The Weekend Edition is updated with a market summary and Morningstar adds two of its most popular articles from the week including stock-specific ideas. It's also a chance for a catch up on previous editions here and hundreds of contributors are listed here.

***

Weekend market update

From AAP Netdesk: Investors are making a mockery of the saying 'sell in May and go away' after the ASX200 notched a record closing high. The benchmark index closed up by 85 points, or 1.2% to 7179.5 on Friday. During the day, the index came within 11 points of its all-time peak and is ahead by 2.2% for May. However, technology stocks have lost 9% this month due to inflation worries.

Investors buying on Friday may have been encouraged by US economic data.

Jobless claims fell to a pandemic low and the economy grew at a solid rate of 6.4%. On the ASX, materials shares were best, and iron ore prices rose and helped the big miners.

From Shane Oliver, AMP Capital: Global share markets rebounded over the last week as inflation fears faded a bit and economic data indicated that the global recovery continues. For the week US shares rose 1.2%, Eurozone shares gained 1.1% and are nearing their 2000 tech boom high, Japanese shares rose 2.9% and Chinese shares rose 3.6%. The Australian share market rise was led by very strong gains in telcos, IT, retail, energy and financial shares. Bond yields actually fell. The S&P 500 and NASDAQ were both steady on Friday.

***

Share investors focus on buying well and selling well, but holding well is at least as important. Next time you attend a fund manager presentation, ask about their longest investment. If they are skilled at identifying great companies, their investments should not be short-term trading decisions. Buy Microsoft or Apple or CBA and stick them in the bottom drawer. But blind devotion to a company whose fortunes are changing is also a failing, so watch where a fund manager falls in love with a stock and overlooks the risks.

Two groups of people who don't worry about buying or selling for themselves are politicians and government officials. We expect them to be passive and yet we want business leaders such as company executives and fund managers to 'drink their own champagne'. Welcome to the issue of who should be 'dogfooding'.

For more active direct investors, two stalwarts of Australians retail portfolios are good examples of the hold or not hold decision. CBA floated 30 years at $5.40, and it not only hit $100 this week for the first time, but investors received $4.31 of fully franked dividends in both 2019 and 2018. The dividend fell to $2.48 in 2020 but it will recover in 2021. Those who sold during the GFC or COVID underestimated the power of Australia's banking oligopoly.

Source: Morningstar

But the lesson is not to simply buy and hold, but to hold well the companies that can withstand short-term downturns because they are great businesses. Telstra, for example, has disappointed millions with a direct or indirect investment over many years. Faced with heavy competition, poor customer service and large capital expenditures to stay on top of technologies such as 5G, it will never return to its heyday.

Source: Morningstar

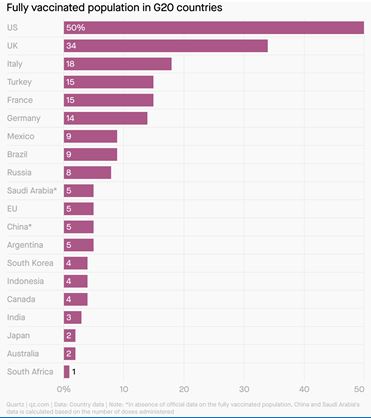

Companies like CBA are part of the 'opening up' story, driven by central bank stimulus and vaccine success. Half of American adults are already fully vaccinated and over 60% have had at least one shot. Plus an estimated 12%-15% have had the virus, taking the US well towards herd immunity. As it opens up, economic activity should support the economy, giving more reasons for optimism about US equities.

Unfortunately, other places have not done as well. When the World Health Organisation set up Covax in 2020 to send vaccines to developing counties, it expected to deliver two billion doses by the end of 2021. Covax has shipped less than 70 million to date. The Serum Institute of India announced this week that it would not provide any vaccines to Covax as India copes with its own disaster.

The table below shows how far Australia is down the vaccine list, second from the bottom. Were we not supposed to be "at the front of the queue"? I had my first jab this week and it was easy and painless. With 30% of Australians refusing to become vaccinated, complacency has set in, although the new Victorian outbreak will change a few minds. The President of the Australian Medical Association, Dr Omar Khorshid, said this week that too many people assume there is little risk of a serious outbreak:

“There is no way for Australia to avoid COVID unless we close ourselves off forever. But that’s not going to be acceptable. So COVID will come, because there is just no way to eradicate this virus from the entire globe. There’s such vaccine inequity that we’re going to have virus hotspots, with huge amounts of devastating COVID for a long period of time. And we are going to have to manage that risk with open borders through mechanisms such as vaccination, quarantine and a boosted health system, which is going to have to learn to manage people with COVID.”

As we open up, the other side of the share price recovery in traditional stocks is the growth companies that boomed in 2020. Alex Pollak says valuing great tech companies should not rely on single-point measures, as their revenues will grow rapidly long into the future.

