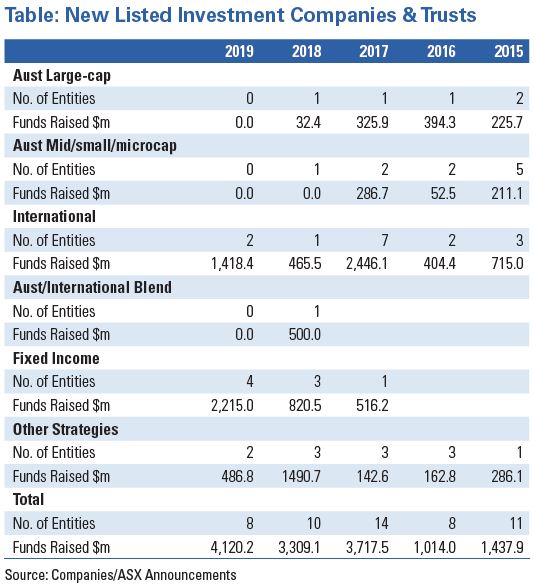

Eight new listed investment companies (LICs) and listed investment trusts (LITs) joined the ASX in 2019. This was two less than in 2018, however, the $4.1 billion in funds raised via initial public offers exceeded the $3.3 billion raised by the sector in 2018 due to a lift in the size of the average raising. The biggest surprise of the year was the dominance of fixed interest funds, which were largely absent before the last two years.

The largest transaction was by KKR Credit Income Fund (ASX:KKC) which raised $925 million in November, followed by Magellan High Conviction Trust (ASX:MHH) which issued $862 million in October. The smallest raising was by Pengana Private Equity Trust (ASX:PE1) which raised $205 million in April. PE1 expects to return to the market early in 2020 for a secondary raising.

Discounts as market caps and volumes increase

Despite the new LICs and LITs joining the ASX, overall numbers remain unchanged at 114 at the end of November. This reflects the removal of some LICs and LITs due to mergers, acquisitions and restructuring. Poor price performance was often the cause of the decision to close. Leading names issued in prior years, such as L1 Capital (ASX:LSF) and Antipodes Global (ASX:APL), have traded at discounts around 20%, which would once have been considered highly unlikely. Most equity LICs have struggled to match the rapid rise in the index during 2019.

We expect further corporate activity in 2020, with Ellerston Global Investments (ASX:EGI) already flagging its potential conversion to a trust structure to overcome the disappointing discount to Net Tangible Asset (NTA) prevalent in the sector.

Despite the unchanged total number, the market cap of LICs and LITs increased from $41.3 billion at 30 November 2018 to $52.1 billion at 30 November 2019. This reflects three factors:

- LICs and LITs that were removed were at the smaller end of the universe

- A significant number of secondary market raisings by existing LICs and LITs

- A strong year for markets led to an increase in portfolio values in 2019.

Retail money eager to invest

With interest rates remaining low, there is still plenty of retail money looking for a home and this enabled existing LICs and LITs to tap the market for new funds. There were a significant number of secondary market raisings across the sector in 2019 with all the existing fixed income LITs returning to the market for additional funds. This should continue in 2020 with some players already foreshadowing raisings for early in the new year.

2019 also saw an uptick in both trading volumes and value as larger and more liquid issues replaced the smaller and less liquid vehicles. The rolling 12-month average number of transactions was up 42.1% and the rolling 12-month average traded value was up 26.6% through to the end of November 2019.

The year of yield

2019 will definitely go down as the year that the credit-focused fixed income asset class really established itself in the sector. Since January 2019, total assets under management in the fixed income asset class rose from $1.25 billion to over $5 billion at the end of November 2019. Four new listings during the year saw the fixed income group grow to eight.

The demand for yield from retail investors has intensified in 2019. However, we remind investors that this asset class has different risk features and the risks associated with these products must be understood before investing. Each fixed income LITs has its own unique features.

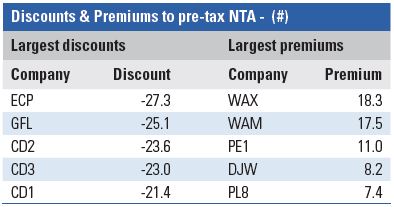

Falling premiums and widening discounts

One additional feature of the sector over the course of 2019 was the reduction in the number of issues trading at premiums and the widening, or dogged persistence, of discounts. Capital management initiatives such as on market buybacks designed to eliminate or narrow these discounts have had limited impact. Here are the five largest premiums and discounts from the LICs we follow.

We have noticed some narrowing of discounts in selected LICs in recent weeks and expect this to continue in the new year. Continued corporate activity could be a catalyst for discounts to narrow across the sector. Whilst we think there are some good opportunities for smart investors to enter well-managed issues at a discount, it’s always important to identify a potential catalysts for a narrowing of the discount. Issues with poorly-performing portfolios are unlikely to see their discounts reduce in a hurry in the absence of a takeover offer.

Access the latest IIR Report with a more detailed list of issues and their discounts and premiums for December 2019 here.

Peter Rae is Supervisory Analyst at Independent Investment Research. This article is general information and does not consider the circumstances of any individual.