The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Looking back on the first half of this year, it’s amazing how the dominant market narrative – of being long US assets – quickly changed.

In January, investors were in love with American ‘exceptionalism’. Most of the major super funds were quoted in the media as being happily overweight US equities. They were joined by many of the world’s biggest fund managers.

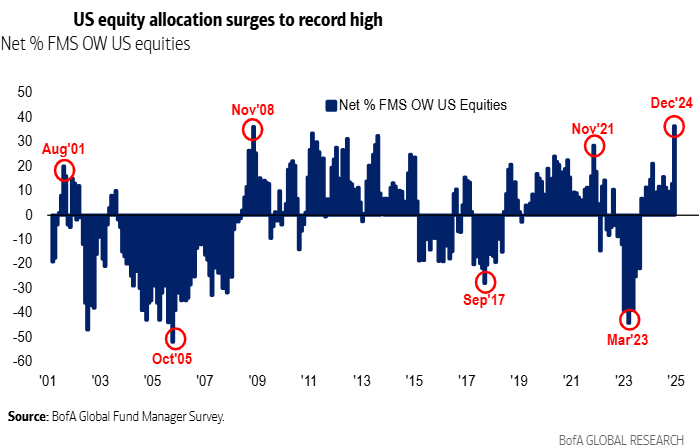

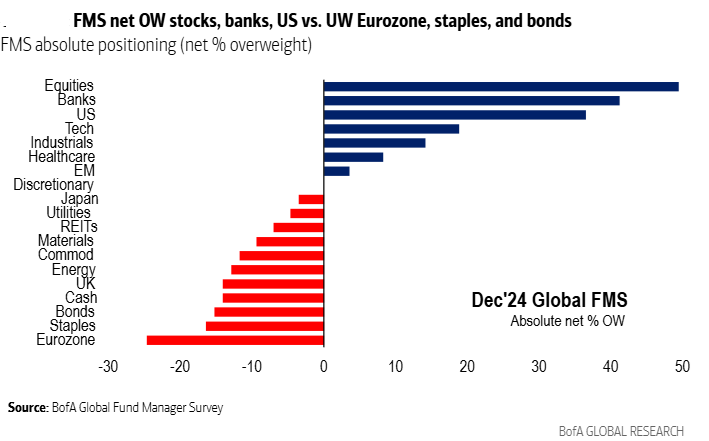

Bank of America’s Global Fund Manager Survey noted that US equity allocations surged to a record high at the end of last year.

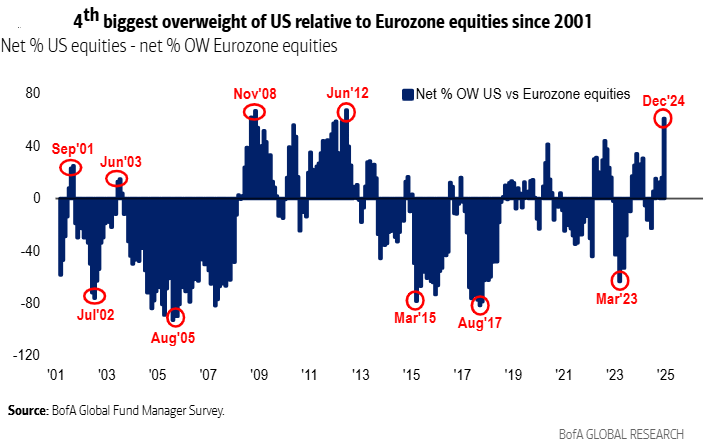

And fund managers had their fourth largest overweight to US equities versus European stock since 2001.

