The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

A few weeks ago, we published an article called 'Why LICs are closing and more should follow'. The last couple of weeks have seen three important developments for Listed Investment Companies (LICs) or Trust (LITs) as issuers act to remove the unacceptable discounts that are costing investors 20% or more in some cases. In fact, large premiums are almost as bad because investors are paying far more than they should.

First up, Steve Johnson's Forager (ASX:FOR) announced its intention to delist. This is a critical proof point because seven years ago, Forager changed from a closed-end, unlisted fund to a LIT in a surge of optimism for the benefits of listing. Now, Forager is going back despite the tedious legal work:

"It is the Manager’s view that investor apathy towards closed-ended investment vehicles has become entrenched and that smaller, less liquid vehicles like FOR are unlikely to trade at NAV for the foreseeable future. The Manager’s current view is that the magnitude and sustained nature of the discount to NAV now outweighs the portfolio management benefits of remaining a closed-ended fund. The Manager has considered a range of additional measures to further improve the traded market price of FOR units. The Manager currently considers that the solution which will be in the best interests of FOR unitholders is likely to be the orderly transition of FOR back to an open-ended fund."

To his credit, Johnson is risking investor redemptions to remove the discount, although many of his investors have confirmed their intention to stay.

Second and equally critical is Magellan's announcement to move the closed-end Magellan Global Fund (ASX:MGF) to open-ended some time in the first half of 2024. We have also covered this in detail including the agitation by Nick Bolton regarding the option value. Magellan said:

"The Board of Magellan has today determined to consider a conversion of the Closed Class Units into Open Class Units, as this should, if implemented, permanently address the trading discount to NAV per Unit, while providing unitholders with a means to still transact on the securities exchange. Additionally, Magellan intends to continue to execute on the initiatives it has previously outlined that are value accretive and seek to deliver improved outcomes for unitholders.

A conversion raises considerable complexities requiring significant work to address and Magellan will have regard to legal, regulatory and tax matters that require detailed assessment. Any conversion would be subject to a number of conditions, including member and regulatory approvals."

As foreshadowed in our article, the conversion will happen sometime in 2024 but the Board is making no timing commitments, and in the meantime, they need to address the continuing push by Nick Bolton.

Then in a response on Friday, the Board of MGF issued the following announcement to the exchange in response to Bolton wanting a meeting of MGF Unitholders:

"Magellan has considered the validity of the Meeting Request and has concerns that the Meeting Request is invalid and ineffective. Magellan has today filed a summons with the Supreme Court of New South Wales seeking judicial advice and direction pursuant to section 63 of the Trustee Act 1925 (NSW) to the effect that, having regard to the Meeting Request, Magellan would be justified in declining to call and arrange the meeting of MGF Unitholders and treating the Meeting Request as invalid and ineffective ... The Meeting Request received from certain MGF Unitholders is not made in accordance with section 252D of the Act and is made by MGF Unitholders carrying less than 5% of votes that may be cast at a meeting."

Third, Geoff Wilson of Wilson Asset Management, the most outspoken supporter of LICs with his own company championing the structure across eight issues, is marketing a $500 million to $1 billion raise for an open-ended version of WAM Leaders (ASX:WLE). Wilson rang me to explain that to participate with the big players in the large cap space, where supply is offered by brokers in IPOs and share sales, he needs a fund of a few billion, or double his current $1.7 billion in WLE. Wilson in open-ended and not LICs is a sign of the times.

***

The Indigenous Voice vote is off-topic for Firstlinks but there is an important parallel between politicians and investment professionals. Many fund managers think the harder they work, the better their results. There's always another stone to turn over and they pride themselves on their commitment to "working hard" for their investors. In the office early, read emails and screens, check limitless market updates, run the morning meeting, coffee with a CEO, lunch with a client, back to the office to check the market, present a webinar, stay late. Hopefully, somewhere in there, they find time for investing, the real meat and potatoes.

Writing in The Conversation, Michelle Grattan explained that Prime Minister Anthony Albanese looks exhausted after his effort on the Voice:

"These past few weeks have also suggested Albanese will need to manage his energy better if he is to perform well for the long haul. Obviously he wanted to do all he could in the final days of the campaign. But tearing around the country, when it was clear the vote was lost, was excessive and left him looking exhausted. Leaders are stronger and tougher than the rest of us. But they are not superhuman, and they need to pace themselves if they are not to wear out, lose focus, and become frazzled and tetchy."

