams: But people still want to know, how would this Voice work and what kinds of issues would it be advising on?

Fran Kelly: That's right, Carly, I still want to know that. Tony McAvoy is firmly in the Yes camp but he's also Australia's first Indigenous Senior Counsel and an experienced barrister and he was on the Referendum Working Group so I thought he'd be a good person to ask about the kinds of things the Voice could advise on.

Tony McAvoy: One of the ones that I like to point people to is the superannuation legislation and the fact that it has been known for a long time that Aboriginal people do not have the life expectancy of the rest of the community. And I know personally know many people, including people in my own family, who have died before they've been able to retire and so it's a common thing in the Aboriginal community that people work all their lives and never get to retire.

And we should have in this country a conversation about whether superannuation legislation should be amended to allow us to access our superannuation earlier. The Voice cannot tell the government what to do. I cannot tell the government that must do this, but I can say let's have this discussion, and you make the decision.

Fran Kelly: That was so interesting to me, Carly. I've never thought about the shorter life expectancy of Indigenous Australians in terms of are they living long enough to enjoy their superannuation, for instance? That's a pretty straight up and down equity issue right there, isn't it? But unless it's pointed out to policymakers, it just might not occur to anyone.

Carly Williams: Absolutely. So that's the sort of thing the Voice could look at.

My only comment is to note that a leading Indigenous Barrister and Senior Counsel, when asked to identify a subject that the Voice might advise on, chooses early access to superannuation.

***

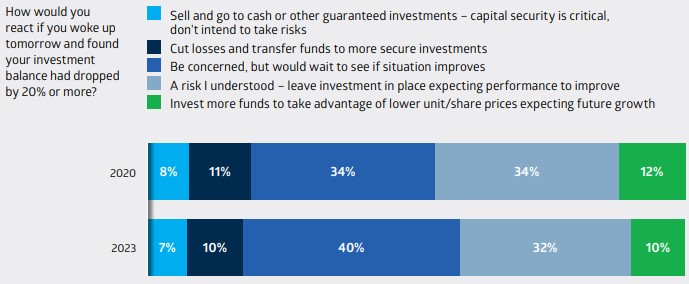

Each year, the ASX carries out an Australian Investor Study, and the 2023 Report includes an intriguing finding. The stockmarket falls by 20% or more at some stage in about one-third of years, and that is the price of access to long-term gains. It is therefore reassuring that the majority if investors, probably over 80%, expect to hang on for the long run in the face of a 20% fall. The challenge is whether this reflects actual not anticipated behaviour, especially with 40% adopting a 'wait-and-see' approach.

***

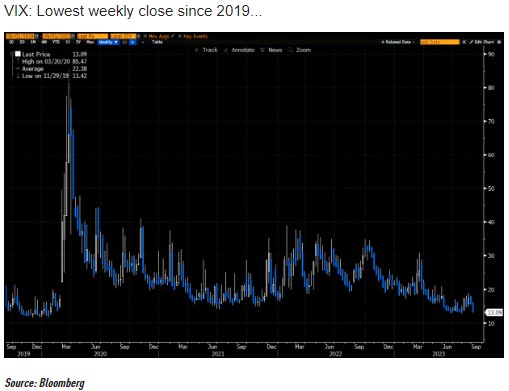

Two charts from the US show how relaxed investors are at the moment, despite rapid rises in rates and signs of more to come, and plenty of recession voices still issuing warnings. The so-called 'fear index', the VIX, is currently at its lowest level for many years.

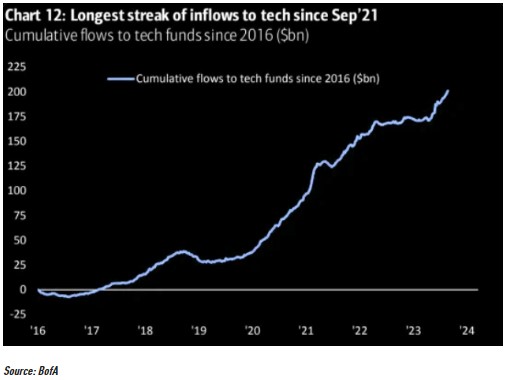

And despite the rapid rise in the price of tech stocks, funds that offer tech exposure continue to receive strong investor flows, with the longest run of monthly net inflows since the heady days of liquidity-inspired and low rates in 2021. Yes, this is chasing recent winners, and US$200 billion into tech funds has done its fair share in pushing the market up further.

