While the 2019 Federal election may lead to significant superannuation changes, 2018 set the long-term agenda for structural reform. The Financial Services Royal Commission led the way, pushing every major bank to plan an exit from wealth management, once seen as the fast train to growth against the slow train of basic banking services. The Commission's revelations wreaked havoc on financial advice, while recommending the extension of the Banking Executive Accountability Regime (BEAR) to superannuation.

In addition, the Productivity Commission supported the removal of underperforming funds and changes to the default system with a 'best in show' proposal. Regulatory changes included Protecting Your Super to remove small balance funds from the super system, while more power was given to APRA and ASIC.

In this context, KPMG's 'Super Insights 2019' is a timely look at the present and future of the superannuation industry. Their work includes a website report and a fascinating interactive dashboard with great detail on which large APRA funds are growing and which are struggling, and their market shares.

In 2018, despite market volatility especially in the final quarter, the superannuation industry delivered strong outcomes for members overall. The APRA-regulated sector grew by 10.3% over the year, with closing assets nearing $1.8 trillion. SMSFs experienced slower growth, with assets increasing by 6% in 2018 to close at almost $750 billion. In total, the assets supporting superannuation closed 2018 at $2.7 trillion, some 39% higher than the market capitalisation of the Australian share market.

Number of funds to halve under industry consolidation

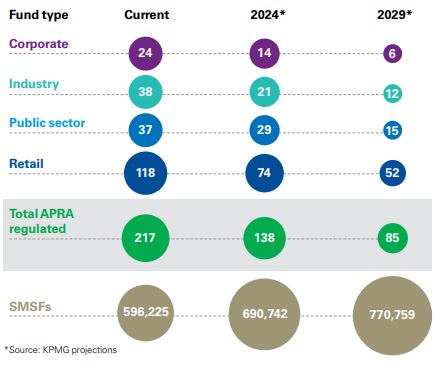

Faced with structural and legislative changes, KPMG expects significant industry consolidation in APRA funds in the short-to-medium term, as shown in Table 1.

Table 1: Projected number of funds, 2019 to 2029

Industry funds to dominate growth, but SMSFs hanging on

The reduction in large APRA funds from 217 to 85 will create some enormous asset management companies, with considerable clout in all sectors of the Australian economy. In particular, a reduction in industry funds from 38 to 12 will see the power of the big funds taken to another level.

KPMG's interactive feature shows how fund size has changed between 2004 and 2018. Back in 2004, the retail funds of NAB/MLC, CBA/CFS and Westpac/BT dominated superannuation, and the industry funds looked like minnows. While these three retain high positions, AustralianSuper is now the largest, and QSuper, Unisuper and First State Super will probably overtake the retail funds in the next few years. For the first time in history, the industry funds in total were larger than retail funds in 2018.

At the end of 2018, as shown in table 2, AMP was second to AustralianSuper by fund size, with substantially more member accounts. AMP's ranking is unlikely to last, based on latest flow statistics.

Table 2. Market position, asset and members of retail and public funds

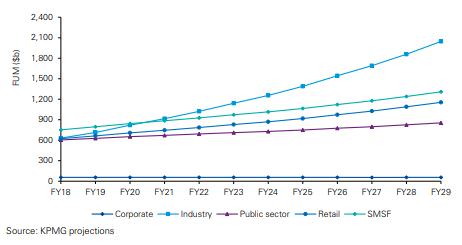

KPMG expects industry funds to overtake SMSFs in 2020, holding over $2 trillion in assets by 2029, as shown ion Table 3. Retail funds will still grow, but at half the rate, reaching $1.2 trillion in a decade. The entire superannuation industry at the moment is about $2.7 trillion. By 2029, total super assets will reach $5.4 trillion, dwarfing anything the ASX can achieve.

Table 3. Forecast assets by superannuation sector

Despite the optimistic outlook, KPMG's Paul Howes added:

"There is no room for complacency, including in the industry sector. During 2019, it is incumbent on all trustees of all funds to review their operations, business models and product portfolios. We believe that in all sectors, significant opportunities exist for funds to develop innovative retirement products to suit the needs of a variety of members.

We are concerned that the potential changes to the advice landscape, including the additional educational requirements proposed by FASEA, the removal of commissions and banning of advice fees being charged on MySuper products will potentially impact the number of members that receive advice. This may have the impact of reducing the demand for pension products going forward and may result in more individuals taking lump sums out of the superannuation systems, which may put more pressure on the social security system, which is unlikely to be a sustainable long-term position for the Federal Government. As such, KPMG believes funds will have to review their advice models to ensure that they can continue to deliver advice to members in an efficient, affordable and compliant manner to facilitate the continued growth of the retirement income product market.”

Footnote, not from the KPMG Report

If Labor's proposals on the refund of franking credits become legislated, many SMSF assets will switch into industry and retail fund structures, including the wraps and direct investment options. In its costing of Labor's proposal, Treasury wrote that the revenue impact will be reduced by SMSFs retaining franking credits through switching to APRA funds:

"This behavioural response is assumed to be greater for higher wealth SMSFs ... Assets that shift into APRA funds are assumed to continue to draw the benefit of the franking credit since most APRA funds are in a net taxpaying position. Some other SMSFs will rebalance their portfolios away from franked dividend paying shares towards other forms of income to compensate for the fall in after-tax returns on shares in the absence of refundability. These other forms of income could include fixed income, property trusts, managed funds or offshore equities."

It will be interesting to see how KPMG amends its 10-year forecast in 2020 if Labor's proposal is implemented.

Graham Hand is Managing Editor of Cuffelinks. The information in this article is drawn from the KPMG Super Insights 2019 Report. See Report for further disclaimers. This summary is general information and does not consider the circumstances of any investor, and does not seek to cover the detail in the report.