It does nobody any favours when a leader or a fund manager is exhausted. Contrast most fund managers with Warren Buffett, who runs a company rather than a fund. He said:

“I insist on a lot of time being spent, almost every day, to just sit and think. That is very uncommon in American business. I read and think, so I do more reading and thinking, and make less impulsive decisions than most people in business. I do it because I like this kind of life.”

He claims to read 500 pages a day, a target few if any fund managers could match. He says that knowledge compounds so he spends perhaps 80% of his work time reading. In many work offices, it would look like inactivity.

Next time you speak to a fund manager, don't focus on their views on the economy or interest rates or inflation. These macro meanderings are mainly best guesses. Ask them how they spend their precious time and what they have read in the last week.

***

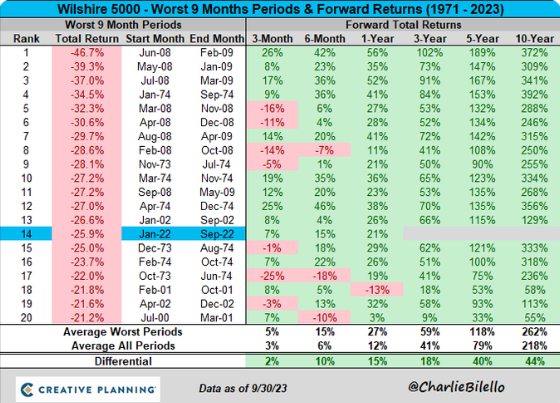

US analyst Charlie Bilello has a reputation for creating fascinating charts like this one. The Wilshire 5000 is an index of all listed stocks actively-traded in the US (not necessarily 5,000 companies) and this table shows the worst 9-month periods for the index between 1971 and 2023, or 52 years. They are all falls of over 21%. Amazingly, only in one of those 20 periods was the subsequent one-year forward return negative, and the average return is 27%, and always strongly positive over subsequent periods. It's an illustration of how the stockmarket can recover from the depths of despair. But it also shows 20 falls over 20% in 52 years, or one every two to three years.

Martin J. Whitman founded Third Avenue and was a well-known portfolio manager and author, and he wrote:

“When securities prices decline, an investor’s perspective can go in one of two directions. The vast majority of investors view a price decline as a loss of value. This has a basis in reality for those who are traders, those whose portfolios are financed with borrowed money, and those who have little or no knowledge about the companies in whose securities they have invested. For value investors, though, price declines frequently mean nothing more than that yields have rallied. The same securities with the same fundamentals, and without any permanent impairments of capital, have become available at far more attractive pricing than was previously available.”

Which is a good segue to my article where I look at the biggest loss in my own SMSF this year. I am not a stock picker so we attach a fuller report from Morningstar Equity Analyst, Alexander Prineas. I write it more as a personal investor, why I bought the stock and why I'm hanging on although it's fallen out of favour. It's a daily dilemma for every fund manager somewhere in their portfolio.

***

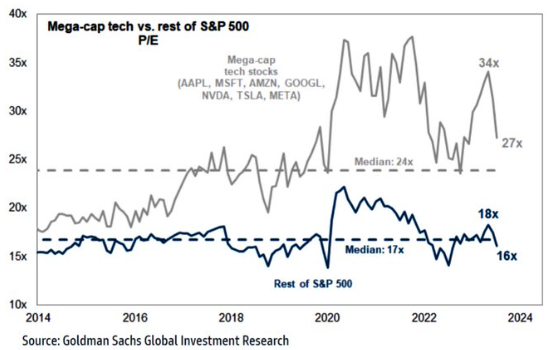

When we focus on the potential future moves in the US S&P500, and the likelihood that returns will be lower in coming years due to high Price to Earnings (P/E) ratios, we need to separate the Magnificent Seven tech stocks trading at a P/E of 27 and the other 493 stocks at a P/E of 16. No wonder the Australian stock market can't keep up with the US market driven by these seven.