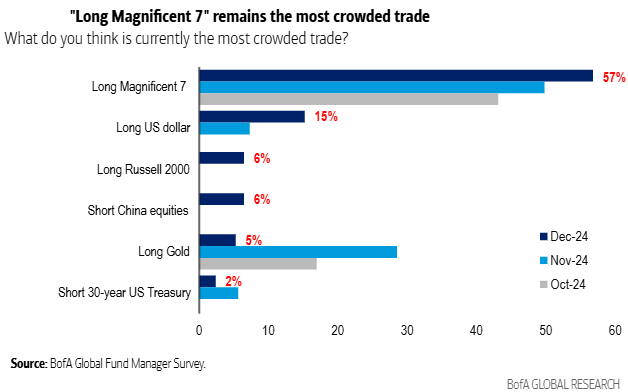

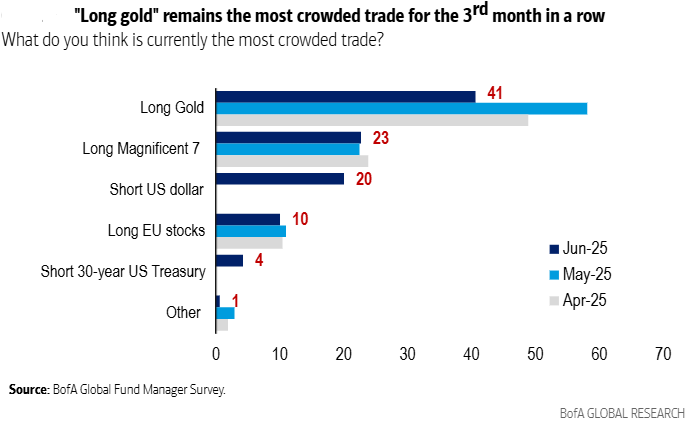

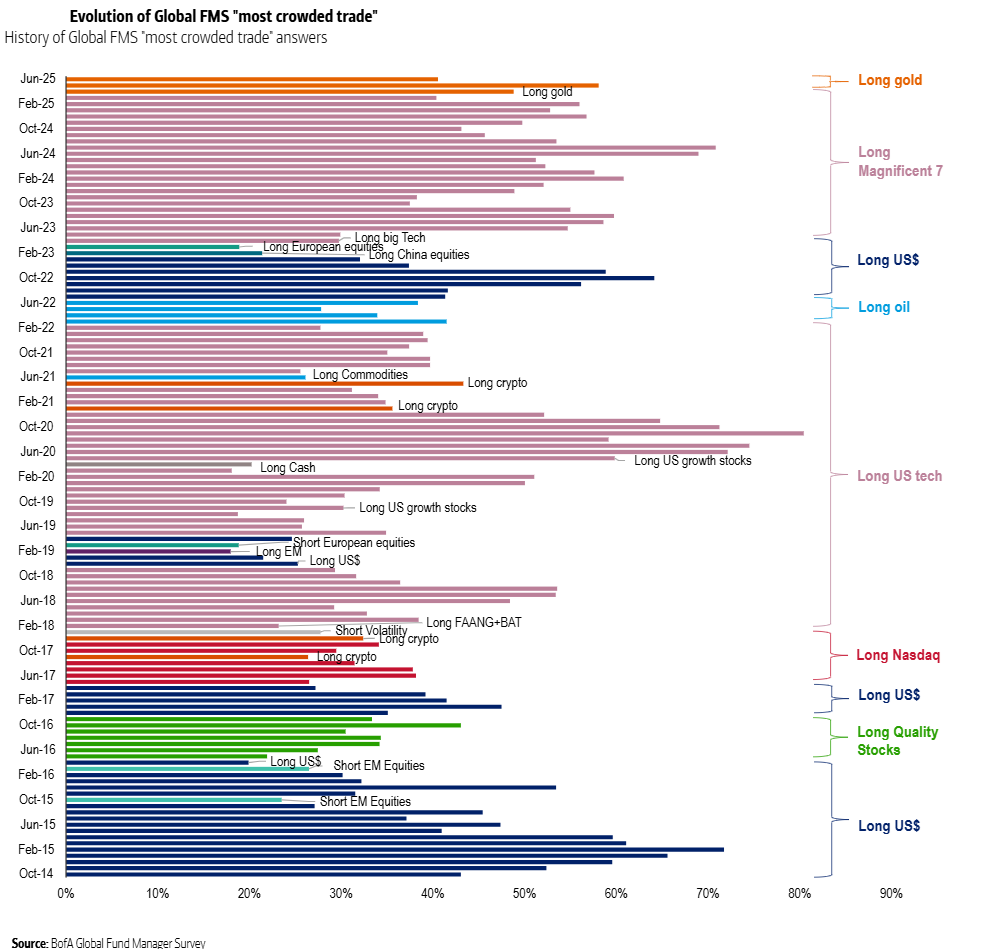

In the survey, fund managers themselves suggested that the most crowded trades were long the ‘Magnificent 7’, long the US dollar, and long US stocks.

The bullishness towards US assets didn’t fare so well in the first half. The S&P 500, after being down 15% for the year in April, finished 6% in the black. And the ‘Magnificent 7’ returned 9%.

Yet, they badly lagged Europe, which was up 21% in US dollar terms, and Emerging Markets, which jumped 13%.