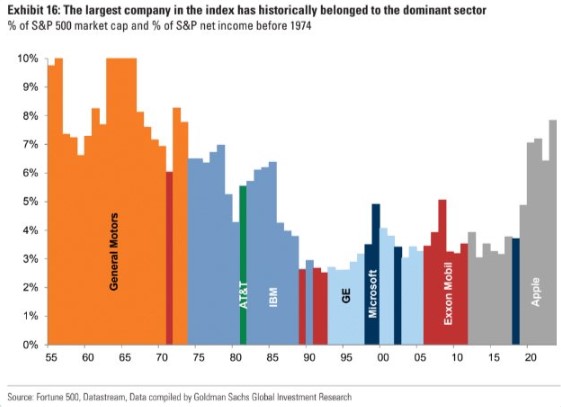

It will not always be thus. This chart of the largest company in the S&P500 and its percentage share of the index shows how the sector determines the dominant company, and how it changes over time.

Graham Hand

Also this week ...

It's the dream of many investors is to be able to live off the dividend income from their shares. Investment author and speaker, Peter Thornhill, offers a way to be able to achieve that, though it requires staying invested through down markets - something that's easier said than done.

It's a theme that Ophir Asset Management's Andrew Mitchell elaborates on in this week's Wealth of Experience podcast. Ophir is celebrating the 10-year anniversary of its Opportunities Fund and Andrew says a key lesson is that staying the course and not trying to time markets bring rich rewards. Also in the podcast, Graham Hand speaks about possible targets to address intergenerational inequity, and Peter Warnes gives a reporting season wrap.

AMP's Shane Oliver bemoans the pervasive negativity that surrounds investment commentary nowadays. He investigates why pessimism has such an allure and how investors need to resist it to be successful in markets.

It's no secret that large caps have trounced small caps over the past decade. H&G's Joseph Constable says passive investing has played a part, with surging investment flows into large caps regardless of price or value. He says it's only a matter of time before that turns around and small caps bounce back.

The Federal Government's Intergenerational Report says Australia is rapidly ageing and we need to be worried about what changes that may bring. Mercer's David Knox disagrees and believes the report used an outdated method to calculate our ageing population. Using a more realistic approach, he suggests that we have less to be concerned about, albeit reform is still needed.

Two extra articles from Morningstar for the weekend. Angus Hewitt doesn't see value in Qantas despite a sharp dip in the share price in recent weeks, while Christine St Anne names four ASX stocks to defend against inflation.

Lastly, in this week's White Paper, Pinnacle affiliate, Firetrail, is also bullish on ASX small caps, and singles out some stocks that it likes.

***

Weekend market update

On Friday in the US, stocks ended marginally higher as investors shifted their attention to next week’s consumer price index report. Apple steadied after a two-day sell-off. The Dow was up 0.2%, while the S&P 500 and Nasdaq edged up 0.1%. The yield on the US 10-year note was 2 basis point higher to 4.26%. Gold was flat, while brent crude oil rose 0.5% to US$87.31.

From AAP Netdesk:

The local share market on Friday suffered its fourth straight day of losses, although they moderated in the late afternoon. After spending much of the day about 0.5 per cent down, the S&P/ASX200 rebounded in the final hour of trading on Friday. The benchmark index finished 14.3 points lower at 7,156.7, a drop of 0.2% on the day and 1.67% for the week. The broader All Ordinaries on Friday closed 16.8 points lower at 7,358.1, a 0.23% fall.

Six of the ASX's 11 sectors finished in the red on Friday, with mining the biggest loser for a second day, down 1%.

BHP fell 1.2% to $43.19, Fortescue Metals dropped 2.4% to $19.40 and Rio Tinto retreated 1.7% to $111.17. Gold miners advanced as the price of the precious metal rebounded, with Newcrest and Evolution both rising 0.6%.