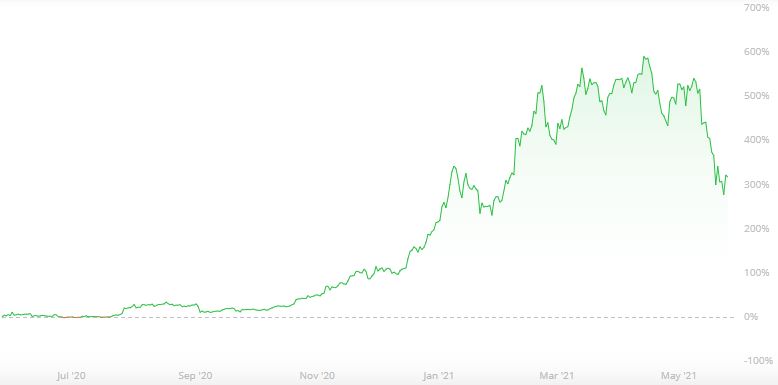

The biggest movers in the last couple of weeks are - surprise, surprise - cryptocurrencies. If you want to see how crazy this market is, check the website CoinMarketCap. It lists thousands of coins, every man and his dog has jumped aboard, not only as a buyer but as issuer. The combined market cap has fallen to US$1.7 trillion from US$2.5 trillion. In case you are losing track of the zeros, that is a loss of US$800 billion or A$1,000,000,000,000 (12 noughts) in a couple of months.

The largest, Bitcoin, is down 50% since its mid-April peak but it is still up 300% in a year, as shown below. Where does it go from here? No idea.

Source: Bitstamp

Both the US and Australian regulators are cracking down on the loss of tax revenue from people not declaring their gains. A US Federal judge in Boston has approved IRS summons against crypto payment companies requiring them to provide customer records. The recent Bitcoin fall continues a pattern which shows this is no place to commit retirement savings. Here are other Bitcoin price movements since 2017.

- -35%, January 2017

- -33%, March 2017

- -32%, May 2017

- -40%, July 2017

- -41%, September 2017

- -30%, November 2017

- -21% December 2017

- -23% December 2017

- -84% December 2018

- -31%, January 2021

- -26% February 2021

This week, Shane Woldenthorp attempts to make sense of cryptocurrency by estimating its value and considering it as a medium of exchange. It comes in the same week as Senator Jane Hume called cryptocurrencies an 'asset class' and not a 'fad', and:

"We have to back Australians to be sensible enough to judge for themselves whether to put their hard-earned money into higher-risk assets. The fact that some people make poor decisions does not justify restricting the ability for ordinary Australians to participate in investment.”

We then cover a wide range of interesting issues.

Hazel Bateman and her colleagues explain the changes to the Pension Loans Scheme (PLS) and expect far more people will use it. Remember, it is available to self-funded retirees, not only those on the age pension. The PLS will increase its profile over the coming year as the Government has clearly indicated it wants retirees to access their home equity. The product is likely to change its name as the Minister for Families and Social Security, Anne Rushton, told the AFR:

“The name has mistakenly led people to believe that self-funded retirees don’t have access to it, which is not the case. I think it could be improved and self-funded retirees haven’t picked it up anywhere near the level you think that they might like to.”

Then Lisa Harlow makes the excellent point that just because an investor uses a passive index fund does not mean they are disinterested in ESG issues. Index fund providers take their stewardship role very seriously.

The concept of a 'Lewis turning point' is used by Michael Collins to show how China is at a critical stage in its history, and the implications for a country like Australia which relies on exports to China are profound.

Rachel Lane looks at the $17.7 billion aged care package in the last budget and fears many older Australians will still be left behind.

We reproduce a quick advice from the Australian Taxation Office on the Top 5 errors trustees make in their SMSF tax returns, worth checking as the end of the financial year approaches.

UPDATE - UPDATE - UPDATE

On 29 May 2021, the Government announced that the temporary reduction in pension drawdown rates by 50% has been extended another year to 30 June 2022. This will make it three years with the lower minimums. These are minimums, not recommended levels, and higher amount can be drawn if needed for your lifestyle.

And in response to reader demand, we have combined the two articles on risks buying property off-the plan into one document to share with others. For example, AlanB commented:

"This is a most informative article that deserves wider publicity and exposure. It should be put into brochure form and compulsorily handed out to all prospective off the plan apartment buyers. But that will be opposed by real estate agents and shonky developers. Parents need exactly this information to pass on to their young adult children."

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

In a two-part series, Emma explores the basics of putting together an all-ETF low-cost 'core' portfolio, including defining financial goals and selecting individual funds. See Part 1 and Part 2. Meanwhile, Anthony Fensom examines a couple upcoming LIC IPOs for signs of a comeback for a structure that has struggled.

This week's White Paper from Vanguard shows Australian attitudes to investing, including that while half think about their financial future daily, 70% don’t have a financial plan. Obviously, not enough read Firstlinks.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website