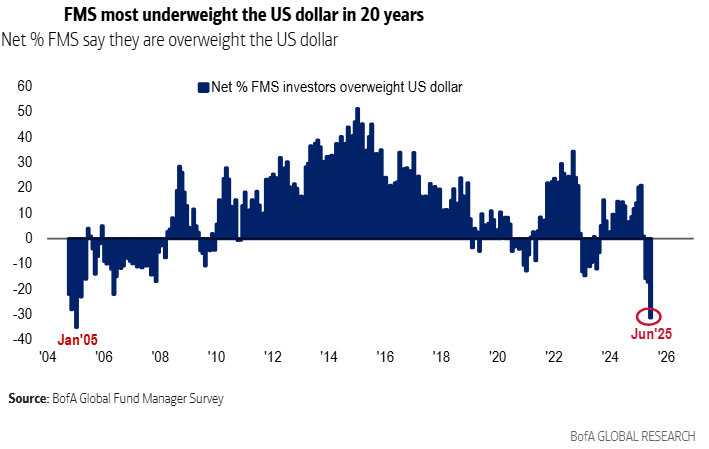

The US dollar was a key culprit, plummeting 11% against a basket of the world’s currencies in the first half.

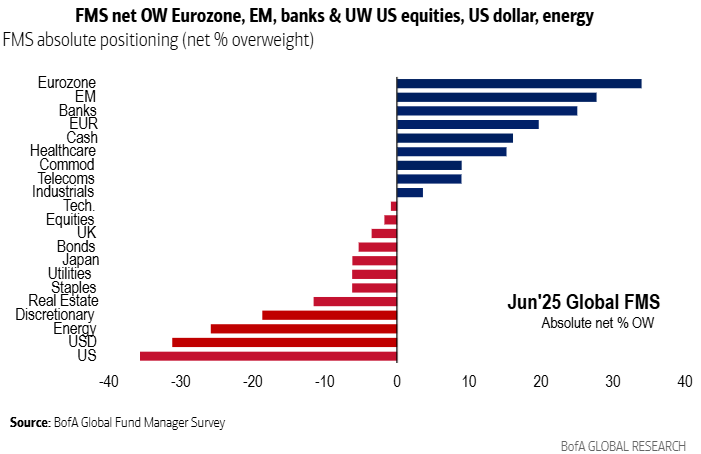

So, what are global fund managers doing now? They’ve flipped the script: they’re long European and Emerging Market stocks at the expense of US equities, short the US dollar, and long gold.

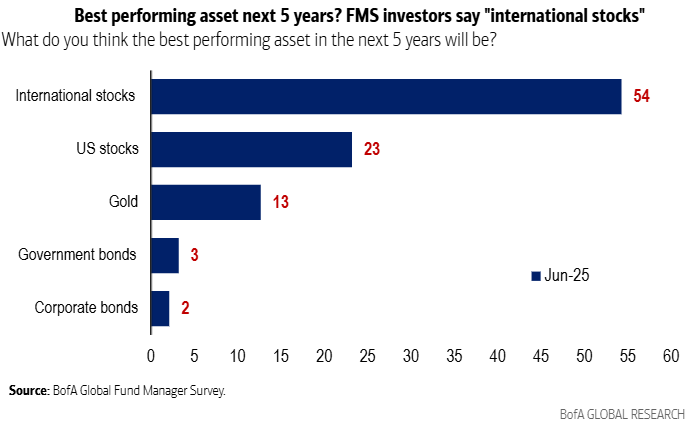

As for what they think will be the best performing asset over the next five years, fund managers have overwhelmingly nominated international stocks.

Now, that’s a 180!

All of this isn’t to belittle these fund managers – far from it. It’s to say that often the dominant trend of the day doesn’t always pan out.

Sometimes it does, though. What I didn’t mention above is that the same global fund managers who were bullish on US assets in January were also positive on global banks and broader equities, and less enthused with cash, bonds, and consumer staples. All of these turned out to be pretty good bets.

Also, the fund managers had been optimist on US tech and the US dollar over much of the past decade and that paid off handsomely too.

What this shows is that some trends can be long running yet turn on a dime. Meanwhile, other trends can prove short-lived.

Distinguishing between short and long-term trends

How can investors tell if a market trend will be enduring?

Nobel Prize-winning economist Robert Shiller has some ideas on this. In his book, Narrative Economics, he suggests that the stories that people tell can have a large influence on economic events and markets.