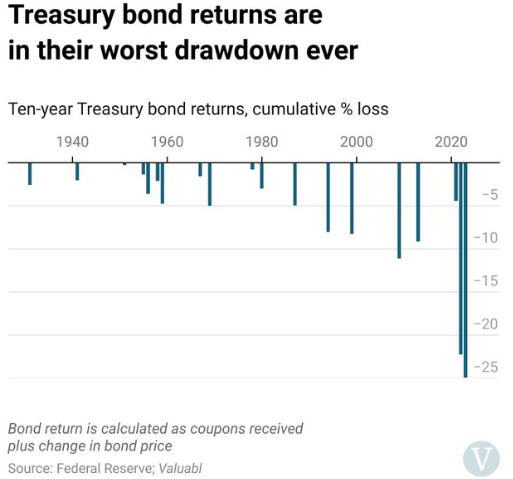

Investing times have changed following a 40-year rally in bond rates until 2020. Nothing shows this more than the losses on the most important bond in the world, the US 10-year bellwether, against which other assets are priced, including the discount rate used in valuing companies. We are investing during the worst drawdowns (losses).

***

Finally, a quick word on crypto as it's back in the headlines as other assets struggle. This is when promoters jump on the future potential, the need to allocate a proportion of a portfolio to crypto, the currency of the future. This week, the Australian Taxation Office (ATO) reminded SMSF trustees of the resources available:

"Investing in crypto can be complex and risky so we recommend trustees seek financial advice before investing and read both MoneySmart and the our SMSF investing in crypto assets page.

You can also check out our short crypto myth busting videos:

SMSFs investing in crypto – reminds you of your regulatory obligations you need to meet when investing in crypto assets

Lost access for my crypto – provides details of how your SMSF may be able to claim a capital loss in situations where you lose your password or your crypto is stolen."

Graham Hand

Also in this week's edition...

Meg Heffron has looked at the draft legislation published earlier this month for ‘Division 296 tax’ and doesn't like what she sees. This is the proposed new tax on members with more than $3 million in super, the 15% tax on part of their super so-called 'earnings' each year. Meg says even the promise to allow these members to carry forward any losses has a few quirks.

APRA is investigating bank hybrid securities to better secure bank capital and the broader financial system, with special emphasis on retail investors holding hybrids. BondAdviser's Charlie Callan and his team examine what could eventuate from the investigation and the implications for current hybrid holders.

At Firstlinks, we have regular articles on how to build wealth for your retirement, yet there's a lot more to retirement than that. Leaving work can lead to a loss of identify if there's a failure to craft a new life and it's a big shock for many retirees. Jon Glass of 64 Plus and previously well known to many readers as the CIO of Media Super offers his tips on how to best prepare for retirement.

Who thought bonds could be sexy again? Investors have been piling into them despite the asset class heading for its third straight down year. Given the yields on offer and the prospects for an economic recession, the lure of bonds is understandable. Van Eck's Cameron McCormack has a primer to help investors decide which bonds may be best for them.

Is a recession on the cards, though? Talaria Capital's Hugh Selby-Smith thinks so. It's unusual for an Australian fund manager to be pessimistic on the market outlook but Hugh details why he's on red-alert and what investors can do.

Morningstar's Peter Warnes is in a similar camp to Hugh as he predicts a protracted global recession starting mid next year, in the latest Wealth of Experience podcast. The podcast also features James Gruber on the investment art of doing nothing and Graham Hand on tax-free super.

Trend-following strategies have been around for some time, though they still don't receive a lot of press. Man Group's Kit Cherry thinks these strategies should be part of an investor's arsenal as they provide diversification benefits and can help protect downside risks to portfolios.

Two extra articles from Morningstar for the weekend. Shani Jayamanne looks at three cheap, fully franked stocks, while Shaun Ler thinks an ASX-listed asset manager has a lot of upside.

Leisa Bell unveils the results of last week's Firstlink's survey on inflation. The survey generated some intriguing data, including reader experience of worst inflation than the official data.

And lastly, in this week's White Paper, Neuberger Berman has its fixed income outlook for the fourth quarter on this year.

***

Weekend market update

On Friday in the US, stocks sank 1.2% on the S&P 500 to have its lowest finish since the end of May. Treasurys managed a modest bounce, with 2- and 30-year yields closing at 5.07% and 5.09% respectively, down seven and two basis points, as the long bond settled above its policy-sensitive peer for the first time this year. Gold reversed after nearing US$2,000 per ounce to end at US$1,980 per ounce, while WTI crude was steady at US$88 per barrel.

