The stock market usually rises well before positive data confirms an economic recovery, and the challenge is deciding whether we are in a bear market rally. Last week, the S&P500 rose 12%, its best week since 1974. The market lost a third in the month to mid-March, but it has clawed back 20% following the massive injections from the Fed. It's a remarkable turnaround, especially as 16 million Americans have made jobless claims in only three weeks.

These are not just numbers, these are people losing jobs. They are also consumers spending less and unable to meet rent or mortgage payments, with high streets and shopping malls already looking like windswept deserts. Moody's estimates 30% of Americans with home loans, or 15 million households, may stop repaying their loans if the economy remains locked up beyond their summer.

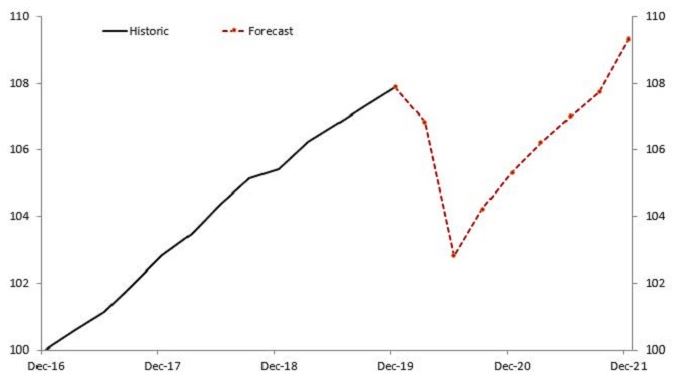

While everyone accepts there will be a significant fall in global GDP, the 'snap back' argument gains momentum. Consider the consensus forecast in the chart below for US GDP (setting December 2016 as 100). 'Consensus' is not one optimistic economist, it's an average view. We have a global shut down in economic activity and although everyone is guessing, enough are wearing rose-coloured glasses.

US real GDP index (Dec 2016 = 100) forecasts

Source: Bloomberg, Janus Henderson Investors, as at 1 April 2020. Projection is based on Bloomberg weighted average of consensus forecasts.

Back in Australia, we have seen about 150 of the companies in the S&P/ASX200 withdraw or downgrade their earnings guidance since the COVID-19 outbreak, confirming the pain is not confined to smaller companies. A recent ABS survey found two-thirds of businesses report cash flow reductions due to the virus.

Where do you stand? How are your investments performing? How are you coping? Please take a moment to complete our survey. We have already received over 500 responses with many excellent comments and some surprising overall results. A summary will be published on Monday with a full report next week.

It should be a stock-pickers market, with some shares trading at a discount of 30% to 50% of prices a month ago. Participating in some of the heavily-discounted capital raising should give a boost to outperforming markets not available to index funds. This is often at the cost to retail investors, who are offered a fraction of the new raising and end up diluted by large funds buying at cheap prices. For example IDP Education raised capital at $10.65 and the share price closed the same day at $14.71. Cochlear issued at $140 and was soon back about $200. Webjet and Kathmandu both issued at half their last-trading price.

Watch for super advice

ASIC has warned real estate agents not to provide advice to tenants on release of super to pay rent, saying:

“Financial advice must only be provided by qualified and licensed financial advisers, or financial counsellors, not by real estate agents who neither hold the requisite licence. The Corporations Act imposes significant penalties for a contravention of section 911A."

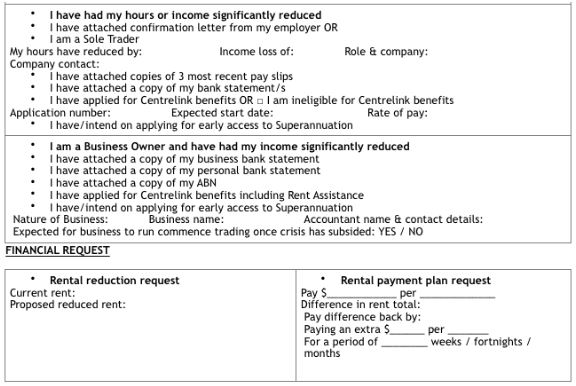

Here is a sample of a form (courtesy of The New Daily) some real estate agents were sending to tenants who were seeking rental relief. It's comprehensive and far from a simple matter for the tenant, including what looks like a requirement to access their super.

In this weekend's edition ...

Hamish Douglass has switched his portfolios significantly to cash amid the current uncertainty, and he describes the turning points he is looking for. Microsoft Founder Bill Gates warned the world about epidemics in 2015 in a TED talk viewed 30 million times, and here's his view on actions required in the current pandemic.

Economist Hans Kunnen explains how Australia can afford a trillion dollars of debt, while Rodney Brown looks ahead to the days when we must start repaying it, and suggests we will face new taxes we should all prepare for. Then actuary Tony Dillon gives a simple maths explanation of why social distancing is so important for managing the virus.

Christopher Dembik raises an overlooked issue that retirees are now withdrawing their savings to live on, rather than investing more in the market, on top of the coronavirus weakness. Norman Derham records movements in the hybrids market and where opportunites lie.

On the point that the market usually recovers far quicker than the economy, Michael LaBella asks whether this time really is as different as many people are saying.

Howard Marks has also issued his fourth client memo in a month as he grapples with changing conditions, and we have updated last week's article.

In the White Paper section this week, Fidelity International provides a handy infographic outlining 10 key principles to help investors manage uncertainty.

The BetaShares March 2020 ETF Report shows trading value reached an all-time high of $18 billion, or 2.5x the previous monthly record of $7 billion recorded only a month before.

We are now publishing regular updates to our website during the week due to the changing markets and number of new contributions.

Graham Hand, Managing Editor

Recent updates

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Monthly Report from Morningstar

PDF version of Firstlinks Newsletter

Plus updates and announcements on the Sponsor Noticeboard on our website