Three of the Big Four banks all finished 0.2% higher - Westpac, ANZ and NAB, at $21.17, $24.93 and $28.65, respectively. CBA was the outlier, edging 0.1% lower at $100.81.

Telstra dipped 0.3% to $3.93 after the telecommunications company confirmed it was preparing an offer for Melbourne cloud consulting company Versent, although it described as "speculative" the $400 million price tag cited by the Australian Financial Review.

Qantas shares closed at a nearly 11-month low of $5.54, down 0.5% for the day and 4.8% for the week, on top of a 6.7% drop last week. It's been a week from hell for the flag carrier, whose chief executive Alan Joyce sped up his retirement by two months following a spate of bad press including news of proceedings by the competition regulator over tickets sold for cancelled flights.

In tech, Audinate Group fell 9.7% to $12.91 after the audio hardware company completed a $50 million capital raising at $13 per share.

Back in the financial sector, Platinum Asset Management fell 4.4% to $1.31 as the asset manager said it suffered $912 million in outflows last month, leaving it with $16.7 billion in assets under management at month-end.

Looking forward, the domestic focus next week will turn to the jobs report for August, which will be released on Thursday.

From Shane Oliver, AMP:

- After a couple of weeks of gains, global share markets fell again over the last week on renewed concerns about more central bank rate hikes, higher oil prices as Saudi Arabia and Russia extended production cuts, a rebound in bond yields and concerns about China’s economy and its plans to extend its iPhone ban. For the week, US shares fell 1.1%, Eurozone shares dropped 1.2%, Japanese shares declined 0.3% and Chinese shares fared worse decreasing 1.4%. Following the weak global lead and given worries about China, Australian shares fell 1.7% for the week led by materials, IT, utility and telco shares. Bond yields rose as expectations for further central bank rate hikes rose. Oil prices were up on the continuing production cuts and falling US inventories, iron ore prices were little changed, and metal prices fell. European gas prices rose 5% on Friday – but note they are still nearly 90% below their high point last year - as workers commenced escalating strike action at Chevron plants in north west Australia which supply 7% of world LNG. The $A fell with the RBA leaving rates on hold and the $US rising again.

- China’s plans to extend its iPhone ban provide a reminder that the threats to free trade – that started to become obvious with President Trump’s trade wars - are continuing to escalate. This poses an immediate threat to Apple (which gets about 20% of its revenue from China) and to the wider US tech industry if the bans are extended further. Of course, bans on Chinese tech companies have also harmed China’s tech industry. Pushing too far down this path could backfire on China economically with job losses as Apple makes most of its iPhones in China, but national security considerations appear to be increasingly trumping economic considerations (and not just in China). The losers will be consumers with a more inflation prone environment. Australia is also at risk to some degree given that China is our biggest export market, although hopefully the adjustment will continue to occur gradually over time as it has since 2017 and Australia’s improving relations with China may help.

- The Australian economy is still growing but it's slowing and getting tougher for households. June quarter GDP data provided mixed messages and something to support most perspectives on the economy. On the one hand, while growth has slowed to 0.4%qoq or 2.1%yoy, it's actually stronger than the RBA was forecasting (1.6%yoy), productivity is continuing to fall putting upwards pressure on unit labour costs (which are up 7.5%yoy), and domestic inflation readings remain firm. All of which will concern the RBA and points to upside risks for interest rates. Against this the evidence of a downturn is continuing to build:

Much of the growth last quarter came from strong population growth of 2.4%yoy, public spending and energy exports, while interest rate sensitive parts of the economy are under pressure.

We are now in a “per capita recession” with GDP per person falling for the second quarter in a row. This explains why people might feel that they are going backwards.

Private demand is weak. Consumer spending rose just 0.1%qoq and discretionary spending fell for the third quarter in a row. This reflects the hit from higher interest payments, rising tax payments, falling small business income and cost of living pressures offsetting strong growth in wage income. It likely has further to go as rate hikes continue to flow through. Particularly with households now eating into their saving buffers with the saving rate falling to its lowest since 2008.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website