From AAP Netdesk:

The Australian share market on Friday dropped precipitously for a second day, closing at two-and-a-half week low amid the spiralling conflict in the Middle East and soaring US bond yields. The benchmark S&P/ASX200 index finished down 80.9 points, or 1.16%, to 6,900.7, while the broader All Ordinaries fell 83 points, or 1.16%, to 7,089.7. The close was the ASX200's third lowest of the year, only exceeded on October 4 and March 20, leaving it down 2.1% for the week and 2.0% for the year.

The mining sector was the biggest loser, down 1.7%, as BHP dropped 1.8% to $44.43, Fortescue fell 2.2% to $21.39 and Rio Tinto retreated 0.7% to $114.62.

Also, Liontown Resources had plunged 31.9% to a seven-month low of $1.90 after raising $365 million at a deep discount of $1.80. The capital raising, which will be used to fund the company's globally significant Kathleen Valley lithium project in WA, comes just days after US lithium giant Albemarle walked away from its $3-per-share takeover offer for Liontown following Gina Rinehart's Hancock Prospecting acquiring a significant stake in the company.

Goldminers Northern Star and Evolution rose 1.3% and 2.2% respectively, as gold traded at a three-month high of $US1,980 an ounce - or an all-time high of $3,136 in Australian dollars.

All the Big Four banks finished lower, with NAB falling 1.6% to $28.65, CBA dipping 1% to $98.75 and Westpac and ANZ both retreating 1.4%, to $20.86 and $25.27, respectively.

Insignia Financial fell 12.8% to an all-time low of $2.04 after announcing that "by mutual agreement" chief executive Renato Mota would step down in February after 20 years with the financial advice company formerly known as IOOF, the last five as its CEO.

Cleanaway Waste Management fell 1.3% to $2.35 as the waste management company forecast $350 million in earnings for 2023/24, with CEO Mark Schubert reporting a strong start to the new financial year.

From Shane Oliver, AMP:

Fed Chair Powell’s comments in the last week were balanced but they still pushed bond yields higher. Powell indicated that the Fed is “attentive” to stronger growth but also to the tightening in financial conditions flowing from higher bond yields and so it can proceed “carefully” – implying no hike in November. But because he didn’t pushback against higher bond yields and said the Fed should let it “play out” and that the neutral rate of interest may now be higher it provided a green light for a further lift in the US 10-year bond yield, which rose to around 5%.

The risk of another rate hike in Australia is high with the RBA getting nervous about the upside risks to inflation. The RBA was out with a somewhat more hawkish message in the last week via the minutes from the last meeting and a “fireside chat” with Governor Bullock. The key messages are that:

- monetary policy is working to slow spending & ease inflation;

- there are few signs of a wage price spiral;

- but services inflation is sticky, with the rise in petrol prices, potentially made worse by the war in Israel adding to the risks;

- the rise in house prices might support household spending and may suggest monetary policy is not as tight as assumed;

- upside risks to inflation are a concern given how long inflation is likely to be above target, as the longer its above target the more long-term inflation expectations may rise making it even harder to get inflation back to target; so

- the RBA has a “low tolerance” for a slower fall in inflation than expected and if its higher than expected then it would respond.

Of course, the RBA has long been flagging that “some further tightening in monetary policy may be required” but its communications over the last week are somewhat more hawkish than flagged in the statement following its last board meeting. This may just be jawboning and an effort by the new Governor to highlight that she is just as determined to get inflation down as Governor Lowe and so is all aimed at keeping long term inflation expectations down. But the clear message is that the risk of another rate hike is high and the RBA has flagged that it will be looking at things very closely at its November meeting after the latest run of data on jobs, economic activity and inflation along with revised RBA forecasts.

We had put the risk of another rate hike at 40% but following the RBA’s latest communications now see it as being close to 50%. Jobs data in the past week was mixed – with slowing jobs growth but still low unemployment – leaving the September quarter inflation data due Wednesday as key to whether the RBA hikes again in November. We think the inflation data will come in roughly in line with RBA forecasts and so no change from the RBA on rates remains our base case, but the risk is on the upside leaving the rates call a very close one. The money market has priced in a 22% chance of a rate hike in November (up from just 6% a week ago) & 100% chance by March (up from 40% a week ago).

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website