I'm shocked by the number and severity of changes to the superannuation rules announced in the 2016 Federal Budget. The next generation of people saving for retirement will not be able to build the high super balances achieved in the last decade, and some of the changes are retrospective. Alternatives such as negative gearing, the tax-free family home, family trusts and investment (insurance) bonds will now receive more support, so it is impossible to know how much the budget will save.

Although there were 10 amendments, they have been covered extensively in the media (and we include links to three summaries in the Sponsor Noticeboard on our website), and this article focusses on the three new caps.

I realise having large amounts in super is a good problem, so let’s get that one out of the way. I have taken advantage of the generous levels, and while I always doubted they would be sustained for new money, I did not expect retrospective treatment. People who have used the rules as intended by the government of the day have now been told they must unwind their financial plans and take the money out of their pension accounts. Wait a minute … it was as recently as 2014/2015 when the non-concessional annual cap was increased from $150,000 to $180,000. Pre-retirees in their 50s who planned to build their super balances after their mortgage, school fees and other expenses had gone will be severely constrained.

What finally drove the current limits to become politically unacceptable was the dramatic deterioration in the budget deficit, and the need to find revenue somewhere. In 2014, the forecast for this financial year was a deficit of about $10 billion, but it has risen to $37 billion. We are heading for even larger deficits that nobody expected when the previous limits were set, and something has to give. Large superannuation balances, with the benefits skewed to the ‘rich’, have become an easy target.

Warren Bird has been in financial markets for over 30 years and he writes regularly for Cuffelinks. His comments on the changes probably echo the sentiments of many who enjoyed the high limits:

“A part of me acknowledges that the system Peter Costello introduced was ‘too generous’, and that in the long run it has turned out to be too expensive for the nation to afford … And lower income people have had to deal with this uncertainty for years as government payments have chopped and changed from Budget to Budget. So those who have more than $1.6 million in pension phase should not complain too loudly lest they sound like they’re simply being greedy.

But it is nonetheless an indictment on our political process that uncertainty is continually being heightened, rather than governments helping to create an environment in which sound plans can be made and rewarded.”

$1.6 million cap on the amount that can be held in a pension with earnings tax-free

For the last decade, superannuation policy encouraged large balances and self-reliance for those who could afford extra contributions and were willing to forego other expenditures (for example, buying an extra-large, tax-free family mansion) for super contributions. There was the $1 million one-off Peter Costello injection, the annual limit on non-concessional contributions (NCC) of $180,000, a $540,000 ‘bring-forward’ rule to make it easier to manage a windfall, and the concessional contribution cap was as high as $100,000 in 2008/2009. Successive governments exhorted the public to save for retirement, to avoid becoming a future burden on society by drawing age pension benefits. Planners warned that with an ageing population, nobody should expect the spiralling cost of health care to be met by the public purse long into the future. The self-funded retiree label became a badge of honour, and government policy wanted it that way.

Many retirees are highly risk-averse, and leave large balances in cash and term deposits. They cannot face the prospect of capital destruction when the money might have to last another 40 years. With the cash rate at 1.75%, a decent capital-secure interest rate might be 2.5%. On $1.6 million, that is $40,000 per year. It’s not much even if the retiree owns their own home.

The main disappointment is the retrospective treatment of this amendment and others. Thousands of hours of financial advice to clients about pumping as much money as possible into superannuation to take advantage of tax-free pensions are now compromised. Retirees with more than $1.6 million will need to transfer the excess, and some Transition to Retirement plans will be unwound due to a new tax treatment.

One look at the financial planning reports issued the day after the Budget shows the windfall for the advice industry. Within hours, planners were finding ways to manage the impact of the changes, such as realising capital gains on assets prior to the 1 July 2017 start date. Far from simplifying the system, the new rules make it even more complex, and nobody around retirement age should go through the next 12 months without some expert, highly-qualified financial advice.

And what about the compliance issues required to determine the fund balance at a particular date? Retirees will need to estimate how much to take out of the pension account a few days before 30 June (to allow for settlement or processing of transfers on share transactions). Many assets are not traded daily, such as real estate, and unlisted bonds have wide valuation spreads. The retiree may be hit with a penalty if the market rallies on say 29 and 30 June 2017 and the balance goes over the $1.6 million cap. The new rule states: "Individuals who breach the cap will be subject to a tax on both the amount in excess of the cap and the earnings on the excess amount."

There is also no detail on whether taxable or non-taxable amounts can be allocated between pension and accumulation accounts to ensure the best outcomes.

Caps on concessional and non-concessional contributions

The NCC door was slammed shut as Scott Morrison stood up at 7:30pm on Tuesday night. Anyone who had placed $500,000 or more into NCCs since 2007 cannot make additional contributions. The potential for error here is considerable when all the NCCs over nine years need to be identified.

This is probably the tightest of the new caps in practice. The previous $540,000 every three years allowed people who had poor balances in super to catch up and plan a decent super balance in their retirement years. The expectation of placing over $1 million in super in just over three years was attractive (OK, and generous). But this one-off limit of $500,000 now can only be supplemented at $25,000 a year. It will take many years plus some good performance to reach the $1.6 million cap for new savers.

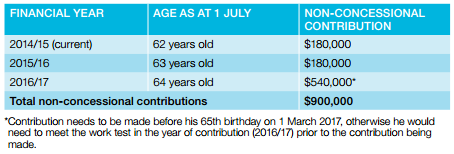

The annual caps and the ‘bring forward’ rule are no longer necessary. In the past, financial planners produced tables like the following, showing their clients how to maximise contributions by waiting until just before they turned 65 to make the final ‘bring forward’ contribution of $540,000. Oops, not such a happy 65th birthday now it is impossible on 1 March 2017.

It’s also worth remembering that high income earners have already paid almost 50% in tax on earnings to establish these NCC savings.

OK, it could have been worse

Many people will say this article reflects the disappointment of people who took advantage of rules that should never have been so generous, and the result is not something to whinge about.

In addition, while the balance over $1.6 million must be taken out of the tax-free environment, it can remain in an accumulation account taxed at only 15%. Arguably, a decent result for someone who might otherwise pay 47% or 49% on earnings outside super.

There is also no change to imputation credits or capital gain concessions, creating the ability to reduce the effective tax rate, even in the accumulation fund.

While annoying and disappointing, the evidence that the outcome for people with large pension balances is not terrible is the fact that the best option is probably to leave the excess (over $1.6 million) in an accumulation account. Moving out of super takes earnings into the personal tax domain, where the tax-free threshold is $18,200, after which the marginal tax rates start at 21% (including 2% Medicare levy). At $37,001, the tax rate rises quickly to 34.5%.

What is the answer to the question: what would I have done differently versus putting money into super in the last decade if I had known these amendments would be introduced in 2016/2017?

The answer is complicated by the knowledge that property prices in Sydney and Melbourne in particular have done so well in the last three years. The money over $1.6 million may have been better placed in a tax-free, expensive family home, or used to negatively gear other property (or shares with the right timing).

But the more likely response is that more people would have used the ‘bring forward’ rule last week to put MORE into super, protected in the 15% tax environment. At least until the rules change again.

(The results of our survey into reader attitudes to superannuation changes before the Budget are linked here).

Graham Hand is Editor of Cuffelinks. This is general information and does not address any individual's specific circumstances.