Weekend market update: While the US S&P500 gained for the sixth week in the last seven, on Friday it struggled to reach an expected all-time high as investors saw the P/E ratio exceed a heady 26. Vaccine progress overseas drove up Asian and European markets, and Australian equities rose a strong 2% for the week with property and retail doing well.

***

It's easy to oscillate between vaccine optimism and pessimism depending on the most recent authoritative report. Many companies and countries have a vested interest in hyping up their treatments, but even if a convincing vaccine were discovered soon (as Putin and Moscow claim they have done), it would take most of 2021 to complete the required testing and roll it out globally. In the meantime, politicians must make tough decisions to sustain economies and manage outbreaks rather than pretending we are close to business as usual.

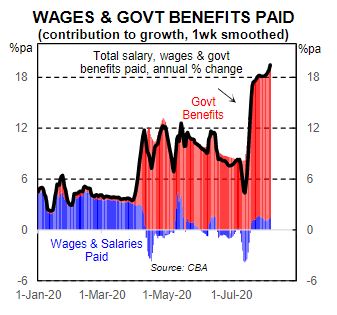

This chart from CBA shows the extraordinary extent to which the Australian economy is relying on government support, with benefit payments driving a rapid increase in household income despite poor wage growth.

Let's check three vaccine opinions, and anyone can draw a line between them, as where the virus goes, so does the economy.

Ian Bremmer writing in Time Magazine, 6 August 2020:

"This liquidity support (along with optimism about a vaccine) has boosted financial markets and may well continue to elevate stocks. But this financial bridge isn’t big enough to span the gap from past to future economic vitality because COVID-19 has created a crisis for the real economy. Both supply and demand have sustained sudden and deep damage. And it will become progressively harder politically to impose second and third lockdowns.

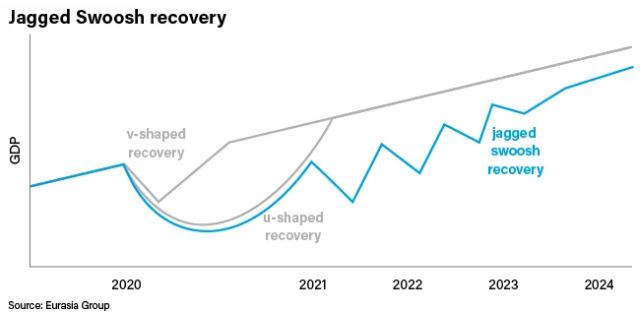

That’s why the shape of economic recovery will be a kind of ugly 'jagged swoosh', a shape that reflects a years-long stop-start recovery process and a global economy that will inevitably reopen in stages until a vaccine is in place and distributed globally."

"The world could get seven to nine vaccines over the next two years given historical vaccine success rates and the current pipeline of candidates. The outlook is even more optimistic if the full pipeline of candidates advances toward clinical trials, tripling the likely number of successful vaccines."

We should also ask, when the world masters COVID-19, what next? The World Health Organisation (WHO) gives a daily virus update with lots of interesting news. But on 10 August, WHO included this longer-term warning:

"We are at greater and greater risk around the world and let's face this. We live on a planet in which we're adding a billion people a decade. We are densely packed, we're exploiting pristine environments, we are creating and driving the ecologic pressure that is creating the risks that are driving the risk at the animal/human species barrier.

There are so many people out there working in the ecologic movement who are seeing this each and every day. We are pressuring the biologic system. We live in a biome, we live in a world of biology and we are actively creating the pressures that are driving the breaches of those barriers and we need to do better at managing the risks associated with that."

So this is not just about COVID-19, as there will be COVID-21 and COVID-23 unless we put far more resources into looking after our ecosystem.

This week, focussing on investing and retirement ...

We start with Brendan Coates and Matt Cowgill who question our preoccupation with superannuation for retirement incomes. Having a place to live and the role of the age pension matters more to most people.

With a lot of attention on the potential bubble of the mega-cap tech stocks, it's easy to overlook that many companies are more expensive and have far worse prospects. Jason Ciccolallo finds a heady 100 and US$3 trillion worth of these companies.

As companies rebuild their balance sheet with capital raisings, Tim Canham and Wik Farwerck have identified three factors which are driving their investment decisions in this new normal. Similarly, Kent Williams finds a sector with promising tailwinds, with local software companies delivering solutions for financial efficiency and customer-centric enhancements.

Stephen Mayne has updated his database on retail Share Purchase Plans, and he awards the 'brickbats and bouquets' for the schemes that are equitable and the ones which are downright unfair.

We regularly hear about the 'fear index', the VIX, but what is it? Tony Dillon explains. Is it really worth the attention it receives whenever the market spits the dummy?

Back on retirement incomes, Arthur Naoumidis descibes five ways to use the family home as a source of income, and why it's likely to become a more common solution in future years.

This week's White Paper from BetaShares is their July 2020 ETF review, where despite market runctions, Australian ETFs reached an all-time high of $67 billion. Check where the money is flowing into.

Morningstar has produced a useful calendar of the company reporting season, so you can watch for results affecting your portfolio.

Graham Hand, Managing Editor

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from BetaShares

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website