Shiller cites the example of the US housing boom and bust of 2007-2008. He asks: why did house prices go up in an unprecedented fashion? It wasn’t because of low interest rates because rates weren’t that low, it wasn’t from building costs going up, and it wasn’t from a population surge.

He thinks the boom was the result of the narrative that built around home purchases and ‘the American dream’. And the narrative included the idea that house prices always go up.

How did the bubble burst? In a later interview, Shiller says:

“…it collapsed when the narrative changed - when people started talking about a housing bubble and started talking about the foolishness of the investors in it. Suddenly it became embarrassing to have invested in homes, and the narrative changed. The Great Recession that followed was substantially caused by a changing narrative about housing.”

Shiller believes that it’s important to understand the stories driving trends as they can often influence human behaviour and economic events as well as markets:

“I believe that human thinking has to be studied if we are going to understand economic fluctuations. We have to understand how people change their thinking through time. People live their lives as fulfilling a story and that’s what matters after one has banished starvation and cold and illness. It becomes the meaning of life—how I fit in to some story of our time. That thinking changes. And it changes motivation in fundamental ways.”

How can investors use Shiller’s theories? Let’s take the topical example of CBA. The overwhelming consensus is that CBA is the best bank in Australia by a long way. It has the best leaders, technology, loan book, risk management and capital allocation.

Despite this, CBA’s price has dropped in recent weeks. Has the narrative changed, however? I’d suggest that it hasn’t changed at all and the recent price movements indicate a rotation out of what is deemed an expensive bank into cheaper, underperforming mining stocks. If Shiller is right, a more sustained fall in CBA’s share price will only happen when the narrative built around it starts to fray. Maybe bad debts tick up? Or they have a tech failure of some sort? Or their risk managements systems are found wanting?

Hedge fund billionaire George Soros would have something else to say on this matter. He thinks there is a ‘reflexivity’ in markets, where investor expectations influence prices, and those prices then further shape their expectations, leading to booms and busts. It’s a different angle to Shiller’s theory.

In CBA’s case, Soros might suggest that if bad debts ticked up, that would influence the share price, which would then shape investor expectations for CBA’s price going forward.

What will be the next big story that drives markets?

One potential question is how investors can tell what will become a narrative in the first place. Put another way, what will be the big stories making headlines tomorrow?

Louis-Vincent Gave of Gavekal Research has a thoughtful take in a recent article, What Will 2025 Be Remembered For?

Gave says that big, market-changing events often don’t make the headlines right away. For instance, 2001 is best known for the September 11 attacks and the continued drop in US tech stocks. Yet, a bigger event happened from a market point of view that year and it didn’t feature as prominently: China’s admission to the World Trade Organisation.

Similarly, 2008 is best known for the Great Financial Crisis. However, the birth of the smartphone and US shale oil revolution happened at the same time and these events have had a huge influence on markets since that time.

Gave goes through a laundry list of possible events that may qualify as the next ‘big thing’ today, from the breakout in Japanese government bond yields, to China embracing the biggest budget deficits in its modern history, Europe abandoning any pretense of fiscal austerity, and the shift in US fiscal policy from ‘DOGE cuts’ to ‘running it hot’.

However, he nominates three recent speeches as marking a key shift in the macro-economic environment:

- US Vice President JD Vance’s speech at the Munich Security Conference

- President Donald Trump’s speech in Riyadh

- Erik Prince’s speech to Hillsdale College in February 2025

Collectively, Gave says these speeches indicate that the US is turning its back on providing its allies with two essential services: a security umbrella and safety of the global oceans.

The former is well understood. It’s why international stocks have started to fly in recent months.

Gave says the latter isn’t understood as well. Without the US providing safety for global oceans, it will make it harder for commodities to move from one location to another. That may result in supply chains moving from the ‘just in time’ era of the past 30 years to a new period of ‘just in case’. What he means by this is that, “all economic actors will have to build up bigger inventories: countries will have to accumulate inventories of key resources; companies will need to maintain higher inventories of spare parts and consumer goods; even individuals may wish to have better stacked pantries, spare electronics, and perhaps even spare vehicles.”

Gave suggests that commodities will be one of the largest beneficiaries, especially those that are easy to store, like precious and industrial metals. And that’s positive for commodity-producing countries such as Australia.

Whether Gave’s ideas turn into the next big market story remains to be seen, though for our sake, let’s hope so.

