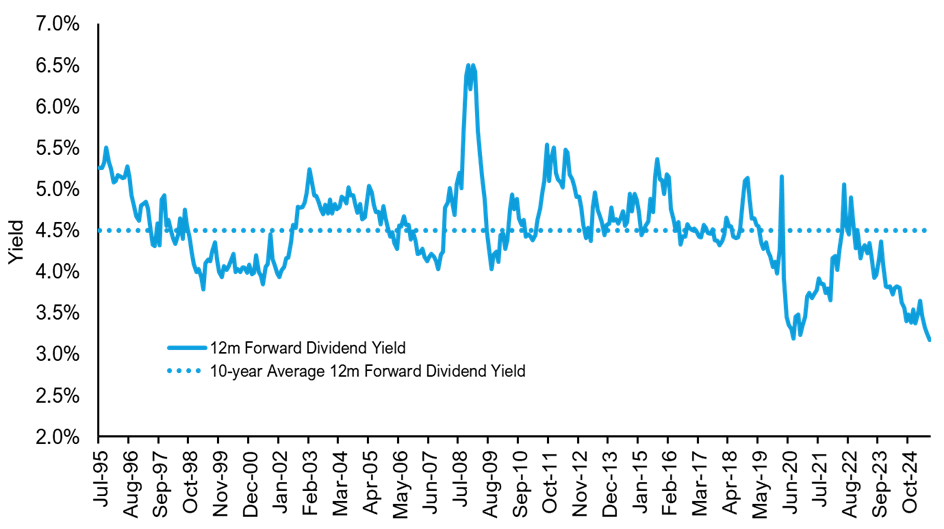

If forward expectations are anything to go by, dividend yields in the year ahead are expected to hit a 30-year low based on the consensus view of markets, as shown by the chart below.

While this low dividend yield could seem alarming to investors, there may be reasons for a more constructive outlook for equity income investors.

Forward dividend yield for the S&P/ASX 300 is at a 30-year low

Source: Bloomberg, Ausbil as at 31 July 2025.

This reporting season, FY25 saw dividends still at weak levels relative to history but doing better than the market expected.

FY25 dividends exceeded consensus expectations three times as often as they disappointed.

Highlights included special dividends from a number of consumer-facing companies, including JB Hi-Fi (ASX: JBH), Super Retail Group (ASX: SUL), ARB Corporation (ASX: ARB), Nine Entertainment Co (ASX: NEC), Qantas (ASX: QAN) and Helia Group (ASX: HLI).

Although dividend expectations for the year ahead were upgraded at around the same frequency as they were downgraded, according to consensus analyst forecasts, this was better than the outcome for revenue and earnings, which both had a downgrade bias.

Earnings growth for FY26 was downgraded by 1% by consensus (to under 5%), but in our view, an improving macro environment could support better earnings growth than expected by the consensus view.

Low expectations reflect dividend risks

The market currently has low expectations for dividends, based on consensus forecasts, because of limited prospects for dividend growth from banks and resources, which pay the majority of the dividends in the Australian market.

However, consensus expectations may be underestimating potential dividend outcomes. Ausbil sees two major things at play that it believes can see dividends exceed market expectations in the year ahead.

First, the market is underestimating the potential for the economy to rebound in Australia and the US following the US tariff shock of April 2025. Consequently, the consensus view underestimates earnings growth, and dividends as a function of that, in Australia.

Second, businesses have been hedging their balance sheets against the unknowns of interest rates, inflation and tariffs, and so have announced lower dividends on average than past years. The good news for investors is that the low in dividends may be nearing a turning point, albeit a slow one.

The consensus view has been bearish on the US, global and Australian economies, contrary to our view that economic growth will improve.

Impact of lower rates

On monetary policy, we expect more rate cuts from global central banks this year, including the US and Australia, further adding support for our outlook for improving economic growth, which may also increase the relative attractiveness of dividend income strategies to other sources of income like term deposits and annuities.

This brings us back to the growth outlook for dividends in FY26 and where equity investors could potentially find income.

The market’s lower outlook for dividends is a challenge for dividend investors looking for extra income, but it is potentially an opportunity for active dividend income strategies that seek to maximise yield through dividend harvesting and optimised franking credits, especially as we may have to look beyond the traditional dividend payers in banks and resources for dividends that are growing.

Conclusion

Earnings and dividends have declined for a number of years, but they could start to climb again in 2026.

For FY26, health care, financial services, consumer discretionary and some select industrials sectors may provide better dividends.

And while we expect resource dividends will fall over the year ahead, they're likely to be higher than the current market consensus forecast.

Michael Price is a Portfolio Manager at Ausbil Investment Management. This article contains factual, general information only and does not constitute financial product advice. It does not take account of your individual objectives, financial situation or needs.