----

There are many ways to invest in stocks, but some strategies are more effective than others. In this week’s article, I explore nine tried and tested investment approaches. Choosing one of these can improve your chances of reaching your financial goals.

James Gruber

Also in this week's edition...

The $3 million super tax has dominated financial headlines of late, though it appears a done deal. Julie Steed has many clients who are rethinking their super strategies, especially about wealth transfer on death. She runs through the key points to consider and offers potential investment alternatives.

The Labor Government has a plethora of reviews into productivity and tax reform coming up. Of course, we've had these types of reviews before and many of the recommendations have proven too politically sensitive to implement. Noel Whittaker thinks the most feasible option is to raise the GST to 15%.

Initial euphoria for artificial intelligence has turned to scepticism about its merits and when its impact will be felt on company profit and loss statements. That's been reflected in the share prices of ASX companies most exposed to AI, including Goodman Group and DigiCo Infrastructure REIT. Rudi Filapek-Vandyck says it provides a significant opportunity for astute investors.

Gold has been one of the best performing assets in recent times - is it too late to get in? Jeremy De Pessemier thinks not, explaining how the US debt crisis, geopolitics, and interest rates are providing powerful tailwinds for gold prices.

The RBA surprised by not cutting rates this week, though further cuts seem inevitable this year. If right, that should be bullish for small caps, which have lagged large caps for some time. Of course, you can invest in ETFs with small cap exposure, however Claire Aitchison says listed investment companies with small cap mandates could be better options given many of them trade at discounts to their net assets.

Forget speculation about a future US-China conflict - John West suggests it's already happening. Through cyberwarfare, propaganda, and tech infrastructure, China is waging a grey war designed to weaken democracies without firing a single shot.

Two highlights from Morningstar for you this weekend. Joseph Taylor weighs up the integrated fuel players Ampol and Viva, while Shaun Ler looks at the potential impact of Platinum’s big proposed merger.

Lastly, in this week's whitepaper, tariff changes, central bank action, geopolitics, and social media messages have all shifted markets. Despite these uncertainties, VanEck says there remain pockets of opportunity in markets.

****

Weekend market update

In the US on Friday, Treasurys came under pressure with 2- and 30-year yields rising 4 and 10 basis points, respectively, to 3.9% and 4.96%, while stocks settled slightly lower after recovering most of another tariff-induced overnight drop, wrapping up a relatively low-wattage week with a flat showing for the S&P 500. WTI crude advanced towards US$69 a barrel, gold jumped to US$3,357 per ounce, bitcoin blasted off to US$118,000 and the VIX ticked above 16.

From AAP:

On Friday, strong gains by the mining giants were not quite enough to keep the local bourse in the green, with every other sector losing ground.

The benchmark S&P/ASX200 index finished down 0.11% to 8,580.1, while the broader All Ordinaries dipped 0.07% to 8,820.3.

The ASX200 finished the week down 0.27%, snapping its two-week winning streak.

The mining sector on Friday rose 1.8% as iron ore prices hit multi-month highs on hopes of further supply-side reform measures in China's steel sector. BHP gained 2.8% to $39.36, Rio Tinto added 2.8% to $111.10 and Fortescue climbed 2.9% to $16.98.

Rare earth miners Lynas and Iluka Resources surged after the Pentagon announced it was taking a multibillion-dollar stake in New York Stock Exchange-listed rare earth miner MP Materials. It is part of a move by the US to try to reduce reliance on China for rare earth magnets, a critical component of weapons systems, electric vehicles and electronics. Lynas rocketed 16.7% to a three-year high of $9.67, while Iluka soared 22.9% to a six-month high of $4.89. Also, critical mineral company Iperionx gained 15.6% to a six-month high of $4.98

Elsewhere in the materials sector, Johns Lyng Group soared 22.6% to a seven-month high of $3.90 after the building services company agreed to be acquired by Sydney-based private equity firm Pacific Equity Partners for $4 a share, or $1.1 billion.

Goldminers were lower. Northern Star dipped 2.2% and Evolution lost 1.5%, while Ora Banda Mining dropped 9% to a seven-month low after the WA goldminer announced production results for 2024/25 that investors found disappointing.

In the financial sector, three of the four big banks finished lower. CBA dropped 0.5% to $179.42, NAB dipped 0.3% to $39.61 and Westpac edged 0.2% lower at $33.81. ANZ was the outlier, up 0.1% at $30.33.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

LIC (LMI) Monthly Review from Independent Investment Research

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website